Data shows the social media sentiment around Dogecoin and Solana has seen a significant improvement following the market turnaround.

Social Media Is Now Bullish On Dogecoin, Solana, & Cardano

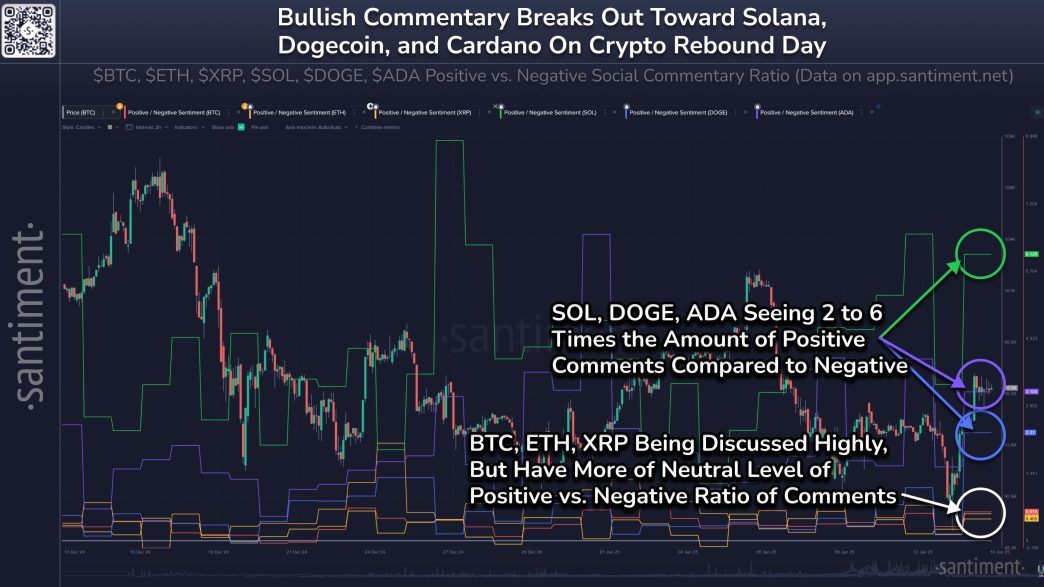

In a new post on X, the analytics firm Santiment has discussed what sentiment the traders on social media currently hold toward the various top assets in the cryptocurrency sector. The metric of relevance here is the “Positive/Negative Sentiment,” which, as its name suggests, tells us about how the bullish and bearish sentiments related to a given asset compare on the major social media platforms.

Related Reading

This indicator works by putting the posts/comments/messages present on the platforms through a machine-learning model to separate between positive and negative ones. It then takes the ratio of these counts to calculate the net situation around the coin. When the Positive/Negative Sentiment has a value greater than zero, it means the bullish posts outweigh the negative ones. On the other hand, it being under the mark implies the investors as a whole share a negative sentiment.

Now, here is a chart that shows the trend in the indicator for six top coins: Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Dogecoin (DOGE), Solana (SOL), and Cardano (ADA):

As displayed in the above graph, the Positive/Negative Sentiment has witnessed an increase for Solana, Dogecoin, and Cardano recently, suggesting the sentiment around the assets has improved. Out of these, traders are the most positive toward SOL, with its bullish comments being around six times the bearish ones. The metric has a value of around 3 for ADA and 2 for DOGE.

The improvement in sentiment for Dogecoin and others has come after a sector-wide rebound in prices. Interestingly, while the bullish wave has made investors more optimistic about these coins, it has failed to do so in the case of Bitcoin, Ethereum, and XRP, the top three cryptocurrencies by market cap.

The indicator is sitting close to the neutral zero level for these assets, which implies there are about as many positive posts as negative ones. This fact, however, may not actually be bad for BTC and the crypto market.

Related Reading: Analyst Says Bitcoin Fun Will Begin When This Flip Happens

Historically, digital assets have tended to show moves in a direction that’s opposite to the expectations of the majority. This means that an overly bullish crowd can lead to tops, while an extremely bearish one can result in bottoms.

Thus, the hype around Dogecoin, Solana, and Cardano may act to the detriment of their prices, while Bitcoin, Ethereum, and XRP could have bullish room to run before they reach a top.

DOGE Price

At the time of writing, Dogecoin is floating around $0.352, up more than 2% over the past week.

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Source link

Keshav Verma

https://www.newsbtc.com/news/dogecoin/social-bullish-dogecoin-solana-market-rebounds/

2025-01-16 02:00:27