TL;DR

- Spot XRP ETF filings from well-known financial players could boost institutional and retail investment in the asset if approved.

- Whales accumulated millions of tokens during the dip, and the RSI briefly dropped below 30, suggesting a potential price rebound.

The Potential Catalysts

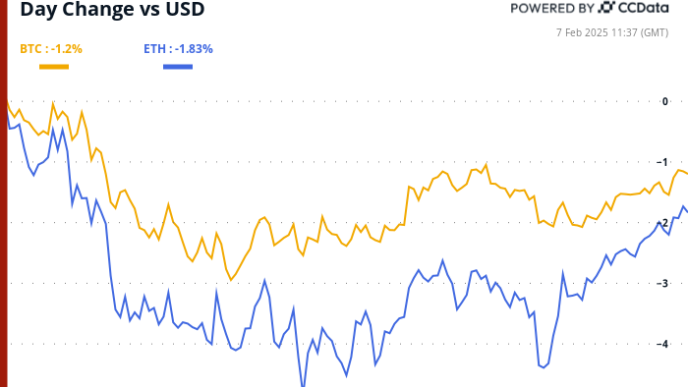

Ripple’s XRP did not start the business week on the right foot, briefly tanking below $2 during the market correction witnessed on February 3. In the following days, the bulls reclaimed some lost ground, but the price remains deep in the red on a weekly scale, currently trading at around $2.37 (per CoinGecko’s data).

Despite the bearish environment, some essential factors hint that a move to the upside could be incoming. On February 6, Cboe BZX Exchange lodged 19b-4 filings on behalf of Canary Capital, WisdomTree, 21Shares, and Bitwise. The well-known asset managers seek to list the first spot XRP exchange-traded funds (ETFs) in the USA.

The filings represent a formal request submitted to the US Securities and Exchange Commission (SEC). The agency must approve or reject the application, often within 240 days.

A potential green light would grant American investors additional options to gain exposure to Ripple’s native token, which could create upward pressure on its price.

The whales’ activity is another factor worth observing. The popular X user Ali Martinez revealed that large investors had accumulated 520 million XRP (worth over $1.2 billion at current rates) during the latest dip.

Whales seized the opportunity during the recent dip, buying 520 million $XRP! pic.twitter.com/v2Lu4uBMgm

— Ali (@ali_charts) February 6, 2025

Such actions reduce the circulating supply of the asset, possibly setting the stage for a rally (should demand keep its level or rise).

Last but not least, we will focus on XRP’s Relative Strength Index (RSI), which measures the speed and change of price movements. The technical analysis tool varies from 0 to 100, with readings below 30 indicating oversold conditions and a potential for a bounce. Earlier this week, the ratio plunged below the bullish mark, currently set at around 35.

Bonus: Garlinghouse and Trump

The president of the USA, Donald Trump, started his second term at the White House with a bang, signing numerous executive orders and doubling down on his focus on the cryptocurrency industry. He reportedly plans to establish a crypto advisory council that may be comprised of some well-known names.

One of the people who could find a place there is Ripple’s CEO, Brad Garlinghouse. The advisors’ main role will be to design a comprehensive regulatory framework for the sector and work closely with Trump and David Sacks (whom the president tapped to serve as cryptocurrency and AI “czar”).

Garlinghouse’s possible connection with the White House could have a significant impact on Ripple’s native token. He might advocate for clearer regulations surrounding the asset, which has faced scrutiny from the US Securities and Exchange Commission (SEC) for years.

Ripple’s CEO and the American president have shown a close connection to each other, having a dinner meeting at the Mar-a-Lago estate earlier this year.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Dimitar Dzhondzhorov

https://cryptopotato.com/3-reasons-that-ripple-xrp-is-preparing-for-a-major-rally/

2025-02-07 11:40:55