Telegram-linked Toncoin has experienced a significant price decline over the past month. It currently trades at $3.89, having shed 28% of its value in the past 30 days.

This dip has pushed TON to a historic low, presenting a potential accumulation phase for long-term investors.

Toncoin Falls, But There Is a Catch

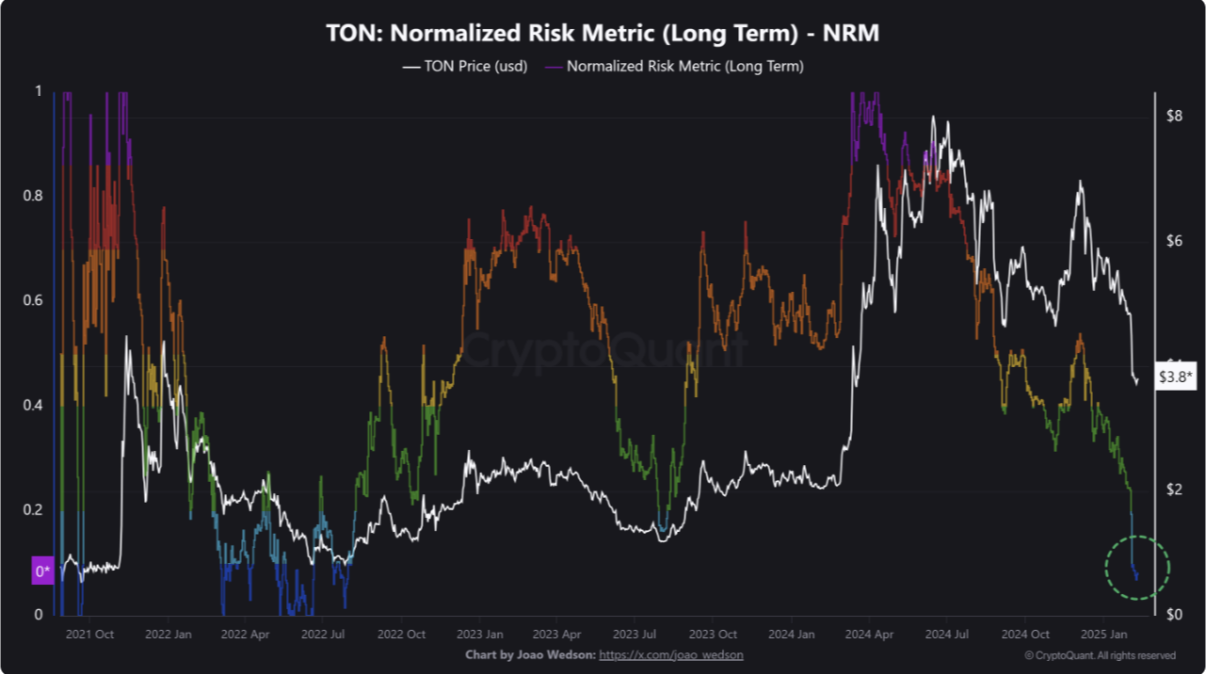

In a new report, CryptoQuant analyst Joao Wedson notes that TON has reached historically low levels on the Normalized Risk Metric (NRM) indicator, presenting a buying opportunity for long-term investors.

The NRM indicator tracks an asset’s value by comparing its current price to key weighted moving averages. When NRM is at low levels like this, it suggests that an asset is trading at a historically undervalued price relative to its long-term trends.

According to Wedson, TON’s NRM is at its lowest in both the medium and long term, suggesting that the token is currently in a low-risk accumulation zone. This means that its current price is undervalued compared to historical trends, making it an attractive entry point for investors who believe in its long-term potential.

“For investors, this scenario could represent an interesting opportunity to start accumulating TON, taking advantage of a moment when the risk (or the asset’s “valuation”) is at its minimum, suggesting potential for appreciation in the medium to long term,” Wedson said.

