Dogecoin is trading at critical supply levels as the broader crypto market begins to show signs of life. Over the past few weeks, DOGE has faced significant volatility and uncertainty, with the price dropping to lower demand zones. This period of turbulence has left analysts divided on its next move. Some predict a bearish continuation, while others anticipate a swift reversal driven by renewed market interest.

Related Reading

Top analyst Bluntz has weighed in on Dogecoin’s price action, sharing a technical analysis that suggests a potential bullish setup. According to Bluntz, DOGE is forming an Adam & Eve bullish pattern on the 4-hour time frame. This pattern, characterized by a sharp “V” bottom followed by a rounded “U” bottom, is often a precursor to a breakout to higher levels if confirmed.

This technical structure has given hope to investors who expect DOGE to recover and potentially lead the meme coin market higher. However, much will depend on whether Dogecoin can hold key levels and gain the momentum needed for a breakout. As the market continues to stir from its recent slumber, DOGE’s price action could provide critical insights into the next trend for the crypto space.

Dogecoin Price Hints At Recovery

Dogecoin is currently trading at key supply levels, attempting to reclaim critical price points to confirm the start of a recovery rally. Analysts are increasingly optimistic, calling for a potential breakout as the intense fear that gripped the market earlier in February begins to fade. Dogecoin, often considered the leader of the meme coin sector, is in the spotlight, with investors closely watching its next move.

Related Reading

The meme coin market, which has faced significant hate and criticism in recent months due to aggressive selloffs, now sees Dogecoin as a potential driver of a healthier phase. A DOGE recovery could signal renewed optimism and set the tone for other meme coins to follow.

Top crypto analyst Bluntz shared an encouraging technical analysis on X, highlighting a bullish setup for Dogecoin. Bluntz stated, “Lots of nice Adam and Eve structures across the board are starting to break out here. Nice on DOGE, as it’s been nearly 2 weeks since the capitulation wick.” This observation refers to a classic bullish pattern, where a sharp “V” bottom is followed by a rounded “U” bottom, often signaling the potential for an upward breakout.

Dogecoin’s ability to reclaim critical price levels and hold above them will be pivotal in confirming a sustained recovery rally. Should the bullish momentum continue, DOGE could lead the meme coin sector back into focus, restoring investor confidence in this unique niche of the crypto market. The coming weeks will be crucial in determining whether Dogecoin can establish itself as a market leader once again and drive a broader recovery across the sector.

DOGE Testing Crucial Supply

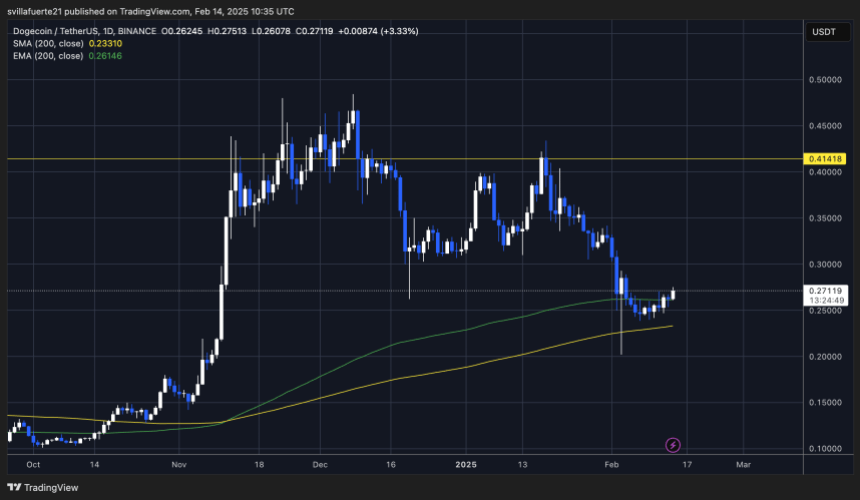

Dogecoin is trading at $0.27 after several days of volatility and sideways trading. The price has been ranging between $0.23 and $0.27, reflecting the uncertainty that has gripped the market in recent weeks. However, bulls are beginning to show signs of life, pushing DOGE toward key supply levels and signaling potential momentum for a breakout.

If DOGE can reclaim the $0.305 mark in the coming days, it could pave the way for a massive recovery rally. This level is a crucial supply zone, and flipping it into support would provide a strong confirmation of a trend reversal, reigniting bullish sentiment across the meme coin market.

On the flip side, if DOGE loses support at the $0.23 level, it risks falling into deeper correction territory. Such a move would likely signal that selling pressure is overwhelming buyer demand, potentially driving the price to test lower demand zones.

Related Reading

For now, all eyes are on whether Dogecoin can break out of its current range and establish a decisive direction. The coming days will be critical in determining whether DOGE can maintain its upward momentum or face further downside as market participants look for clear signals of recovery or continued consolidation.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/news/dogecoin/dogecoin-adam-eve-structure-hints-at-bullish-potential-can-doge-breakout/

2025-02-14 18:30:59