Ethereum’s inability to establish a strong foothold above $2,000 continues to dampen investor sentiment, causing many traders to keep their assets liquid in case of a potential selloff.

This cautious stance is reflected in ETH withdrawals from exchanges, which have plunged to a seven-month low.

ETH Exchange Activity Signals Growing Bearish Sentiment

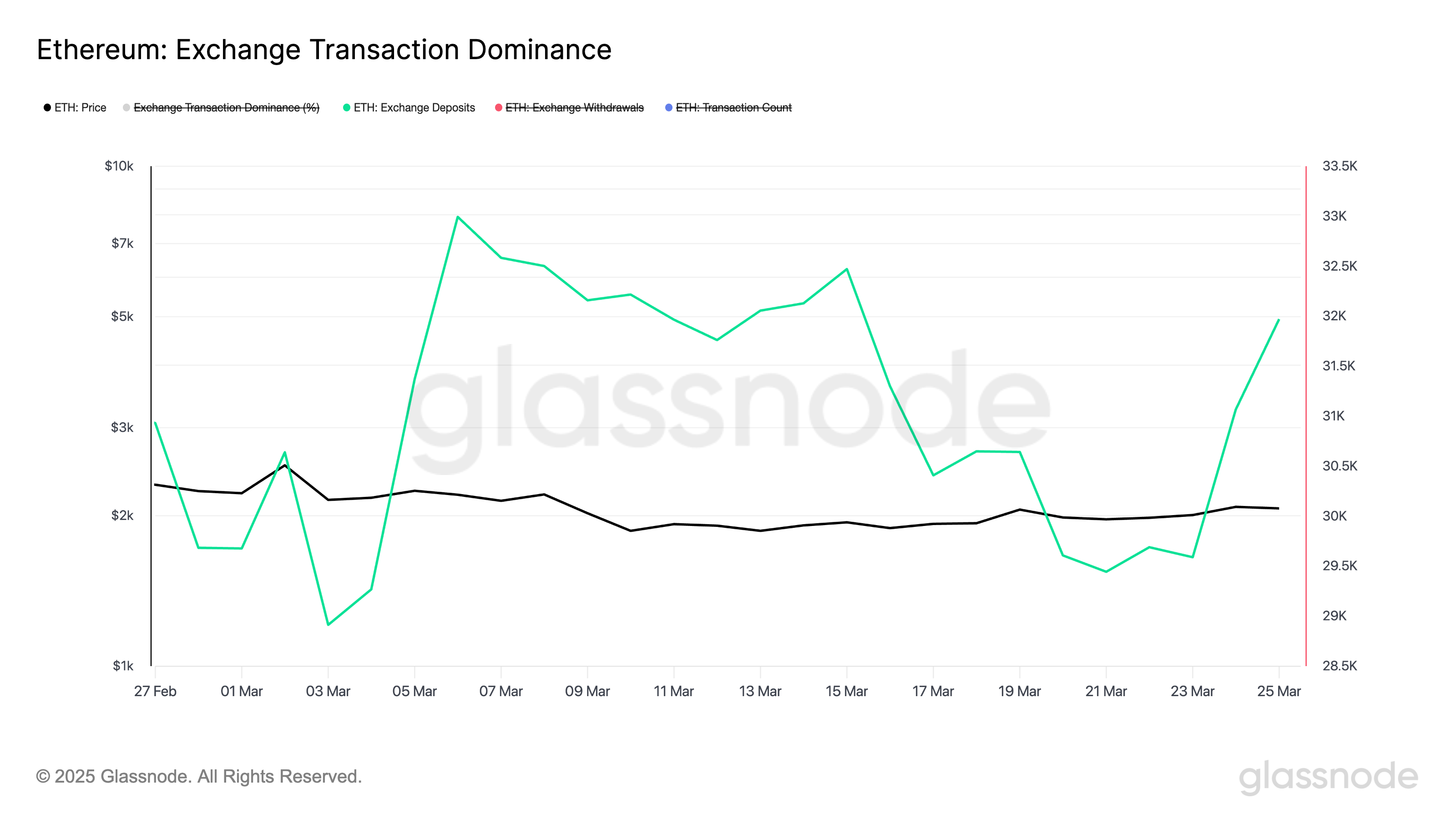

An assessment of Ethereum’s exchange transaction dominance shows a significant decline in ETH withdrawals since late January. According to Glassnode, ETH’s exchange withdrawal transactions totaled 59,755 coins on Tuesday, marking its lowest single-day count since August 31.

When ETH withdrawals from exchanges drop, it means fewer investors are moving their holdings to private wallets or cold storage. This suggests they are not planning to hold the coin long-term. Instead, they are keen on keeping their ETH coins on exchanges; a trend that signals a readiness to sell.

At the same time, ETH deposits have climbed, confirming the increasing selling pressure in the market. According to Glassnode, the number of ETH coins sent to exchanges has surged by 10% since the beginning of March.

When an asset’s exchange deposits spike like this, more investors are moving their holdings onto exchanges, often in preparation to sell. As bearish sentiment grows weaker, these coins are sold for profit, putting more downward pressure on ETH’s price.

Will ETH’s Uptrend Hold? Bulls Face Resistance at $2,148

At press time, ETH is trading at $2,073, marking a 3% gain over the past week as part of the broader market recovery.

On the daily chart, the leading altcoin follows an ascending trendline, signaling sustained price growth. If bullish momentum intensifies and exchange withdrawals increase while deposits slow, ETH could maintain this trend and reclaim the $2,148 level.

However, if exchange activity remains unchanged and selling pressure rises, ETH risks breaking below the ascending trendline, potentially falling to $1,759.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ethereum-exchange-withdrawals-fall/

2025-03-26 18:00:00