Bitcoin ETF outflows continue as Powell’s rejection of rate cuts and high inflation trigger a pullback from institutional investors. However, the Ethereum ETF market performed well, showing strong confidence and investor appetite for buying the dip.

It may be alluring to suggest that high inflation will decrease investment across the entire crypto market, but other factors can overcome this bearish headwind.

Bitcoin ETFs Feel the Inflation

Since the SEC first approved Bitcoin ETFs in 2024, they’ve heralded a wave of integration between the crypto industry and traditional finance. In some ways, crypto has benefitted greatly, with BlackRock’s IBIT counting as one of the most successful ETFs ever. This market entanglement, however, can sometimes have a negative impact, as shown by recent outflows:

Yesterday, the Bitcoin ETF market saw $56.76 million in outflows, with $243 million in total outflows this week. This may seem surprising at first, considering that these funds were headed toward a dramatic recovery less than a month ago.

However, the BTC ETFs saw their first week of net outflows in 2025 last week, and outflows have since continued.

A few factors in the broader market help explain this phenomenon. Top-level analysts have predicted that US inflation and economic policies will have an outsized role on the crypto market, and that prediction is coming true. Yesterday, Jerome Powell rejected President Trump’s plan to use rate cuts to reduce inflation.

Powell’s decision does have a few positive factors for crypto, but in the short term, it’s making investors very skittish. US inflation climbed to 3% YoY this morning, causing capital to pull back from Bitcoin and its ETF market.

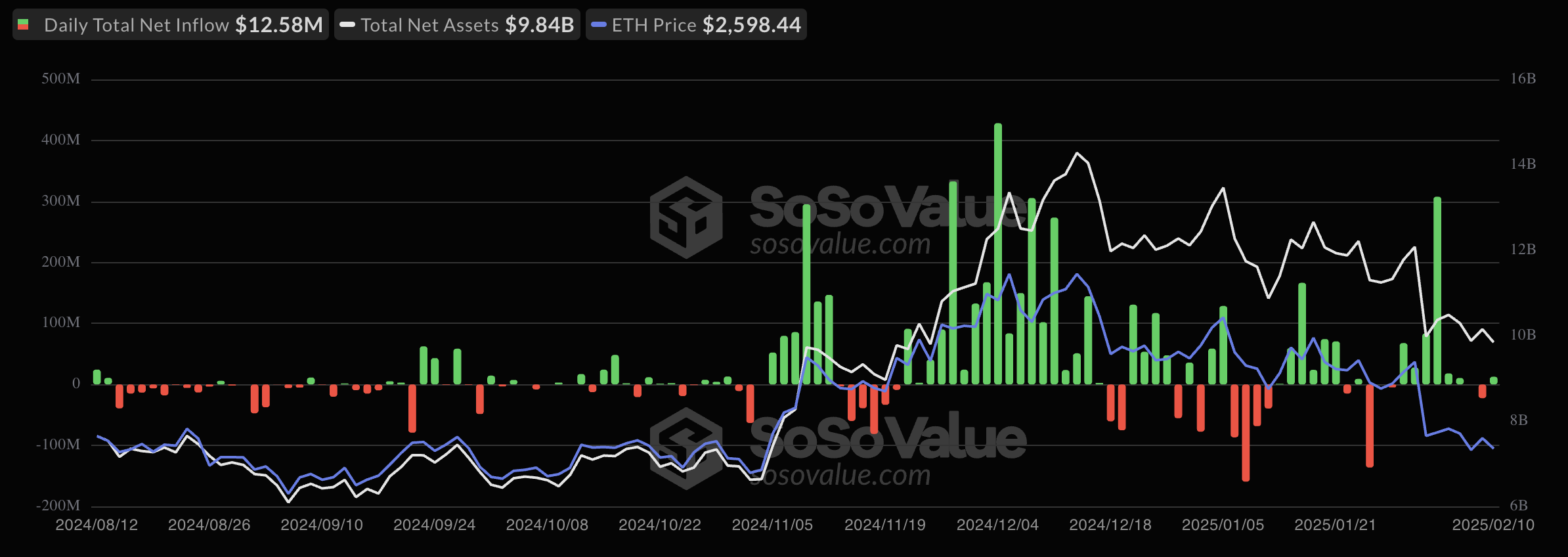

However, these factors have not halted the momentum of Ethereum ETFs, as they saw inflows of $12.58 million yesterday.

Perversely, this ETF category is actually gaining from its asset’s underlying woes, in contrast with Bitcoin. Last week, these products saw a huge rush in trading volume as investors sought to buy the dip. Since then, Ethereum has stayed low, pushing ETF inflows to a two-month high.

In short, inflation and other broad market factors have triggered a brief pullback for Bitcoin ETFs, but they aren’t the only factors in play. For Ethereum, there seems to be a strong short-term confidence.

The upcoming Pectra upgrade in March and recent purchases from Donald Trump-backed World Liberty Financial have driven institutional interest in the largest altcoin. So, the US spot Ethereum ETF market might continue to see net inflows as long as ETH is below $3,000.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/inflation-triggers-bitcoin-etf-outflow/

2025-02-12 17:07:35