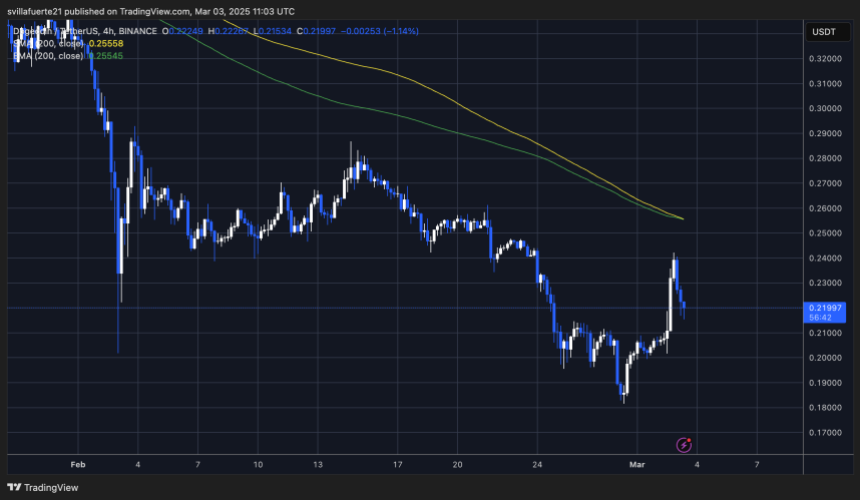

Dogecoin is trading below key levels after dropping over 10% following last night’s bullish price action. The meme coin market continues to struggle, and Dogecoin is no exception. Since late January, DOGE has failed to reclaim previous highs and consistently set lower prices each week. Investors are growing cautious as selling pressure remains strong, preventing any meaningful recovery.

Related Reading

Despite the recent downturn, some analysts remain optimistic about DOGE’s long-term prospects. Top analyst Carl Runefelt shared a technical analysis on X, showing that DOGE recently broke out of a long-term falling wedge pattern and is now retesting it. Historically, falling wedge breakouts have led to significant upward movements, provided that the breakout is confirmed.

If Dogecoin holds firm above this key level and successfully confirms the breakout, a massive price move could follow, potentially reversing the bearish trend. However, failure to hold this level could lead to further declines, pushing DOGE into lower demand zones. The next few days will be crucial in determining Dogecoin’s short-term price direction as traders watch for confirmation of the breakout or signs of another downturn.

Investors Keep Selling Dogecoin: Can This Change?

Dogecoin is facing a crucial test as it attempts to break above key resistance without falling below critical demand levels. Bulls are now working to reclaim lost territory that could ignite a significant rally, but price action remains uncertain in the short term.

Related Reading

The meme coin market has been under intense selling pressure, and Dogecoin has struggled to establish strong demand despite multiple breakout attempts. Investors are closely watching for signs of strength, but so far, bulls have failed to generate the momentum needed for a sustained recovery.

Runefelt’s technical analysis reveals that DOGE recently broke out of a long-term falling wedge pattern and is now in the process of retesting it. Historically, falling wedge breakouts have led to explosive price movements, provided the breakout holds. Runefelt has set a price target of $0.434 in the coming weeks if the breakout remains intact.

However, despite this bullish setup, there is no clear direction for the broader crypto market as long as Bitcoin remains below the $100K level. With BTC leading the way for the entire industry, meme coins like Dogecoin are likely to follow Bitcoin’s moves. If BTC reclaims key levels, DOGE could experience a rapid price surge, but continued uncertainty in the market could limit its upside potential.

DOGE Testing Short-Term Liquidity

Dogecoin is trading at $0.21 after a strong 33% rally over the past few days. Bulls have gained a slight advantage, pushing the price above key resistance levels. However, for DOGE to maintain momentum, it must hold above the critical $0.20 mark, which now serves as short-term support.

If bulls successfully reclaim $0.255 in the coming days, Dogecoin could see a significant breakout, leading to a massive recovery phase. A move above this level would confirm a bullish reversal and potentially trigger further buying pressure, sending DOGE toward higher resistance zones.

However, the market remains volatile, and losing the $0.20 level could quickly reverse recent gains. If DOGE fails to hold this support, a 15% drop could follow, bringing the price back into lower demand zones. Traders are closely watching Bitcoin’s movement as any major BTC sell-off could impact meme coins, including Dogecoin.

Related Reading

For now, DOGE bulls are in control, but they must continue defending key levels to sustain the current uptrend. A decisive move in either direction will set the stage for Dogecoin’s next big move.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/news/dogecoin/dogecoin-breaks-above-falling-wedge-pattern-analyst-sets-0-43-target/

2025-03-03 15:30:57