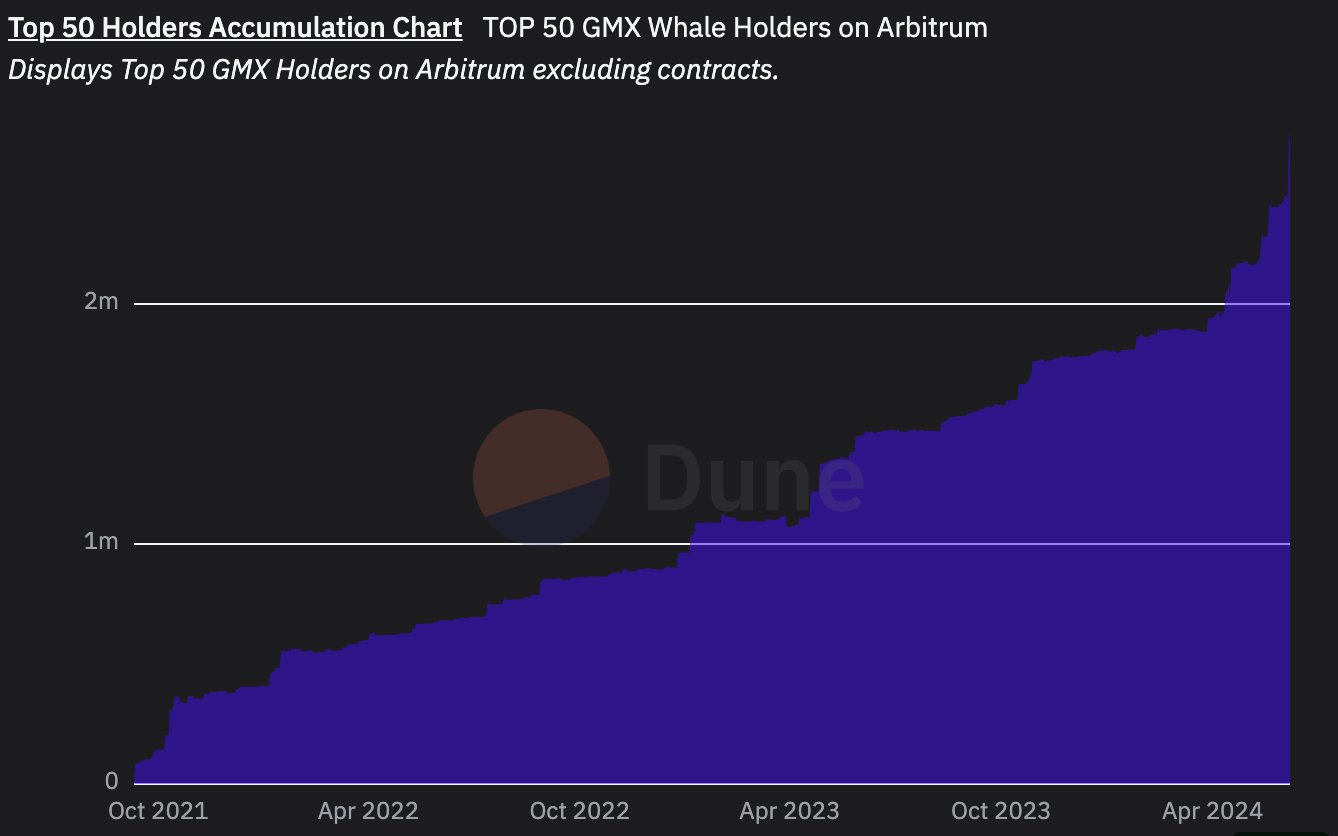

- GMX’s top 50 holders bags have been on a non-stop uptrend in 2024.

- According to data analytics sources, institutions have been accumulating and withdrawing GMX out of exchanges.

- GMX price has shot up more than 20% in the past two days and is likely to continue its ascent.

GMX, a Decentralized perpetual exchange, seems to be making waves as many speculate that the exchange might have something big planned. The reason for this spike in social activity surrounding GMX is the whale activity and rally in the asset’s price.

Also read: XRP sinks as Ripple moves 200 million tokens, inviting community suspicion

GMX whales on buying spree

Lookonchain, a data analytics platform, posted that whales or institutions are buying GMX tokens. It stated that six fresh wallets withdrew $15.3 million worth of tokens (344K GMX).

Whales/institutions are buying $GMX, and the price of $GMX has increased by ~24% in the past 2 days.

6 fresh wallets withdrew a total of 344,502 $GMX($15.3M) from #Binance in the past 2 days.

