- Ethereum ecosystem generated more revenue in Q1 than Etsy, Robinhood or Reddit.

- Issuers plan to market Ethereum as a ‘producing tech stock’ and the ‘ultimate app store’.

- Ethereum could see a bullish reversal in the coming days.

Ethereum’s (ETH) price is down 1% on Monday as its exchange supply hit record lows following growth in global ETH ETFs’ inflows. Meanwhile, issuers plan to market Ethereum as the ‘ultimate app store’.

Daily digest market movers: Low exchange supply, high ETF inflows, ‘ultimate app store’

Ethereum has recorded several amazing feats in the past few days despite its recent price decline. Here are the latest ETH market movers:

- According to Glassnode data, only 10.5% of the total ETH supply was left on exchanges as of June 8. Coupled with the declining exchange supply, data from IntoTheBlock shows that large ETH holders (addresses with >10K ETH) recorded a net inflow of 267K ETH on Thursday, the highest daily accumulation since March. This shows that investors are becoming increasingly bullish on ETH, potentially because of the expectation of spot ETH ETFs.

Also read: Ethereum’s price suffers slight decline amid Hong Kong’s plan to allow staking in ETH ETFs

- Recent Bitwise research revealed that crypto protocols on Ethereum generated more revenue than Robinhood, Reddit, Yelp and Etsy in Q1 2024. “These applications are a testament to the resilience, creativity, and vision of the global crypto industry,” said Bitwise.

- Global Ethereum ETFs witnessed about $69 million in inflows — their highest inflow since March. Inflows across ETH ETFs will likely continue to rise as investors expect spot ETH ETFs to begin trading in the US in the coming weeks.

- High inflows follow predictions from Bitfinex’s Head of Derivatives, Jag Kooner, that spot Ethereum ETFs could attract around 10-20% of flows witnessed in spot Bitcoin ETFs.

He built his predictions around the historical flows seen in Gold ETFs after they launched in 2004 and how it paved the way for subsequent flows in Silver ETF launches in 2006. Bloomberg analyst Eric Balchunas has previously shared a similar analysis comparing ETFs of Bitcoin to those of Gold and Ethereum to Silver.

Also read: Ethereum ecosystem active users spike 55% in Q1, 2x ETH ETF records impressive volume

- Meanwhile, executives of different issuers, including Van Eck, 21Shares and Franklin Templeton, deliberated on the potential demand for Ethereum ETFs in a recent panel session moderated by Eric Balchunas. According to Balchunas, the executives plan to “position it (Ethereum) as being like a ‘producing tech stock’, ‘ultimate app store’, very different pitch than BTC.”

