A closely followed economist thinks that Bitcoin (BTC) may be repeating a similar pattern from last year and still has room to run to the upside.

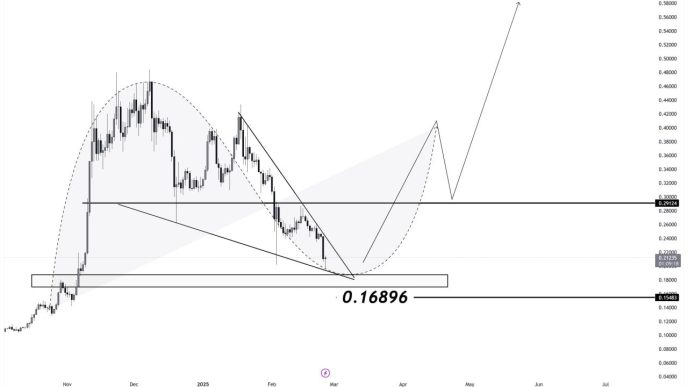

Alex Krüger tells his 206,800 followers on the social media platform X that Bitcoin’s latest severe correction is similar to when the flagship crypto asset collapsed to range lows in April 2024 before printing a series of rallies.

However, he warns that the uncertainty around US President Donald Trump’s tariff polices remains a big risk for the crypto markets.

“The dominant mood across crypto market participants is ‘it is over.’ For good reason. The Bitcoin dip is large, yet not extraordinary. But across alts the destruction is real. That said, I see this BTC chart as a replica of early 2024. Range lows are meant to be taken out (check the early 2024 range). Do need the Donald not to nuke us. The trigger for the last move down was precisely tariffs news (on Canada and Mexico).”

Krüger also says Bitcoin may still hit lower price targets before rallying.

“BTC is bottom of the range, akin to April 30th, 2024 in my opinion. Maybe we go lower, maybe we bounce. Don’t know, but it’s a good spot regardless.”

He notes that severe Bitcoin corrections occur multiple times a year, and may present buying opportunities.

“One can make a living just from getting good at buying liquidations. We get two-four such liquidations a year.”

The economist previously said that investors should zoom out because he thinks crypto is amid a supercycle, which could include painful Bitcoin pullbacks.

“BTC is stuck in a range, which I think eventually resolves higher. The supercycle theory is intact. Even though it applies to Bitcoin and crypto as a whole (market cap ex BTC and stables is considerably higher), most old alts don’t benefit from it on a sustained basis. Should not expect an insane wave of liquidity driving all cr*p higher for an extended period of time. Be selective.”

Bitcoin is trading for $84,608 at time of writing, down 4.8% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Daily Hodl Staff

https://dailyhodl.com/2025/02/27/economist-alex-kruger-says-current-bitcoin-setup-looking-like-replica-of-early-2024-heres-his-forecast/

2025-02-28 01:00:41