After the FOMC (Federal Open Market Committee) minutes and the digital asset summit on Wednesday and Thursday, respectively, approximately $2.09 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today.

The expiration may influence market conditions, with investors monitoring potential shifts.

Over $2 Billion in Options Expiry Today

According to Deribit, $1.826 billion in Bitcoin options expire today. The maximum pain point of these contracts stands at $85,000.

These options include 21,596 contracts, slightly fewer than last week’s 35,176. Despite recent volatility, the put-to-call ratio of 0.83 indicates a general bullish sentiment.

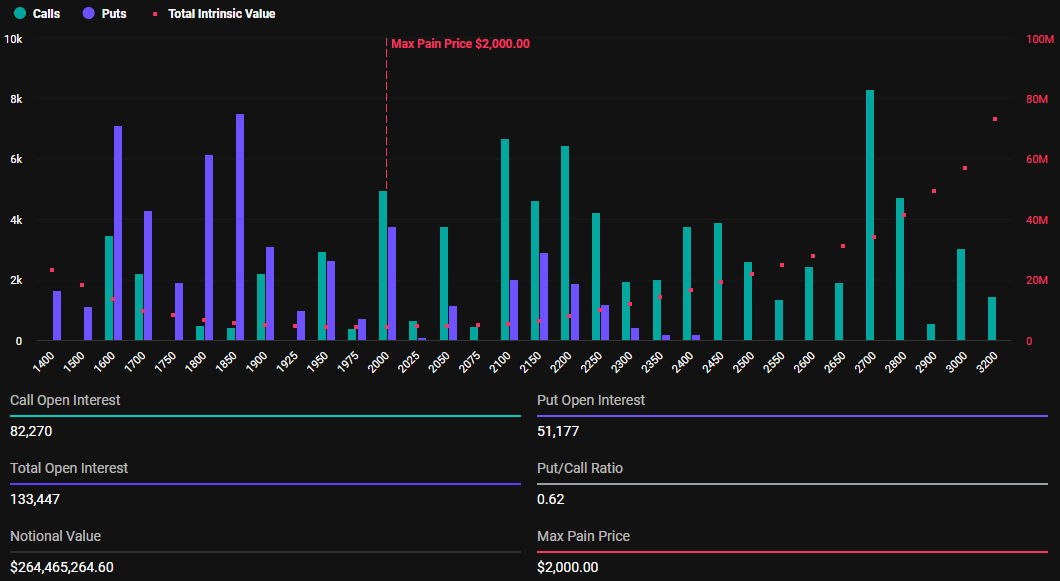

Ethereum has $264.46 million in options expiring, involving 133,447 contracts. This figure is also lower than the previous week’s 223,395 contracts. The maximum pain point for these options is $2,000, and the put-to-call ratio is 0.62.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. According to BeInCrypto data, BTC traded for $84,414, whereas ETH exchanged hands for $1,977.

This suggests a modest upside for Bitcoin and Ethereum towards the $85,000 and $2,000 strike prices, respectively. This surge is plausible given smart money’s Strategy in options trading, pushing prices toward the “max pain” level. Here, the highest number of contracts, both calls and puts, expire worthless.

“Will we see a volatility squeeze or a slow unwind?” Deribit posed in a post on X (Twitter).

Based on Bitcoin and Ethereum’s put-to-call ratios, both below 1, call options (purchases) have a higher prevalence than put options (sales).

Market Sentiment Ahead of Today’s Options Expiry

Analysts from crypto options trading tool Greeks.live provided insights on the current market sentiment, highlighting a divided trader community. On the one hand, some expect a price drop after the FOMC meeting, as policymakers rejected further interest rate cuts, effectively disappointing the crypto market.

On the other hand, some anticipate a temporary rise before choppy conditions. With this, the analysts note the range between $83,000 and $85,000 as the area of interest, with expected volatility around President Trump-related developments and potential MicroStrategy (now Strategy) purchases.

“Expect chop and drift lower before heading higher again on Monday, despite the current pump not being viewed as sustainable,” Greeks.live analysts observed.

Elsewhere, BeInCrypto reported that Bitget exchange CEO Gracy Chen is confident BTC will hold above the $73,000 to $78,000 range, paving the way for a potential rally to $200,000. She attaches her optimism to the US strategic Bitcoin reserve’s potential to drive institutional legitimacy and long-term price stability.

Even as Bitget’s Chen remains optimistic, traders and investors should brace for short-term volatility. Historically, options expirations tend to cause temporary price movements. However, the market usually stabilizes shortly after.

This calls for vigilance and analysis of technical indicators and market sentiment to manage potential volatility effectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/bitcoin-ethereum-options-expire-fomc/

2025-03-21 05:29:37