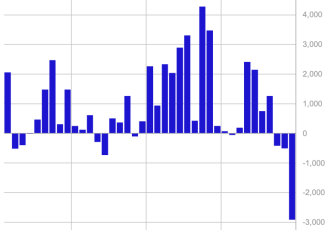

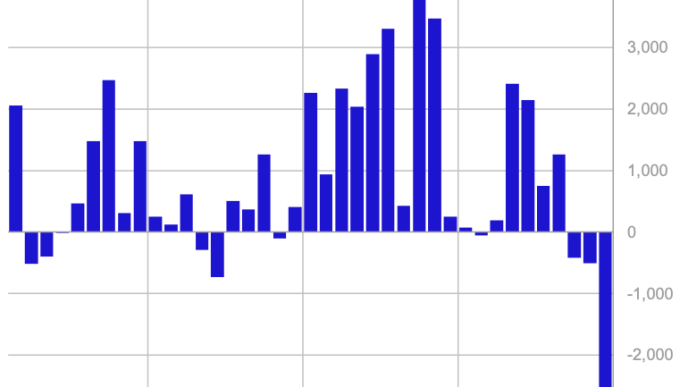

Cardano recent price surge has been nothing short of impressive, with ADA climbing steadily to challenge the $1.17 resistance level, a key psychological and technical barrier. Overbought conditions often precede a period of consolidation or correction, as traders take profits and the market seeks equilibrium.

For ADA, this could mean a temporary slowdown or pullback from the $1.17 resistance, especially if buyers fail to muster enough strength to break through this stubborn level. On the other hand, a successful breach could open the door for further gains, potentially propelling ADA toward higher price targets.

Cardano’s Rally Hits A Wall At $1.17

After an impressive rally that stalled at the $1.17 resistance level, ADA is beginning to show signs of weakness, with selling pressure gradually increasing. The failure to break past this key resistance has led to a shift in momentum, causing the price to decline toward the $0.9077 support zone. This pullback suggests that bulls may be losing strength and bears are beginning to take control.

Related Reading

Technical indicators further reinforce the possibility of a continued downturn as momentum begins to shift in favor of the bears. The Relative Strength Index (RSI), which previously hovered in overbought territory due to strong buying pressure, is trending downward. This decline suggests that bullish momentum is weakening, and traders may be taking profits, leading to an increase in selling pressure.

Additionally, a break below the mid-level (50) on the RSI would validate the bearish outlook, increasing the likelihood of a deeper correction. If the RSI continues to slide toward the oversold region and ADA fails to hold above the critical $0.9077, it could accelerate ADA’s decline toward lower support levels

A breakdown below this level would signal rising bearish pressure, potentially pushing the price toward $0.8119, a key area where buyers previously stepped in to halt declines. If this support fails to provide a strong rebound, ADA might extend losses, testing the $0.80 level and serving as another crucial barrier for the bulls.

Bullish Scenarios For ADA

Cardano has the potential for a bullish turnaround as key support levels hold and buying pressure increases. The $0.9077 level is crucial for a rebound, and a strong bounce from this area could trigger renewed momentum, allowing ADA to challenge resistance levels and regain upside directions.

Related Reading

Furthermore, the $1.17 level serves as a key pivot for ADA’s bullish scenario. A breakout above this mark, backed by strong volume, may signal growing buyer confidence. If successful, ADA may gain momentum and target $1.58 and beyond.

However, for these bullish scenarios to play out, Cardano must hold above key support levels, especially $0.9077. Failure to maintain control by buyers puts ADA at the risk of further declines. For now, traders are watching for signs of stabilization and bullish confirmations before expecting a strong upward move.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

Godspower Owie

https://www.newsbtc.com/news/cardano/cardano-surge-to-1-17/

2025-03-03 17:00:23