SUI has experienced a significant price decline, falling from its all-time high of $5.36, formed earlier this month. Currently trading at a monthly low, the altcoin faces the potential for further drawdowns.

Despite the recent losses, traders remain cautiously optimistic about the cryptocurrency’s recovery prospects.

SUI Traders Are Hopeful

The Relative Strength Index (RSI) indicates that bearish momentum is dominating SUI’s price action. The RSI has slipped below the neutral line and is at its lowest level since August 2024. This suggests that broader market conditions are not favorable for a recovery in the immediate term.

The extended bearish sentiment, reflected in the RSI’s trajectory, highlights a lack of buying pressure. Traders are closely monitoring whether the momentum can stabilize, as any further decline could push SUI into deeper losses. The market currently lacks the signals needed for a strong reversal.

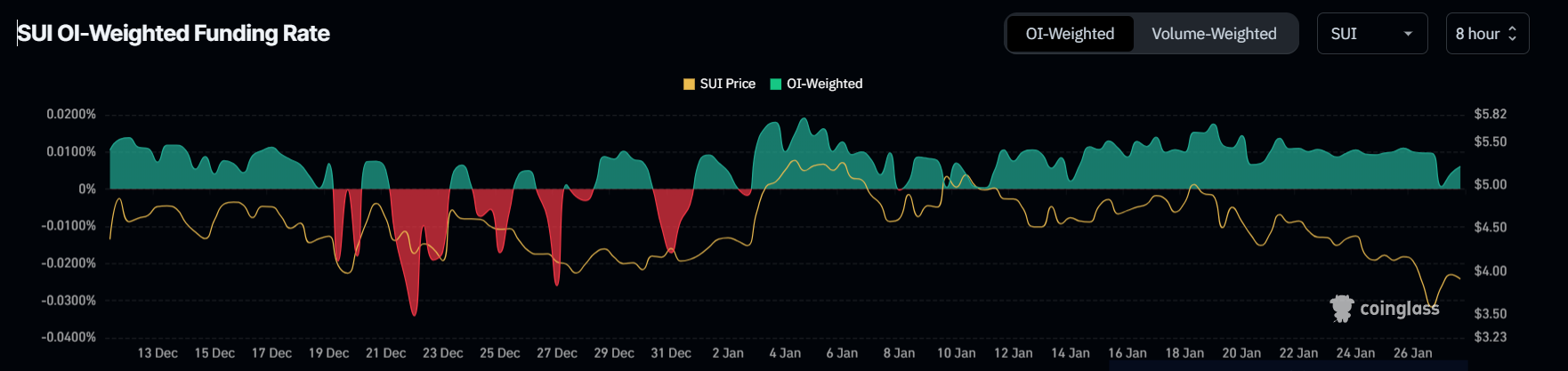

Despite the downturn, SUI’s funding rate remains positive, indicating lingering optimism among traders. This trend has persisted since the start of the year, following the formation of SUI’s all-time high. Notably, this contrasts with December 2024, when traders placed short contracts even during minor declines.

The positive funding rate suggests that traders believe in SUI’s long-term potential despite the current challenges. This optimism is providing some stability for the crypto token, which could prevent a steep sell-off if the broader market conditions begin to improve.

SUI Price Prediction: Finding A Way Back

SUI’s price has dropped by 22% over the last nine days, currently trading at $3.87. The crypto recently lost the $4.05 support level but remains above the critical support at $3.69. Holding this level is essential to prevent further downside in the near term.

At its current monthly low, SUI remains vulnerable to additional losses. However, maintaining support above $3.69 could prevent a significant crash and buy time for potential market stabilization.

For the bearish outlook to be invalidated, SUI must reclaim $4.05 as a support level. Doing so would set the stage for a potential recovery, allowing the altcoin to aim for $4.35. This move would help offset recent losses and restore confidence among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/sui-price-hits-4-week-low/

2025-01-28 18:00:00