The XRP community is concerned about the network’s utility as its DEX trading volumes and TVL remain extremely low. Despite XRP’s impressive $137 billion market cap, the network recorded only $44,000 in daily DEX trading volume yesterday, raising questions about its overall utility and adoption.

When compared to leading blockchain networks, the XRP ledger suffers from a shortage of nodes, validators, and smart contract token holdings. This discrepancy highlights a clear misalignment between the altcoin’s market valuation and the practical usability of its blockchain network.

XRP Ledger Reflects Massive Issues

Since Donald Trump’s re-election in November 2024, XRP has become one of the most trending crypto assets in the market. Under the SEC’s pro-crypto regulatory shift, XRP has surged nearly 300% in the past four months, and become the 4th largest asset in the market.

Most notably, the SEC dropped its long-running lawsuit against Ripple, sparking hope that the token could reach an all-time high. Despite all of these positive developments, the XRP Ledger has shown little to no improvement in trading activity.

“I think XRP is the biggest financial scam the world has ever seen. There has never been something which has produced less value that has reached this market cap ($140 billion). The XRP ledger did $44,000 in volume in the last 24 hours, according to DefiLlama,” on-chain researcher Aylo claimed on X.

One look at DefiLlama’s data reveals the problem. So far, the network’s volume in March was a measly $1.5 million, and its TVL is $80 million. In other words, there’s practically zero utility for its size.

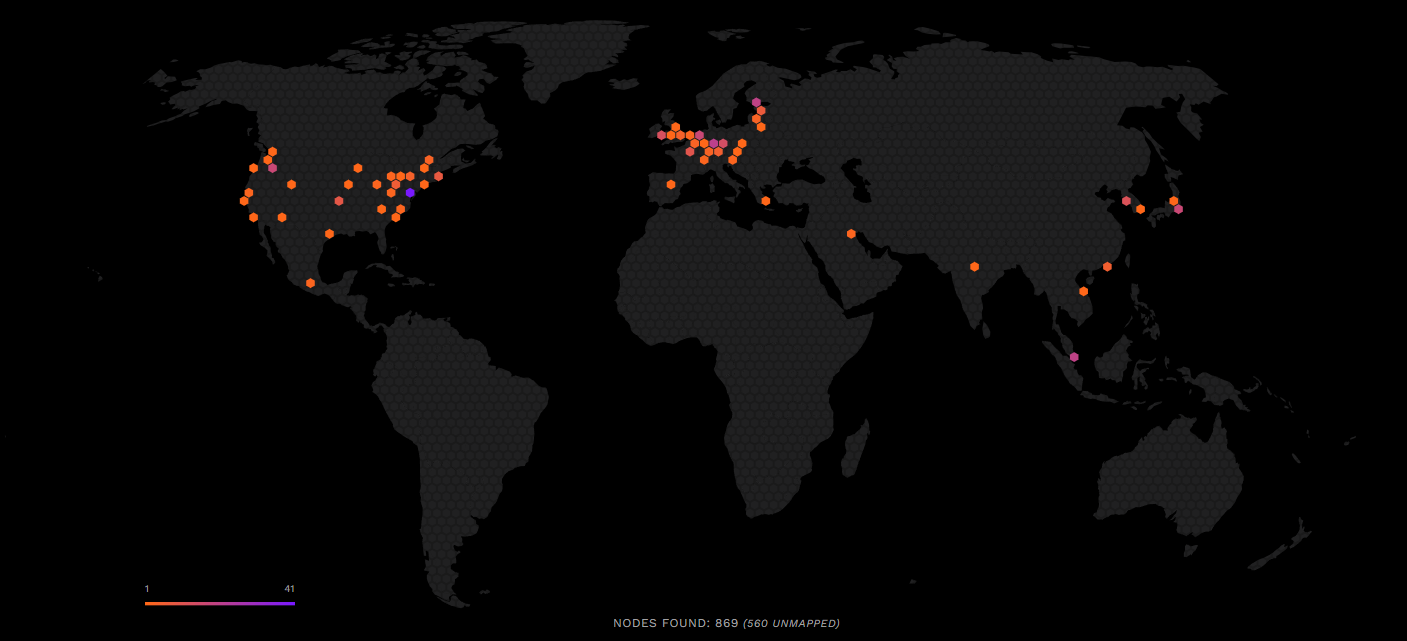

This trade volume and TVL data is an important window into the state of XRP, but there are other vital clues. For example, according to its own website, XRP currently has 386 nodes and 96 validators.

Compare this to other leading assets, Bitcoin has nearly 22,000 nodes, Ethereum has 11,000, and Solana has 4,700.

In other words, general crypto traders don’t seem to be interested in the network’s utility. It’s a concerning indication that the majority of the community considers XRP primarily as a speculative asset.

However, there is a counter perspective that the XRP community needs to consider. While XRPL DEX volume remains modest, Ripple continues to establish itself as a key infrastructure provider for global banking institutions.

Ripple’s technology streamlines cross-border payments by reducing settlement times and lowering costs, attracting leading banks and financial service providers worldwide. This strong institutional focus drives interest in XRP, as it supports efficient liquidity management.

In this context, XRP’s value proposition extends beyond conventional crypto trading. It plays a larger strategic role in modernizing global financial transactions and bridging traditional finance with emerging digital payment solutions.

So, XRPL’s low trading volume is concerning, but there is a good reason why it doesn’t align with the altcoin’s valuation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/xrp-ledger-dex-trading-sparks-concern/

2025-03-21 20:21:31