Pi Network’s native token, PI, has bounced back following a few days of decline. It has noted a 6% gain in the past 24 hours to trade at $1.47 at press time.

The recovery comes ahead of Pi Day on March 14. There is also growing market speculation about a potential Binance listing.

PI Gains 21% as Traders Gain Confidence

PI has jumped 21.3% over the past 24 hours, driven by growing speculation over a potential Binance listing and the upcoming Pi Day announcements on March 14.

This date also marks the deadline for KYC completion and the migration of PI holdings from the mobile app to the Mainnet. These upcoming developments have triggered a new wave of PI demand, putting upward pressure on its price.

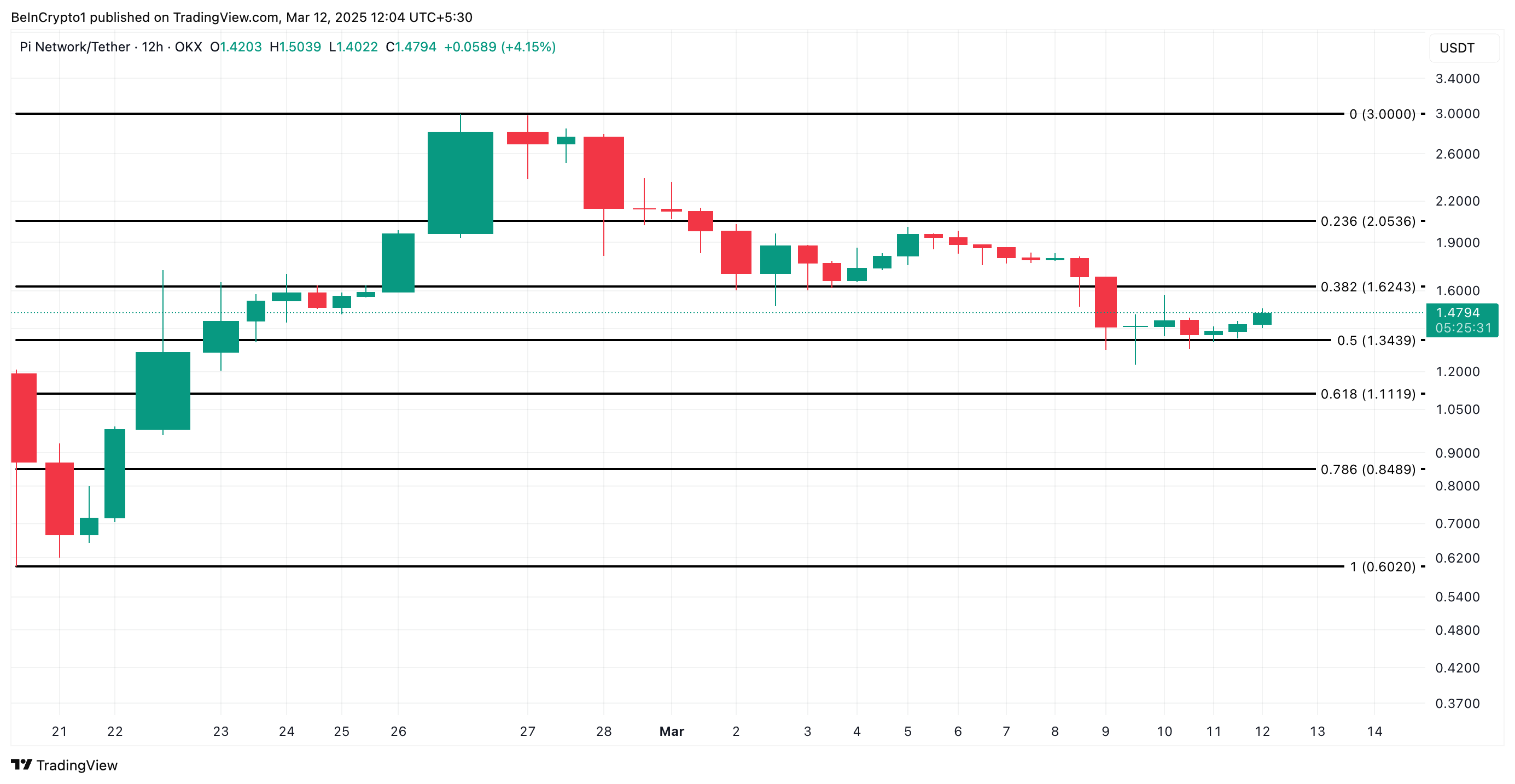

The steady rise in PI’s Relative Strength Index (RSI) reflects the surge in buying activity among spot market participants. The momentum indicator is in an upward trend and poised to break above the 50-center line at press time.

When an asset’s RSI is attempting to cross above its 50-neutral level, it signals a shift in momentum from bearish to bullish. This suggests that buying pressure is increasing, potentially leading to further price gains if the trend continues.

