Hedera’s HBAR has witnessed a sharp decline in price over the past week. Exchanging hands at $0.21 at press time, the token’s value has plummeted by 17% during that period.

The token’s low demand is reflected in its open interest, which has fallen to its lowest level of the year. This signals a reduction in leveraged positions and could drive further price dips.

HBAR’s Open Interest Hits Yearly Low—Is More Downside Ahead?

HBAR’s open interest, which measures its total number of outstanding derivative contracts, such as futures or options, that have not been settled, has steadily declined since January 9. This month alone, it has plunged by 8% and is currently at $149 million, its lowest level since the year began.

When an asset’s price and open interest decline, it signals waning market participation and weakening trader confidence. This trend suggests that existing HBAR positions are being closed without new ones being opened. It presents a bearish outlook for the altcoin in the near term as its price may continue to decline unless new buying pressure re-emerges.

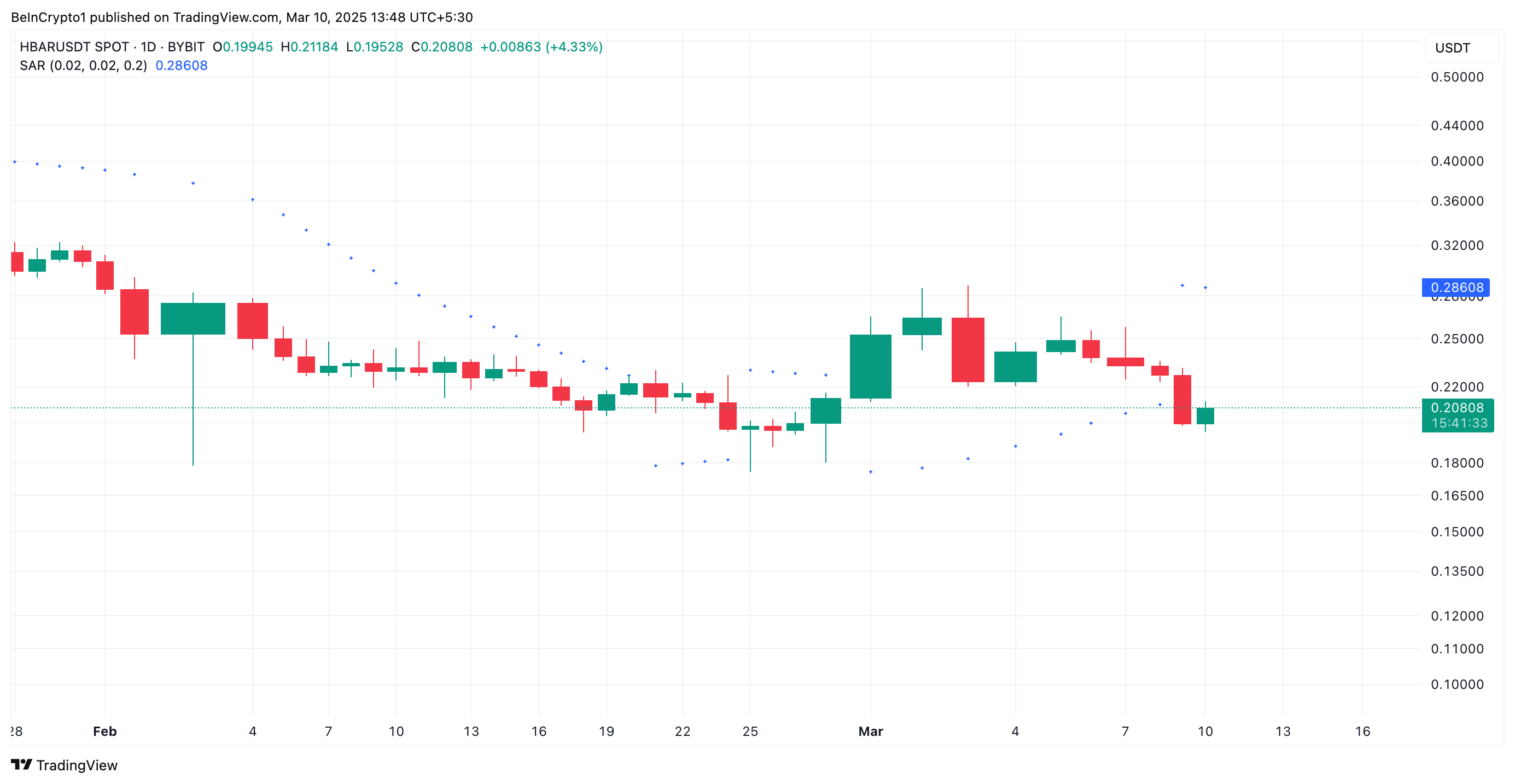

Furthermore, on the HBAR/USD one-day chart, the token trades below the dots of its Parabolic Stop and Reverse (SAR) indicator.

The Parabolic SAR indicator identifies an asset’s potential trend direction and reversals. When its dots are placed below an asset’s price, the market is in a downtrend. It confirms that HBAR’s price is declining, and the trend could continue if buying activity remains low.

HBAR Slips Back Into Bearish Channel

On the daily chart, HBAR has fallen back within the descending parallel channel, which kept its price in a downtrend between January 16 and March 1.

Last week, a surge in market volatility briefly pushed the token above this range, hinting at a potential breakout. However, waning demand has led HBAR to slip back into the bearish channel, signaling renewed downside pressure.

If this continues, HBAR’s price could fall to $0.16.

On the other hand, a resurgence in HBAR demand could drive its price to $0.24.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/hbar-open-interest-yearly-lows/

2025-03-10 14:00:00