Leading meme coin Dogecoin (DOGE) has encountered considerable challenges in recent weeks. Currently trading at $0.10, the altcoin’s value has dropped by 16% over the past 30 days.

On-chain data shows that this decline is largely driven by a decrease in whale activity during this period.

Dogecoin Whales Reduce Accumulation

Data from IntoTheBlock shows a significant drop in large transactions involving Dogecoin. The on-chain data provider reports that the daily number of DOGE transactions valued between $1 million and $10 million has fallen by 62% over the past 30 days.

Similarly, transactions exceeding $10 million have decreased by 67% during this period.

Large transactions are typically linked to confidence in an asset’s future performance. When these transactions decline, it signals a loss of confidence among whales, underscoring their bearish outlook on the asset’s potential movements.

The drop in DOGE’s Large Holders Netflow to Exchange Netflow Ratio further validates this reduced whale activity. According to IntoTheBlock, this metric has plummeted by 383% over the past 30 days, confirming a significant decline in whale accumulation.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. The netflow to exchange netflow ratio measures the activity of these investors relative to the broader market.

A high Large Holders Netflow to Exchange Netflow Ratio indicates strong accumulation by large holders, which is a bullish signal. Conversely, a low ratio suggests increased selling activity from these key investors, applying downward pressure on the asset’s price. This sell-off often triggers retail traders to follow suit, further intensifying the selling pressure.

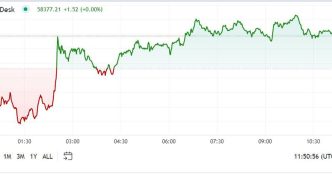

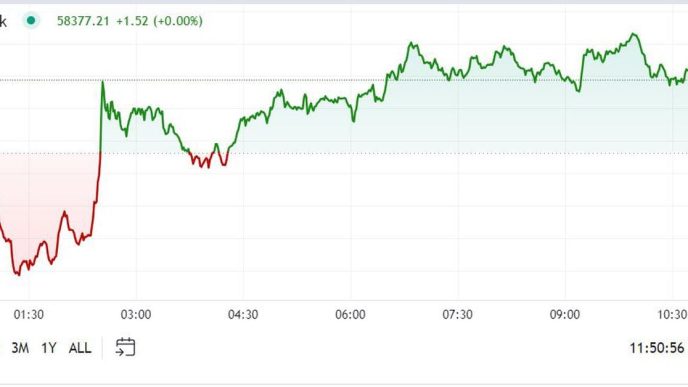

DOGE Price Prediction: a 20% Fall Is Imminent

If buying pressure from DOGE whales continues to decline, the price could drop to $0.08, marking a 20% decrease from its current value. The meme coin was last seen at this level on August 5, when the crypto market experienced over $1 billion in liquidations. Prior to that, DOGE traded this low in February.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in August 2024

However, if whale sentiment shifts from bearish to bullish and they begin to accumulate once again, it may push the meme coin’s price up to $0.12.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/doge-targets-multi-month-lows/

2024-08-16 12:00:00