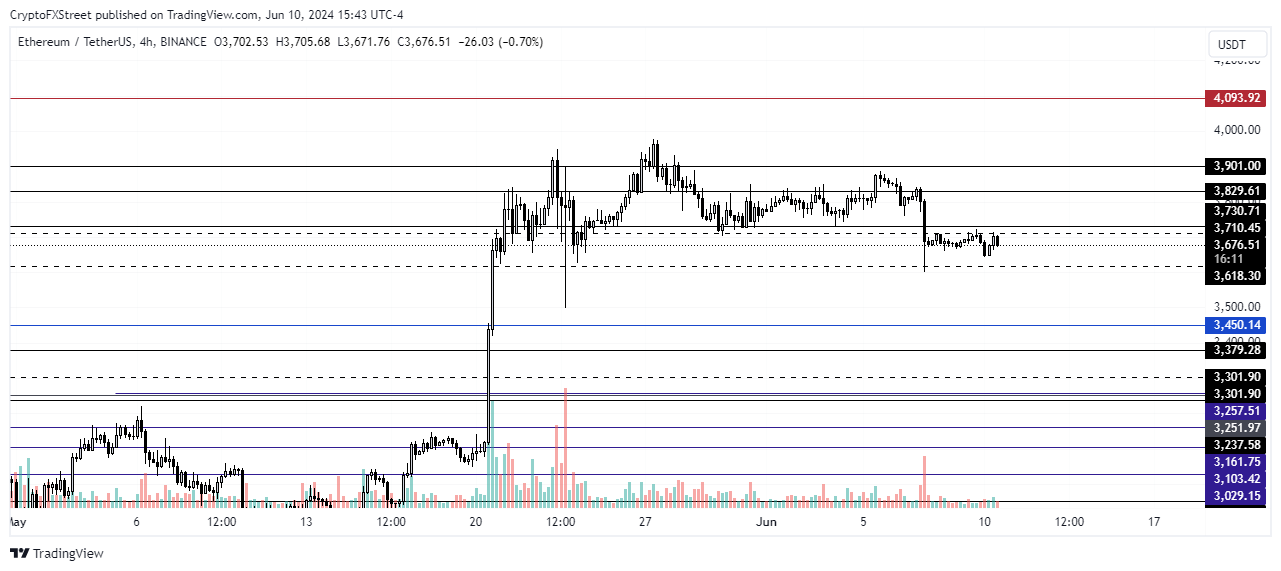

ETH technical analysis: Ethereum to see a potential bullish reversal

Ethereum is trading around $3,661 on Monday after the US Nonfarm Payrolls (NFP) data on Friday cooled signs of any potential breakout above the $3,900 resistance. The NFP news briefly sent ETH below the $3,618 support before a slight recovery. ETH liquidations sit at $9.47 million, with the majority coming from long liquidations worth $6.99 million.

ETH/USDT 4-hour chart

According to data from Laevitas.ch, the ETH futures premium dropped from around the 15% mark to 13% on Monday — its lowest level since the SEC’s position response toward spot ETH ETFs — signaling dwindling investor interest. The futures premium stays around 5% to 10% in neutral market conditions.

Read more: Ethereum open interest surges by 50%, SEC Chair says ETH ETF launch will take more time

ETH Open Interest (OI) also declined from $16.97 billion on June 6 to $16.37 billion on Monday, a $600 million decrease. However, considering prices declined faster than OI, investors may still be confident of a bullish reversal, indicating the bearish move could be temporary.

As a result, ETH will likely sustain a horizontal move slightly tilted toward an upward movement. The $3,900 resistance is the key price level for ETH to overcome before any significant breakout. A sustained move below the $3,618 support will invalidate the bullish thesis.

Ethereum development FAQs

After the Merge, the Ethereum community is looking at the Sharding upgrade next, which has been slated for sometime later in the year. The development can be summarized in four words, “scalability through more efficient data storage.” The software update will increase the capacity of the blockchain, widening the amount of data that can be stored or accessed. At the same time, all services running atop the Ethereum blockchain will enjoy significantly reduced transaction fees.

A fork is the splitting of a blockchain after developers agree and proceed to implement upgrades. The decision comes after these developers reach a consensus for a software upgrade. The ensuing part will see one part continue with the status as is, while the other one will proceed with new features combined with the former ones. A hard fork basically entails permanent divergence of a new side chain from the original one, while a soft fork is doing the same, only difference being that it is temporary.

EIP-4844 is an improvement proposal for the Ethereum network. The upgrade promises reduced gas fees, which is a valuable offering considering the high transaction cost that continues to daunt crypto players. It has been a long-standing concern for the Ethereum network. The proposal is also referred to as “proto-Danksharding,” with an unmatched ability to increase the speed of transactions on the Ethereum blockchain. At the same time, it helps to reduce the transaction cost as everything becomes decentralized.

Gas token is a new, innovative Ethereum contract where users can tokenize gas on the Ethereum network. This means they can store gas when it is cheap and start to deploy the gas once the market has shifted to the north. The use of Gas token helps to subsidize high gas prices on transactions, meaning investors can do everything from arbitraging decentralized exchanges to buying into initial coin offerings (ICOs) early.