A confirmed move above 50 would reinforce positive sentiment around PI and attract more traders looking for upward momentum.

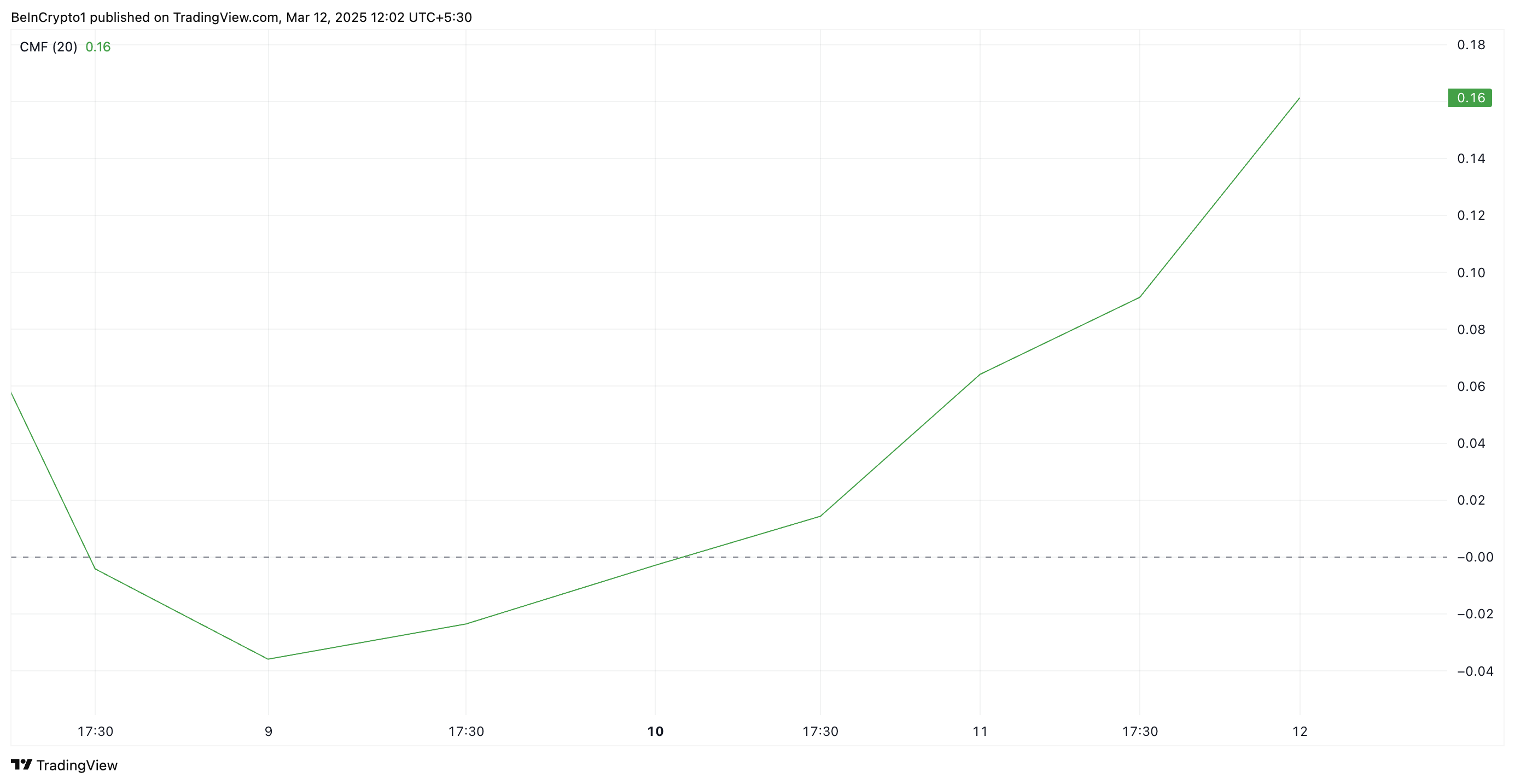

Furthermore, its positive Chaikin Money Flow (CMF) confirms this bullish outlook. This indicator, which tracks how money flows into and out of PI, is above zero at 0.16.

This trend indicates that buying pressure is stronger than selling pressure among PI traders. It signals that investors are confident in the asset, increasing the likelihood of further price appreciation.

PI Eyes Recovery After Steep Drop—Can It Reclaim $2?

PI has steadily declined, plummeting over 19% in the past week. This has pushed its price under a key price level of $1.62, which forms significant resistance. If the bullish trend persists and the demand for PI soars, its price could attempt to breach this level.

A successful break above $1.62 could propel PI above $2 and closer to its all-time high of $3.

On the other hand, a resurgence in profit-taking would invalidate this bullish projection. If selloffs spike again, PI’s price would resume its downtrend and fall to $1.34.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/pi-network-token-surge-pi-day/

2025-03-12 16:00:00