Amid the broader market downturn, user activity on the Layer-1 (L1) network Ethereum has plummeted to its year-to-date low. This comes as the value of Ethereum’s native token, ETH, sinks below the $3,000 mark for the first time since November.

With a strengthening bearish sentiment, ETH could extend its price decline in the short term.

Ethereum Sees Decline in User Activity

On February 2, ETH fell to a five-month low of $2,143 before making a slight rebound. While this price dip is part of a broader market decline, a key factor contributing to ETH’s struggles is a reduction in the active addresses on its network.

According to Glassnode, the daily count of active addresses on the Ethereum network fell to a year-to-date low of 420,346 on February 2.

A decline in Ethereum’s active addresses suggests reduced user activity on the network, indicating lower transaction volumes and engagement with the decentralized applications on the blockchain.

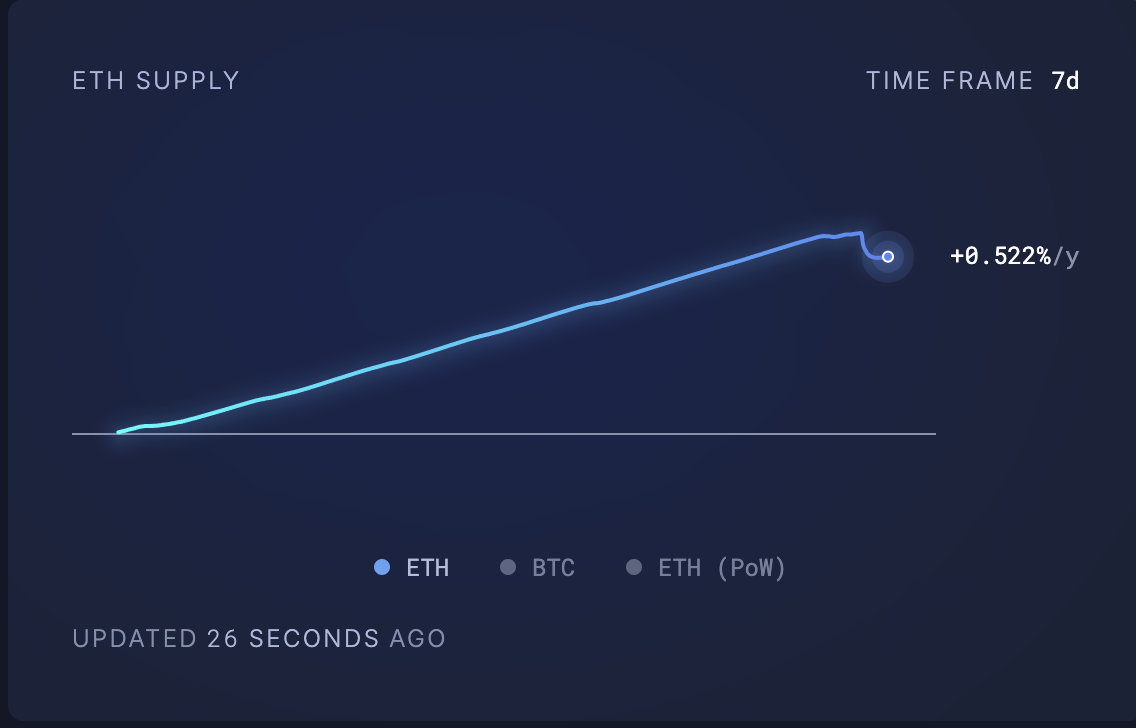

The drop in demand can weaken ETH’s price momentum, as fewer transactions mean less network utility and a reduced burn rate, making ETH more inflationary. This has been the case for the leading altcoin, whose circulating supply has added 12,066 ETH over the past week.

According to Ultrasoundmoney, 12,066 ETH, valued above $31 million at current market prices, have been added to the altcoin’s circulating supply in the past seven days.

When more ETH tokens enter circulation like this, the overall supply available for purchase rises. This typically results in a price drop, especially as the increased supply can exceed demand.

ETH Price Prediction: More Pain Ahead for Coin Holders?

ETH trades at $2,595 at press time, noting a 16% price drop over the past 24 hours. The coin’s negative Balance of Power (BoP) on the daily chart reflects the strong selling pressure. At press time, the indicator stands at -0.38.

The BOP indicator measures the strength of buyers versus sellers by analyzing price movements within a given period. When BOP is negative, sellers have more control, indicating bearish momentum and potential downward pressure on the asset’s price.

If the downtrend continues, ETH’s value could fall to $2,500. If this support level fails to hold, the altcoin’s price could drop further to $2,224.

However, a positive shift in market trends could propel ETH’s price to $2,811.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ethereum-active-address-year-to-date-low/

2025-02-03 12:30:00