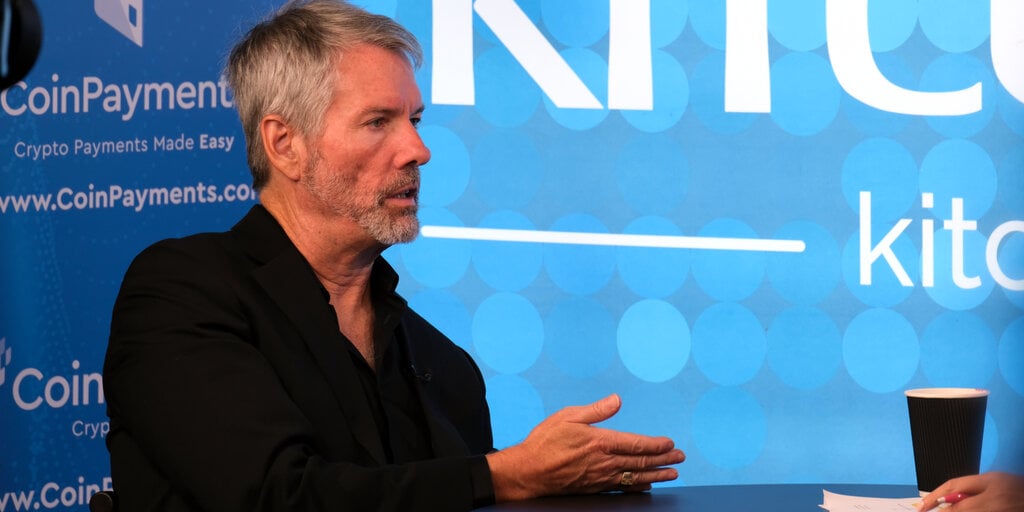

Michael Saylor’s Strategy has resumed its Bitcoin buying.

After a brief pause, the business intelligence firm has snapped up another $10.7 million worth of BTC, adding 130 coins to its already massive stash, bringing its total holdings to nearly half a million.

The purchase, made at an average price of $82,981 per Bitcoin, represents the smallest acquisition by the company since it first started buying Bitcoin in 2020.

https://x.com/saylor/status/1901606324447646170

With this latest buy, Strategy’s total Bitcoin holdings have now reached 499,226 BTC, valued at around $41.4 billion, or approximately 2.4% of the total Bitcoin supply, per the latest U.S. Securities and Exchange (SEC) Commission filing.

The acquisition was funded using proceeds from the “STRK ATM,” a new program Strategy launched to raise up to $21 billion in fresh capital.

An At-The-Market (ATM) offering allows a company to sell shares directly into the secondary trading market at prevailing market prices over time, rather than through a traditional public offering.

The Bitcoin giant’s long-term plan involves raising $42 billion over the next three years to expand its holdings significantly as part of its “strategy” to acquire Bitcoin as a key asset despite market fluctuations.

Following the announcement, Bitcoin’s price jumped slightly, but has since fallen by 0.3%, trading at $82, 921.51, CoinGecko data shows.

Amid the recent price fluctuations of the asset, Strategy’s Bitcoin yield stands at 6.9% year-to-date, though it still falls short of the firm’s target of 15% for 2025.

While the latest buy is among its smallest, the company had its largest acquisition of 2025 on Feb. 24, purchasing 20,365 BTC for nearly $2 billion. Starting in early November, it had purchased Bitcoin on a near-weekly basis.

Alongside its corporate acquisitions, Michael Saylor, co-founder of Strategy, has always advocated for Bitcoin as a strategic reserve asset for the U.S. government.

Last month, Saylor suggested the U.S. could purchase up to 20% of Bitcoin’s total supply, potentially using the asset to eliminate the national debt—just before President Donald Trump unveiled plans for a strategic “crypto reserve.”

Even with the smaller size of the latest acquisition, Strategy continues as the largest corporate Bitcoin holder, followed by MARA Holdings (MARA) and Riot Platforms (RIOT), Bitcoin Treasuries data shows.

Strategy stock (NASDAQ: MSTR) was most recently trading at about $293.60—a 13.41% increase at the close, per Yahoo Finance.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

James Rubin

https://decrypt.co/310146/strategys-latest-purchase-adds-130-btc

2025-03-17 14:59:43