The crypto market has suffered a massive downturn, wiping out $160 billion in total market capitalization over the past 24 hours. This sharp decline has caused PI to shed 24% of its value.

However, technical indicators suggest that a rebound could be on the horizon for the popular altcoin.

PI’s Market Decline Shows Signs of Seller Fatigue

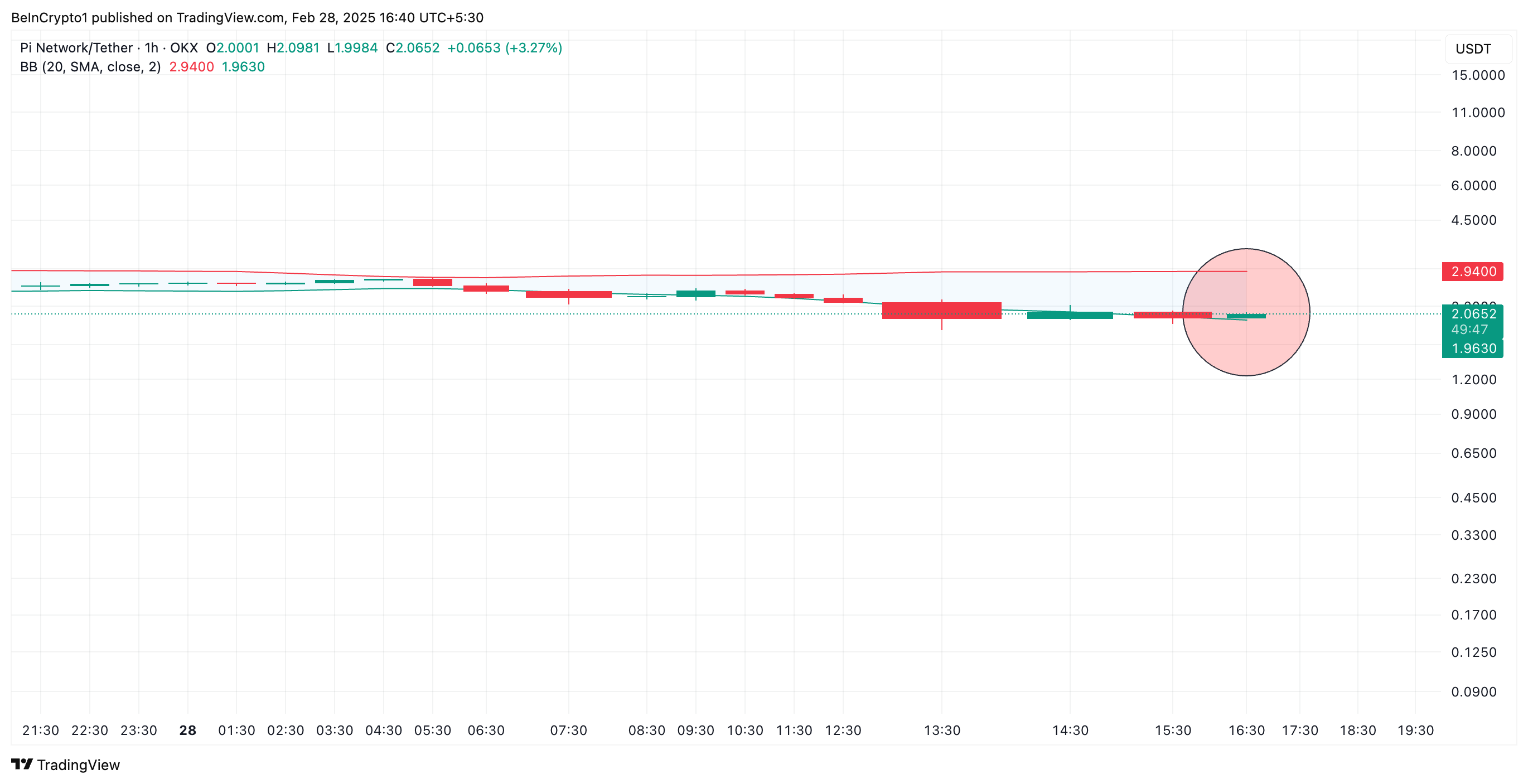

PI’s hourly chart reveals that its Relative Strength Index (RSI) is near the oversold territory, signaling that selling pressure may be reaching exhaustion. As of this writing, this momentum indicator is downward at 31.36.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a retracement. On the other hand, values under 30 suggest that the asset is oversold and may witness a rebound.

At 31.36, PI’s RSI signals that the token is nearing oversold territory. This suggests weakening selling pressure and the potential for a price rebound if buyers step in.

In addition, PI’s price just broke below the lower line of its Bollinger Bands indicator, confirming sellers’ exhaustion. This indicator is a volatility marker consisting of a middle-moving average line and two outer bands that expand and contract based on price fluctuations.

When an asset’s price breaks below the lower band, it signals that it is oversold and trading at an extreme deviation from its average price. If buying pressure increases, this can indicate a possible rebound or trend reversal.

PI Teeters at Crucial Level—Breakout or Breakdown Ahead?

A resurgence in PI demand could trigger a rebound toward its all-time high of $3, which was reached on Thursday. This represents a 44% uptick from its current value of $2.08. However, for this to happen, PI must first break above the resistance formed at $2.56.

Conversely, if the downtrend continues due to a lack of new demand for PI, its price could plummet toward $1.62.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/pi-price-rebound-may-be-near/

2025-02-28 21:30:00