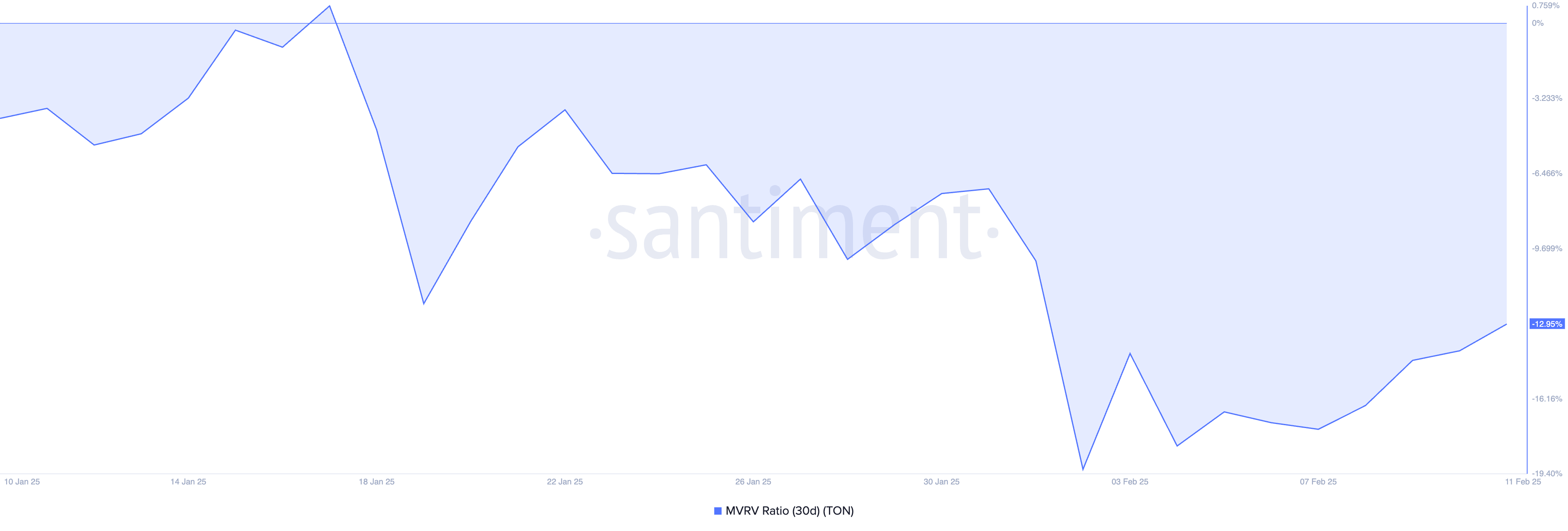

BeInCrypto’s assessment of the altcoin’s market value to realized value (MVRV) ratio using a 30-day moving average confirms its undervalued status. According to Santiment, this is -12.95% at press time.

An asset’s MVRV ratio identifies whether it is overvalued or undervalued by measuring the relationship between its market value and its realized value. When an asset’s MVRV ratio is positive, its market value is higher than the realized value, suggesting it is overvalued.

On the other hand, as with TON, when the ratio is negative, the asset’s market value is lower than its realized value. This suggests that the coin is undervalued compared to what people originally paid for it. Historically, negative ratios like this present a buying opportunity for those looking to “buy the dip” and “sell high.”

TON Price Prediction: Can It Sustain Momentum and Reach $4.96?

On a daily timeframe, TON has benefited from the broader market rally, noting a 1% price hike in the past 24 hours. If market participants increase their token accumulation, TON may maintain this upward trend in the short term.

In that case, its price could break above the critical resistance at $4 to trade at $4.17. If bullish support intensifies at this level, TON’s value could rally further to $4.96

Conversely, if TON holders refrain from accumulation, the token could lose its recent gains and drop to $2.91.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/toncoin-price-historic-low-risk-metrics/

2025-02-11 14:00:00