Bitcoin’s price is still consolidating around the $100K level despite a slide below that line on Monday.

However, things could change soon, as a rally might be about to begin.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the asset is currently trapped in a range between the $108K and $100K levels, failing to break to either side. Yet, as the cryptocurrency has just rebounded from the $100K support level, a rise toward the $108K resistance zone can be expected.

The RSI also shows values above 50%, which indicates that the market momentum is still bullish and in favor of a higher rally.

The 4-Hour Chart

The 4-hour chart demonstrates a potential bullish continuation scenario for BTC soon. The price has been consolidating inside a bullish flag pattern over the last week.

Based on classical price action concepts, a breakout above this pattern could result in a rally higher toward the $108K level and potentially higher toward the $115K mark. With the recent rebound from the lower boundary of the pattern and the $100K level, this bullish scenario is likely bound to happen soon.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Exchange Reserve

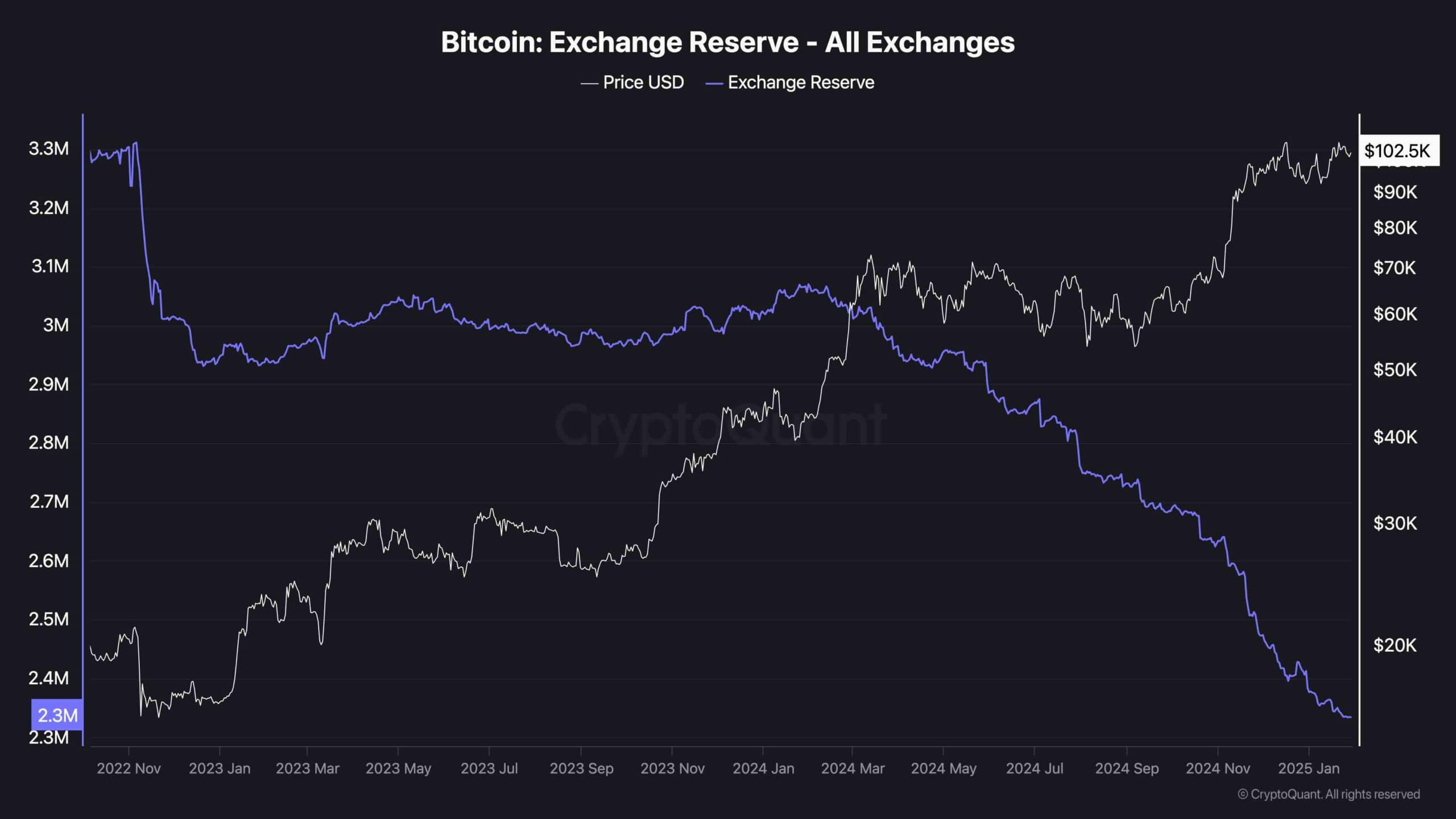

During Bitcoin’s bull run over the last year, one of the contributing factors that pushed the price higher has been the decline in supply. This is clearly evident in this exchange reserve chart, which demonstrates the amount of BTC that is held in exchanges.

Since early 2024, when Bitcoin was trading around the $70K level, the exchange reserve metric has been taking a nosedive, indicating the accumulation behavior by investors as they remove their BTC from exchanges and move them to personal custody. This supply shrink has had a massive influence on the market, leading to the current bullish wave, and could even push the price higher in the coming months.

The post Bitcoin Price Analysis: BTC at a Turning Point, What’s Next After Consolidation? appeared first on CryptoPotato.

Source link

CryptoVizArt

https://cryptopotato.com/bitcoin-price-analysis-btc-at-a-turning-point-whats-next-after-consolidation/

2025-01-29 15:18:01