Wallets:

0x68fdea13878d7ce741cc596db55564909d9ecc8a… pic.twitter.com/Err6YfdYrb— Lookonchain (@lookonchain) June 7, 2024

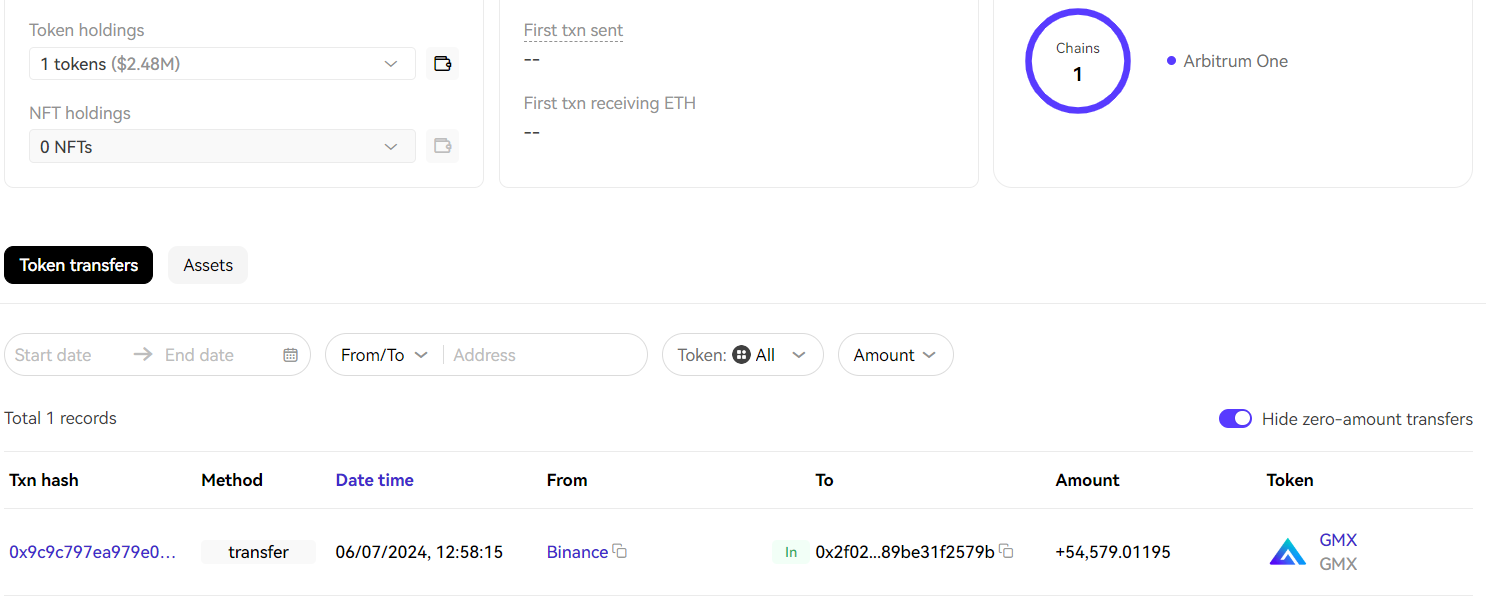

TheDataNerd also posted that one whale withdrew nearly 55,000 GMX worth roughly $2.47 million.

Source: TheDataNerd Twitter

Additionally, the top 50 GMX whale holders have grown their stack exponentially in 2024, showing the big-picture outlook and the confidence these investors have.

Top 50 Holders Accumulation chart

With whales showcasing their interest, GMX price has shot up more than 20% in the past two days. But technical analysis suggests there might be another opportunity to accumulate GMX in the coming days before it takes off for good.

Also read: Ethereum’s price suffers slight decline amid Hong Kong’s plan to allow staking in ETH ETFs

GMX price likely to dip before skyrocketing

GMX price is hovering above the $39.68 support level but is facing rejection at $42.80, which is the midpoint of the 66% crash witnessed between March 13 and April 13. Going forward, investors can expect the DEX token to crash nearly 8% and revisit the $39.68 to $35.98 accumulation zone.

Depending on the interest from sidelined buyers, GMX could see a quick bounce that kickstarts its massive ascent. If this move flips $42.80, it would open the doors to the $56.05 hurdle, roughly 30% away.

But the bulls’ target would ideally be the sell-side liquidity resting above the set of equal highs formed at $64.93. This move would constitute a 63% gain, measured from the $39.68 level.

GMX/USDT 1-day chart

Regardless of the whales’ involvement, a crash in Bitcoin (BTC) price could trigger a correction for GMX as well. In such a case, a breakdown of $35.98 would produce a lower low and invalidate the bullish thesis.

This development could open the path for GMX to crash 16% before finding a stable support level at $30.13.

Also read: Dogecoin whales could end DOGE’s muted volatility