Cardano’s recent sideways price action has led to a surge in demand for short positions among futures traders.

As the coin’s momentum slows, traders are increasingly betting on a price decline, signaling a bearish sentiment toward ADA.

Cardano Traders Bet on a Price Decline

According to Coinglass, ADA’s Long/Short Ratio is at a monthly low of 0.82, indicating a high demand for short positions.

An asset’s Long/Short Ratio compares the number of its long (buy) positions to short (sell) positions in a market. As with ADA, when the ratio is below one, more traders are betting on the price falling (shorting) rather than rising. If short sellers continue to dominate, this can increase the downward pressure on the asset’s price.

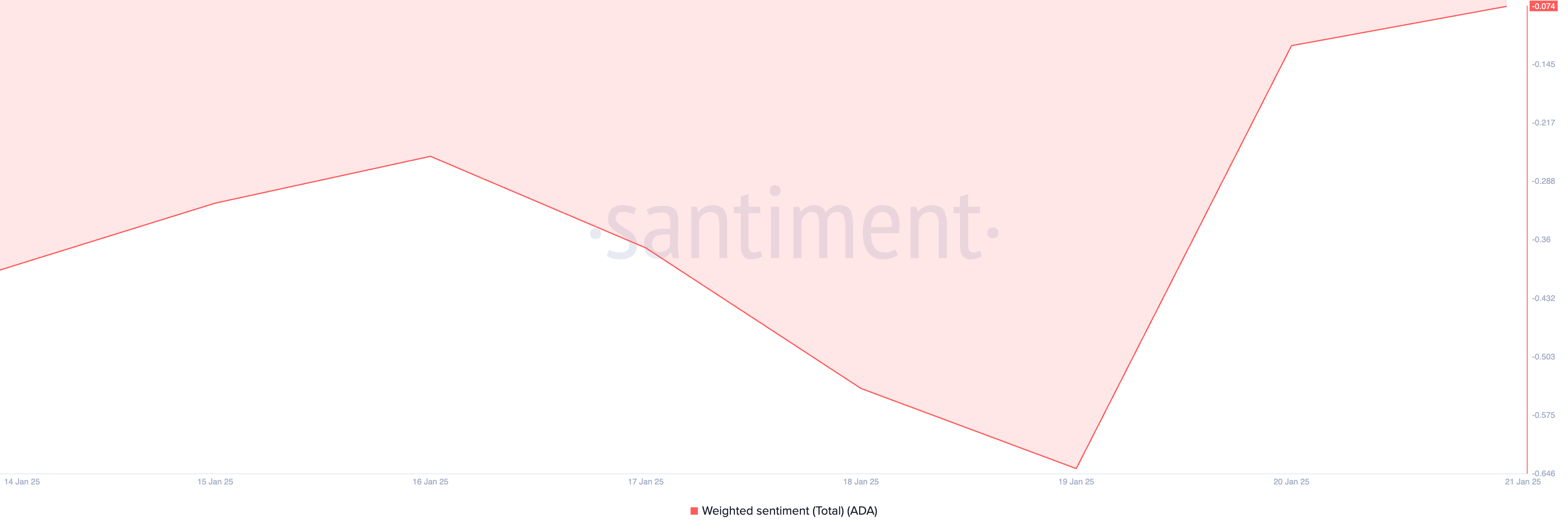

Additionally, ADA’s Weighted Sentiment remains negative, currently standing at -0.074, reinforcing the bearish outlook for the altcoin.

Weighted Sentiment gauges the overall market bias by analyzing the volume and tone of social media mentions. A negative value signals growing skepticism among investors, often leading to reduced trading activity and downward pressure on the asset’s price.

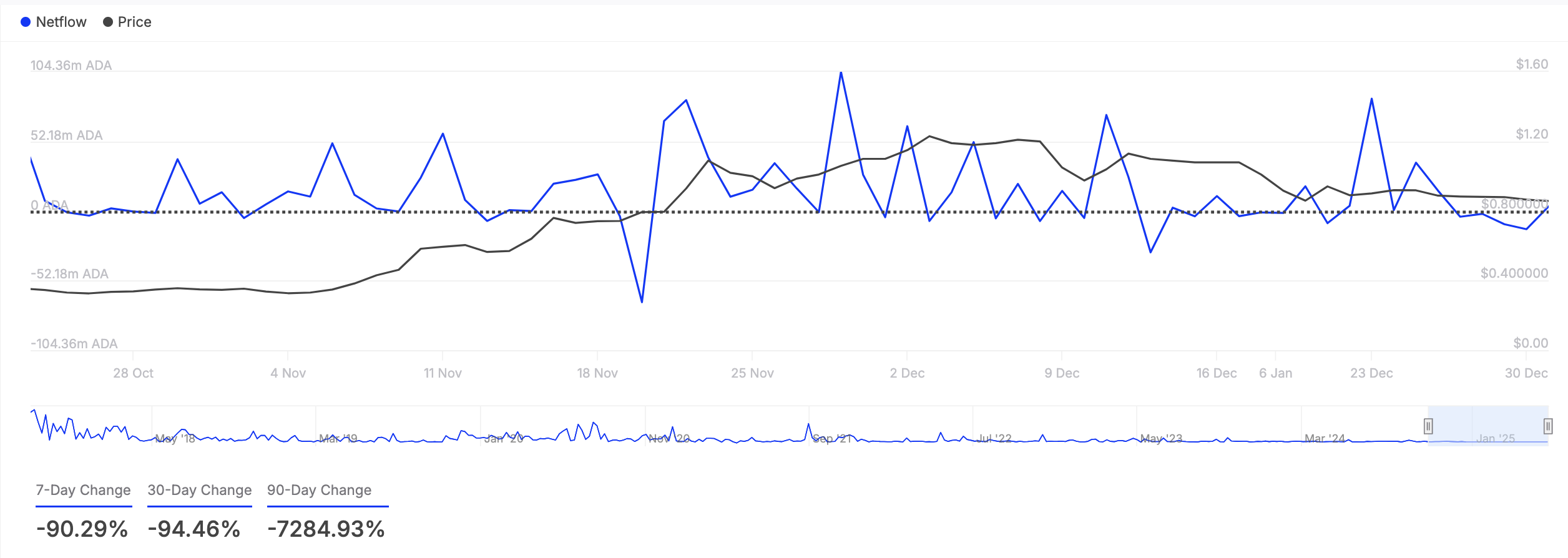

Notably, ADA whales have reduced their trading activity over the past week, with the coin’s large holders’ netflow dropping by 90.29%, according to IntoTheBlock.

Large holders, defined as addresses holding more than 0.1% of an asset’s circulating supply, play a significant role in market movements. A decline in their netflow indicates reduced buying activity, adding to the downward pressure on ADA’s price.

ADA Price Prediction: Recovery to $1 or Decline to $0.80?

ADA is currently trading at $0.98, hovering just above its support level of $0.90. If bearish pressure intensifies, the price may test this support. A failure to hold at $0.90 could see ADA’s decline extend further, potentially dropping to $0.80.

Conversely, if buying activity resurges, ADA’s price could stabilize above the $1 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ada-futures-traders-go-short/

2025-01-22 12:00:00