- Bitcoin’s correction has seen the crypto market suffer a decline after the US reported an increase in employment rate.

- NFP data has historically impacted the price of Bitcoin due to its growing correlation with the stock and commodities market.

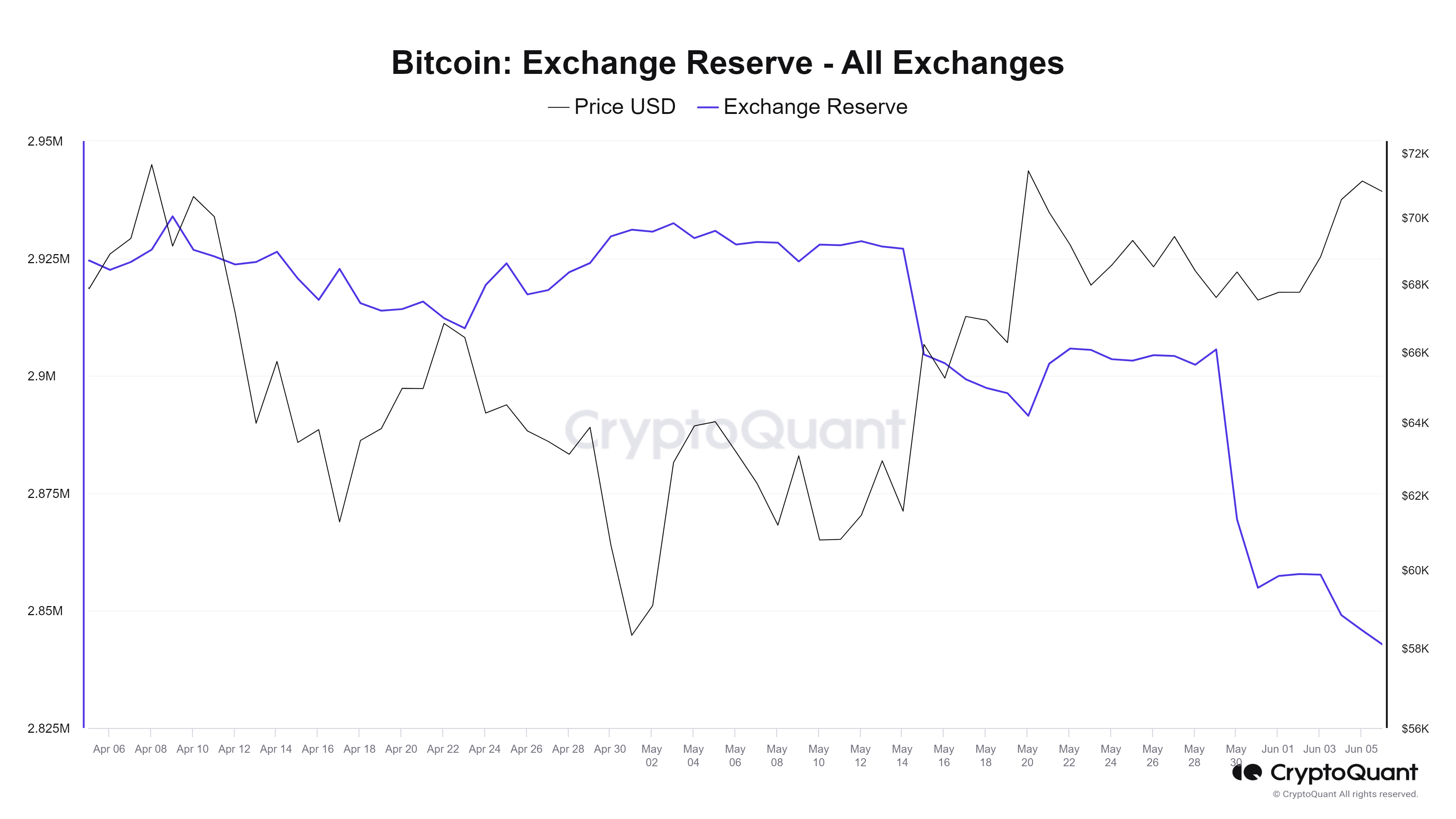

- Growth of Bitcoin ETFs likely causing a decline in miners and exchange BTC reserves.

Bitcoin (BTC) and the entire crypto market took a hit on Friday after the non-farm payroll (NFP) report for May beat analysts’ expectations, with 272,000 new jobs added. The report seems to have quenched expectations of the Federal Reserve reducing interest rates, in turn, improving the dollar’s value and dashing hopes of Bitcoin reaching an all-time high before the weekend.

Strong NFP ducks Bitcoin hopes of all-time high

NFP measures the number of workers employed during the prior month in the United States (US). A high employment rate signifies a stronger economy, implying the Fed may favor a high interest rate, which in turn strengthens the US dollar. This negatively impacts the prices of stocks and commodities, which has shown a positive correlation with the price of Bitcoin and, by extension, the entire crypto market.

Conversely, a low employment rate signifies a weaker economy and may cause a rally in the crypto market.

Also read: Bitcoin Weekly Forecast: Is BTC ready for a new all-time high?

Bitcoin initially teased a new all-time high in the early hours of Friday after attempting a move above the $72,000 mark. However, with the strong NFP report coming in at the early hours of the US session, Bitcoin shed nearly 4% of its value.

The crash heavily affected the Bitcoin derivatives market, as BTC open interest across exchanges dipped by $1.55 billion in the past several hours. In addition, Bitcoin’s long liquidations reached $67.4 million in the past 24 hours.

Following BTC’s crash, several altcoins also sustained losses, with Ethereum (ETH), BNB, Solana (SOL), and XRP all seeing declines of 2.6%, 3%, 3.9% and 5%, respectively.

Also read: Bitcoin could see higher volatility spike if a new all-time high is reached

The meme coin category wasn’t left out of the decline, especially after GameStop reported poor earnings and Keith Gill’s—aka Roaring Kitty—first YouTube livestream in years failed to interest investors. Dogecoin (DOGE) and Shiba Inu (SHIB) are down 7% and 6%, respectively, while Pepe, dogwifhat (WIF) and Bonk have seen double-digit losses.

The entire crypto market is down more than 3% at press time, with more than $400 million in liquidations in the past 24 hours.

Meanwhile, more than 183,253 BTC, valued at an average of $12.9 billion, has left the reserve of exchanges and miners since the beginning of the year, according to data from CryptoQuant.

Read more: Bitcoin ETFs set for new wave of adoption as Marathon Digital sells portions of its mined coins

BTC Exchange Reserve

Most of the supply may have gone to US Bitcoin ETFs, which now hold over $60 billion in BTC. These ETFs are on track to end the week with over $2 billion in inflows.