Bitcoin ETFs saw a record $2.7 billion in outflows this week, signaling an impending bear market. Corporate Bitcoin holders are feeling the pain, and liquidations are spiking all across the crypto industry.

Additionally, the Federal Reserve Bank of Atlanta predicted that the US GDP would decrease by 1.5% in Q1 2025, fueling further economic pessimism.

Is Bitcoin Heading for a Bear Market?

The US spot Bitcoin ETF market, which grew so quickly in its first year, is seeing massive outflows. Earlier this week, it hit a new record for outflows, approaching $1 billion. Now that we have most of the week’s data, it reflects the growing concerns among institutional investors.

Over the past week, Bitcoin ETFs had $2.7 billion in net outflows, a troubling sign of a bear market. For comparison, this is the largest weekly net outflow since March 2024.

Fears of a bear market are gripping the entire crypto space, even hitting corporate Bitcoin holders. Strategy (formerly MicroStrategy) recently spent nearly $2 billion on BTC, and this didn’t help its stock price.

Today, trade data shows that it has fallen 57% since last November. Metaplanet fell 54% from its peak, and Tesla has been falling too. All these firms hold huge amounts of Bitcoin.

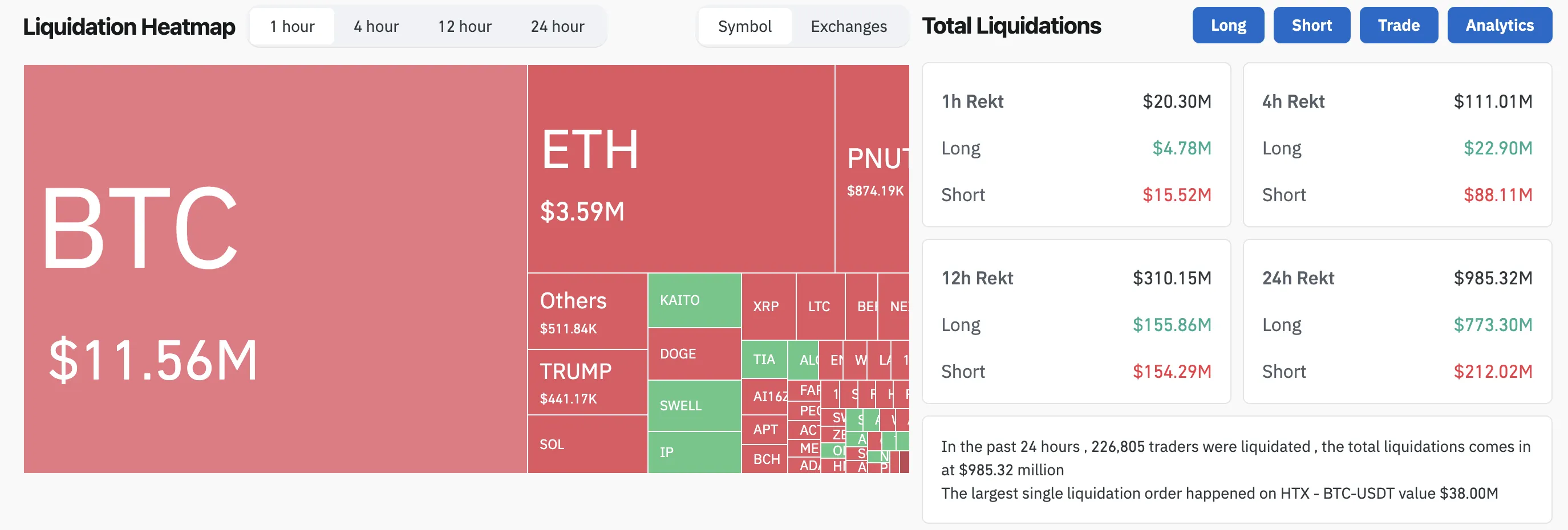

Bitcoin may be feeling the brunt of this potential bear market, but liquidations are spiking all across the crypto sector. According to the latest data, nearly $1 billion was liquidated in the last 24 hours. Traders are currently showing Extreme Fear, the lowest level since the 2022 FTX collapse.

A few prominent figures are looking at the brighter side. Michael Saylor urged the community not to panic sell, telling his followers to “sell a kidney if you must, but keep the Bitcoin.”

Arthur Hayes, former CEO of BitMEX, amended his recent prediction that BTC will drop and bounce back. However, he maintains that Bitcoin will rebound after a bear market.

“We are making lower lows in this current wave. I was tempted to add risk this morning, but looking at this price action I think we have one more violent wave down below $80,000, most likely over the weekend, then crickets for a while. Hold on to your butts!” Hayes claimed via social media.

Dark economic portents have been present for a few days now, and a market correction seems inevitable. This afternoon, the Federal Reserve Bank of Atlanta claimed that the US GDP is on track to decline by 1.5% in Q1 2025.

Even a disproven rumor could cause a lot of problems. Overall, the current macroeconomic factors point towards a short-term bearish cycle for Bitcoin and the entire market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/bitcoin-etf-record-outflow-bear-market-signals/

2025-02-28 21:12:09