Cardano (ADA) has struggled to maintain $1 as support, facing resistance that led to a sharp 9% decline in the last 24 hours. Despite this downturn, traders appear increasingly bullish.

With ADA currently trading at $0.80, the recent price action has sparked optimism, opening the door for a potential recovery.

Cardano Enthusiasts Are Certain Of Recovery

Cardano’s funding rate is on the verge of turning positive after nearly a week in the negative zone. This shift indicates a potential change in trader sentiment.

When the funding rate is negative, short sellers dominate, showing bearish sentiment. However, as the rate moves toward positive territory, it suggests traders are now placing more long contracts than short, signaling confidence in a price rebound.

The shift in sentiment follows ADA’s price drop to $0.80, allowing traders to enter positions at lower levels. Many now anticipate an uptrend, believing the cryptocurrency’s recovery is imminent.

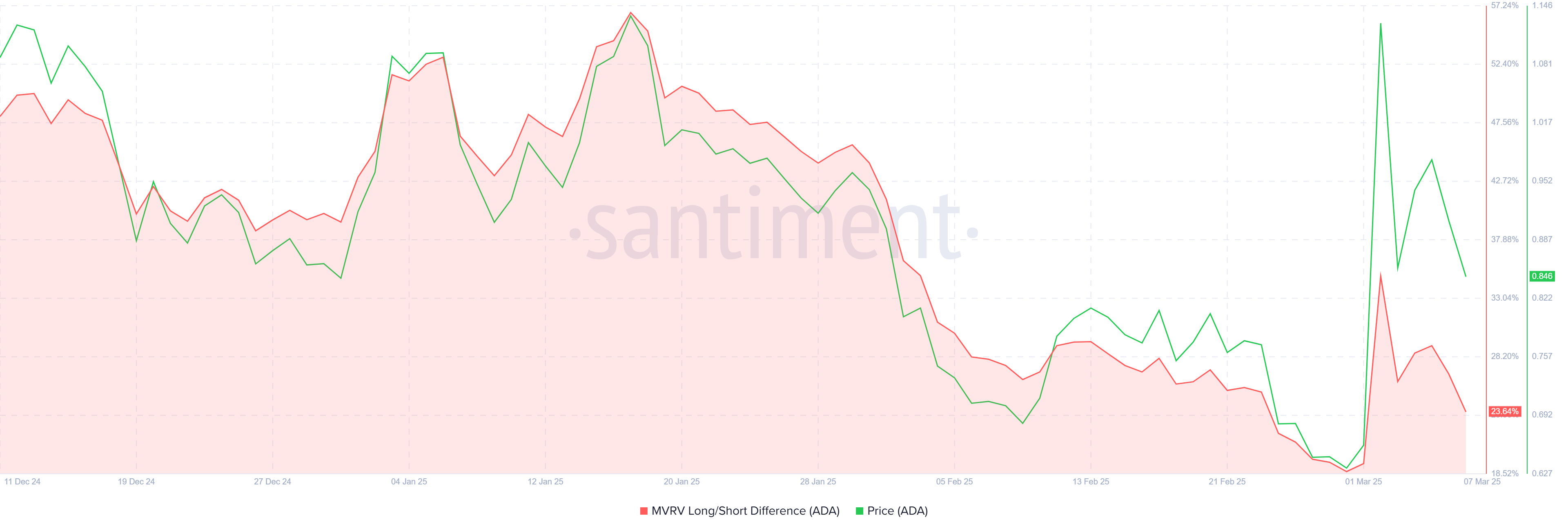

One key metric supporting Cardano’s potential recovery is the Market Value to Realized Value (MVRV) Long/Short Difference, currently at 23%. This metric assesses the profitability of long-term holders (LTHs) versus short-term traders.

A positive value indicates LTHs are sitting in profits, reinforcing market stability.

Long-term holders often act as the backbone of an asset, and their profitability supports overall market health. As these investors see their positions return to profit, they are less likely to sell, reducing downward pressure on ADA’s price.

ADA Price Is Aiming High

Cardano’s price fell by 16.8% over the past 48 hours, struggling to breach the $0.99 resistance level. This sharp decline pushed ADA to its current trading price of $0.80, leaving traders assessing potential recovery scenarios.

Despite the drop, Cardano has maintained support above $0.77, suggesting a possible bounce. If the funding rate flips positive and macro momentum remains strong, ADA could reclaim $0.85 as support.

A successful flip would enable Cardano to retest $0.99 and potentially establish $1.00 as a new support level.

However, risks remain. If broader market conditions deteriorate, ADA could lose its footing above $0.77. A break below this level would invalidate the bullish outlook, exposing Cardano to a further decline towards $0.70.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-pulls-away-after-drop/

2025-03-08 13:00:00