Story’s IP has emerged as the market’s top gainer over the past 24 hours. It has bucked the broader market decline, noting a 4% price uptick during that period.

The asset’s rally is fueled by strong demand, as reflected in its surging trading volume and short liquidations. With the bulls regaining their strength, they could propel IP toward new highs in the coming days.

IP’s Rally Fueled by Demand, But Short Sellers Are Piling In

IP’s daily trading volume has surged by 53% in the past 24 hours, reaching $159.47 million. This spike comes despite a broader market downturn, which has wiped out $148 billion from the total crypto market capitalization over the same period.

A rise in an asset’s price, accompanied by surging trading volume, signals strong market interest and growing demand. For IP, this trend indicates that its price rally is driven by actual demand, not speculative trading activity.

Despite the current bullish momentum, futures market data reveals that IP traders have been aggressively opening short positions against it, as indicated by its long/short ratio. At press time, this ratio is below one, at 0.97.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in a market. A higher ratio indicates bullish sentiment, while a lower ratio suggests growing bearish pressure.

As with IP, when the ratio falls below 1, it means there are more short positions than long positions, signaling its traders are predominantly betting on a price drop.

However, IP’s rising price has triggered a short squeeze of almost $1 million in the past 24 hours. This is forcing short sellers to cover their positions, which could further propel the asset’s price higher in the short term.

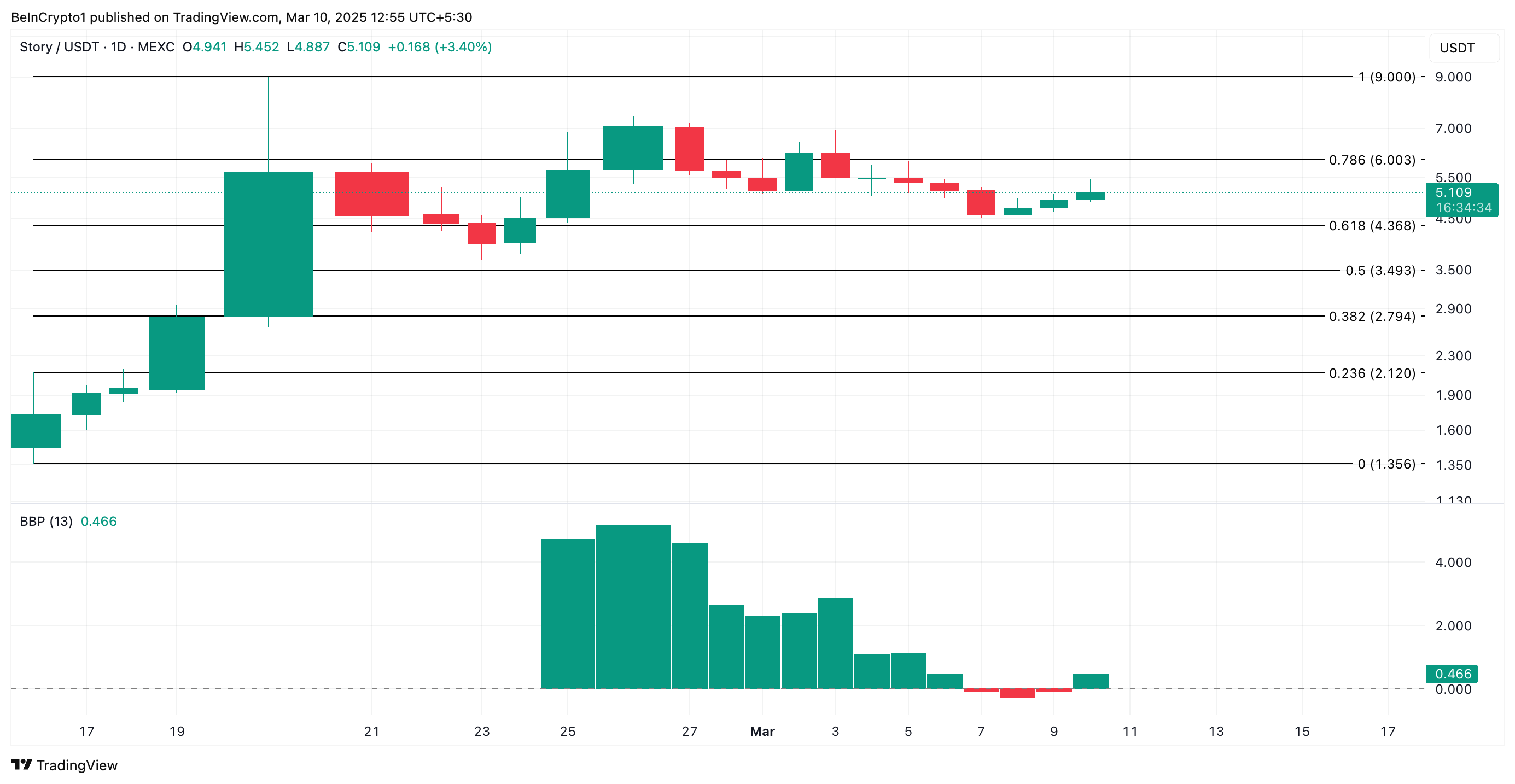

IP’s Upward Momentum Holds Firm

Readings from IP’s Elder-Ray Index support the bullish outlook. As of this writing, the indicator, which measures an asset’s bull and bear strength, is at 0.46.

When the indicator’s value is positive, bulls are in control. The trend indicates that IP currently trades at a price higher than the bear power value, signaling upward momentum. Should this continue, the token’s price could rally to $6.

On the other hand, if demand stalls, IP’s price could fall to $4.36.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ip-short-traders-price-rally/

2025-03-10 10:00:00