Altcoins with strong fundamentals and growing ecosystems could see a rebound in February. Jupiter (JUP) has strengthened its position in the Solana ecosystem with key acquisitions, pushing its TVL past Raydium.

Aerodrome Finance (AERO), the dominant DEX on Base, is trading near key psychological levels after a sharp decline, making it one of the most interesting altcoins to watch. Meanwhile, Grass (GRASS) has struggled with the broader AI token correction but could recover if AI-related hype returns next month.

Jupiter (JUP)

Jupiter (JUP) is expanding its presence in the Solana ecosystem through key acquisitions. It recently acquired Moonshot, a coins launchpad, and SonarWatch, a portfolio tracker. With these moves, JUP has surpassed Raydium in Total Value Locked (TVL), reaching $2.87 billion.

Despite a 7% drop in the last 24 hours, JUP remains up 29% over the past week. As one of Solana’s most used platforms, its growing ecosystem could drive further gains. Increased adoption and integrations may continue boosting its relevance.

If momentum continues, JUP could test $1.22 and $1.27 soon. However, if the trend reverses, it may fall to $0.98, with further downside to $0.83 or even $0.76.

Aerodrome Finance (AERO)

AERO is the leading application on the Base chain, with $1 billion in TVL and $1.16 million in daily fees. As the most used DEX on Base, it holds a dominant position despite being 56% down from its all-time high on December 7, 2024, making it one of the most interesting altcoins for February.

Over the past month, AERO has dropped nearly 31%, now trading around $1 with a market cap of $765 million. The recent decline has pushed it closer to key psychological levels, making the next moves crucial.

If AERO regains strong momentum, it could see a major rally in February. Key targets include $1.4 and $1.6, with a potential move above $2 for the first time since mid-December.

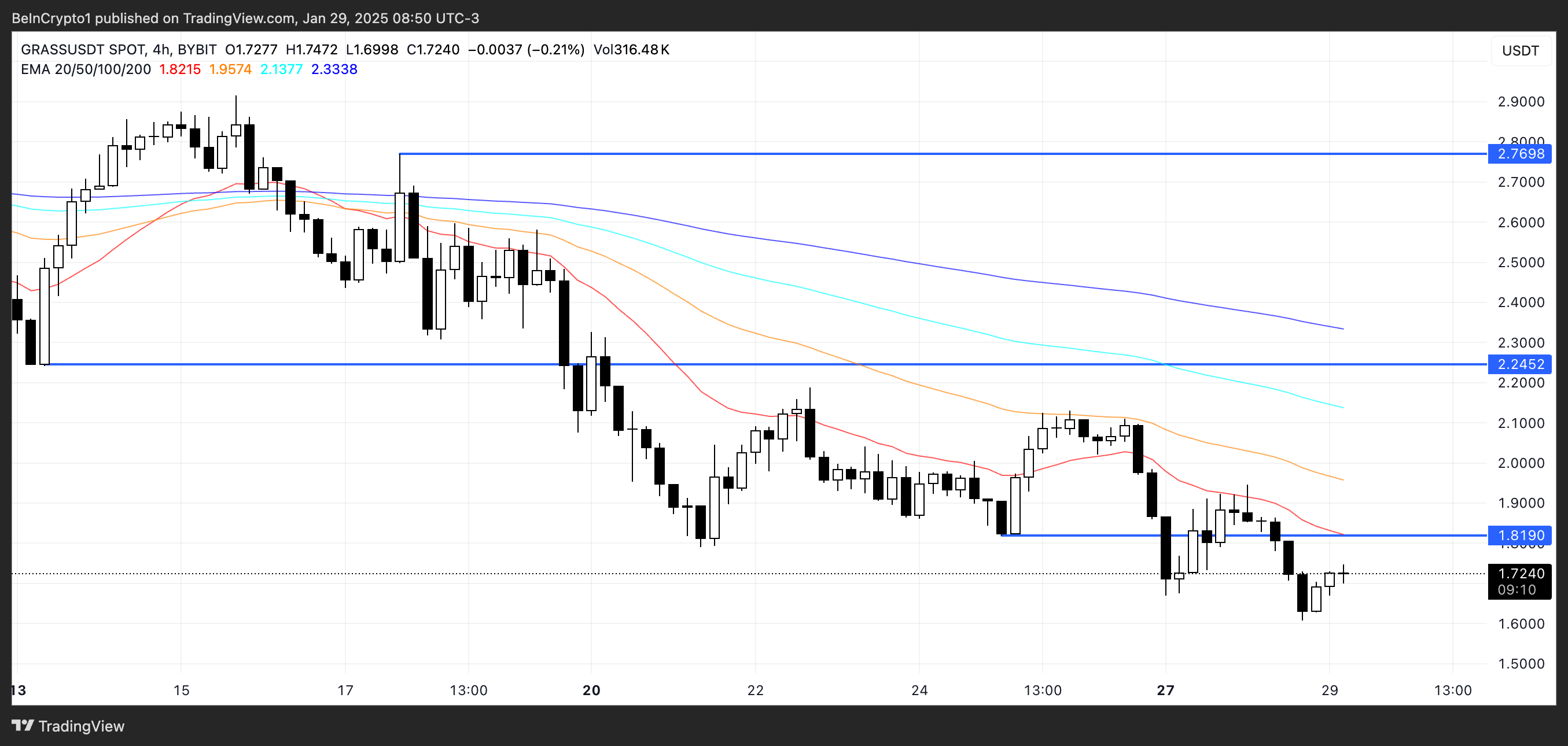

Grass (GRASS)

GRASS has been hit hard by the recent correction in artificial intelligence cryptos, with its price dropping over 27% in the past 30 days. It is now trading at its lowest levels since November 5, 2024, just days after its airdrop.

The token attempted to break above $4 on three separate occasions in 2024 but failed each time. Since January 6, 2025, it has remained below $3, indicating a clear downtrend.

If AI-related altcoins regain momentum in February, GRASS price could benefit from the renewed interest. A rebound toward the $2 range is possible, and if the uptrend strengthens, the token could revisit the $3 level as well.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/hidden-gem-altcoins-to-watch-february/

2025-01-29 21:00:00