Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP remains stuck around the $2 level, with experts issuing warnings of restricted near-term growth prospects. According to recent analysis, the digital currency is going through a phase of uncommon stability that has investors speculating about its next step.

Related Reading

Investor Sentiment Dampens Market Momentum

According to financial commentator Austin Hilton, millions of crypto traders have withdrawn from active participation. The market is stuck in neutral, as traders are simply waiting for a big event to set things into motion. The volumes of trade have been above $4 billion at peak levels, but the price itself remains virtually unchanged.

Summer Slowdown Impacts Crypto Trading

Analysts cite seasonal patterns as the major reason for XRP’s current behavior. Hilton describes how summer months usually experience lower trading volumes, with investors more inclined to engage in private activities than respond to market activity. This pattern might continue until July, possibly maintaining XRP’s price relatively stable.

A realistic XRP price prediction!

– Lets talk about the resistance levels for $XRP

– Also, discussed are the support levels that you need to know about

– What you need to know about your XRP holdings – so that you can navigate what is going on right now pic.twitter.com/h9kxG3a0Ex— Austin Hilton (@austinahilton) March 23, 2025

Price Barriers Create Market Challenges

Technical analysis indicates key price levels for XRP. Resistance levels are found at $2.61 and $2.81, while support levels are at $2.22 and $2.31. Experts caution that in the absence of heavy buy pressure, the cryptocurrency might not be able to overcome these levels. Currently, XRP is trading at $2.44, with a modest 0.04% gain over the last 24 hours.

XRP market cap currently at $141 billion. Chart: TradingView.com

Long-Term Outlook Remains Hopeful

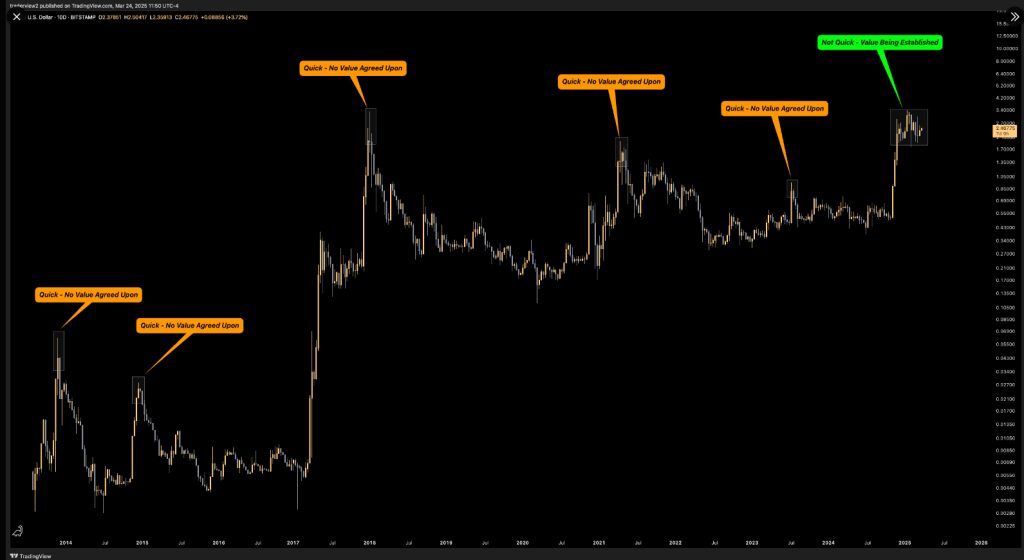

Despite current market challenges, some experts remain optimistic. Market analyst Dom suggests the current price consolidation might indicate a strong foundation for future growth. Unlike previous market cycles where XRP experienced rapid price spikes and drops, the current stability suggests a more measured approach.

There’s one reason I will be pretty surprised if $XRP does not go higher this year, read along –

Every time $XRP has historically put in a multi month or year top, it did it quickly (as shown below)

Essentially, it never showed any mid term acceptance at those higher… pic.twitter.com/RahjM2xHwz

— Dom (@traderview2) March 24, 2025

A number of possible catalysts are on the horizon, such as developments in XRP ETF products, continued action in the SEC vs. Ripple case, and possible reserve disclosures. As of yet, however, none of these events have caused major market activity.

Related Reading

Institutional investors remain quietly accumulating digital assets, creating yet another level of sophistication to the current market dynamics. Hilton advises not to anticipate extreme price increases in the near term, highlighting that there needs to be a major positive event for drastic change.

As the cryptocurrency market keeps growing, XRP investors are warned to keep close watch on the market conditions. The fourth quarter could see things pick up once again, but for the meantime, patience seems to be the main approach for those who possess the cryptocurrency.

Featured image from Gemini Imagen, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/altcoin/xrp-breakout-on-hold-financial-expert-reveals-whats-missing/

2025-03-25 11:30:05