In a recent integration, Base provided its developers and users with access to all Chainlink services, including Data Streams and VRF infrastructure.

This collaboration unites a builder-friendly ecosystem with industry-standard decentralized computing infrastructure, enhancing both platforms’ capabilities.

Chainlink Services on Base

The integration allows developers on Base to create user experiences rivaling those of centralized exchanges (CEXs). Chainlink contributes ultra-fast, user-friendly DeFi products with high throughput, while Base Layer-2 (L2) brings unmatched on-chain execution speed and security through its Ethereum connection.

Although Coinbase incubates the Base blockchain, it is secured by the Ethereum network, providing the stability and scalability needed to support decentralized applications (dApps).

With Chainlink’s full suite of products available on Base, developers can leverage CCIP, functions, price feeds, data streams, and VRF. According to Tom Vieira, Head of Product at Base, this will enable the building of on-chain apps.

Read More: What is Base Chain? Everything You Need to Know

The development enhances capabilities for both developers and users. It marks a significant milestone in the evolution of the decentralized finance (DeFi) market and the progress of blockchain technology. By equipping developers with essential tools to build dynamic, secure, and high-performance applications, it also ensures that users enjoy a seamless and efficient on-chain experience.

“Base’s builder-friendly environment is a natural fit for Chainlink products, and we’re excited to see the entire Chainlink platform now available on Base. Chainlink Data Streams’ low-latency market data will enable developers to build the next generation of DeFi products. VRF will now enable smart contracts on Base to access random number generation securely,” said Thodoris Karakostas, Head of Blockchain Partnerships at Chainlink Labs.

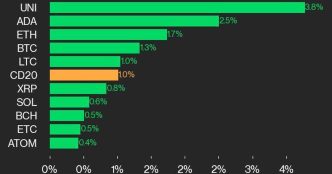

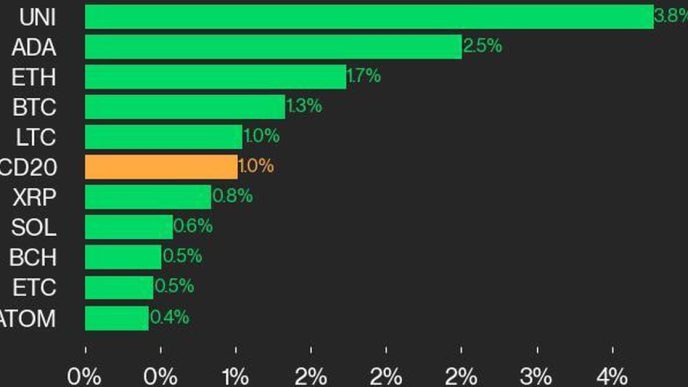

Base TVL Grows 19.7% in August

As BeInCrypto reported, Base founder Jesse Pollak is also planning to build a “dream wallet. These developments highlight the continued acceleration of the L2 flywheel, with assets steadily flowing into the blockchain.

Base has seen a 19.7% surge in total value locked (TVL) since August 5, climbing from $1.229 billion to $1.472 billion by August 16. This sharp increase indicates rising user participation and growing interest in the platform.

Despite its recent gains, Base faces key challenges, including concerns about decentralization due to its current setup. Coinbase is currently the sole sequencer for the network, giving the exchange full control over transaction validation. This centralized model contradicts crypto’s principles, leading to mistrust and limiting the number of projects built on the platform.

In addition to centralization issues, Base L2 has experienced withdrawal delays due to its reliance on Optimistic Rollups. Developed in partnership with Optimism, Base inherits the chain’s anti-fraud system, which allows users to challenge transactions by submitting fraud proofs, contributing to these delays.

Read more: 7 Best Base Chain Meme Coins to Watch in 2024

Security concerns also arise from Optimism’s vulnerabilities, affecting meme coins and exposing users to potential losses, which have negatively impacted Base’s total value locked (TVL).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/base-enhances-defi-with-chainlink/

2024-08-16 12:30:00