Regardless of rationale, each crypto investor is aiming to seek maximum participation in upside performance while budgeting for downside exposure. We leave the rationale on why to invest in crypto with the reader and focus on asset allocation. From an institutional investor viewpoint, it is important to consider the risk contribution to a Multi-Asset Portfolio and highly volatile nature of crypto assets.

In our analysis, we focus on the two most well-known crypto assets: Bitcoin and Ethereum. Bloomberg has single indices available on both with tickers {BITCOIN Index} and {ETHEREUM Index} respectively. We have created an equally weighted basket of both these indices with quarterly rebalancing (“Crypto Basket”). For an extended data history, we use just Bitcoin index’s timeseries prior to Ethereum index’s base date in 2017 – we show the log-scaled historical performance in Exhibit 2. The long-term volatility of the Crypto Basket is close to 100%, however as we see from Exhibit 3 the 1-year rolling volatility profile has been declining over time. As per Exhibit 4, the Crypto Basket has stable, neutral correlations against Equities, Bonds, Commodities and USD Dollar. The Crypto Basket correlation is very slightly negative against the USD Dollar.

For the purposes of our analysis, we use Equities = Bloomberg Developed Markets Large & Mid Cap Total Return Index {DMTR Index}, Bonds = Bloomberg Global Aggregate Total Return Unhedged Index {LEGATRUU Index}, Commodities = Bloomberg Enhanced Roll Yield {BERY Index} and USD = {DXY Index}.

We apply principles from modern portfolio theory to determine an optimal allocation to Crypto from a Multi-Asset Portfolio. In our analysis below, we plot the Sharpe Ratios and Maximum Drawdown (Max DD) for the Multi-Asset Portfolio on the far left and then each of the Portfolios by replacing a smaller increment up to 1% and then 1% up to 5% allocation to Crypto Basket as we move to the right.

Our results show that the higher the allocation to the Crypto Basket the better the Sharpe Ratio of the portfolio, however this comes at the expense of a larger Max Drawdown.

Crypto risk is deep-rooted

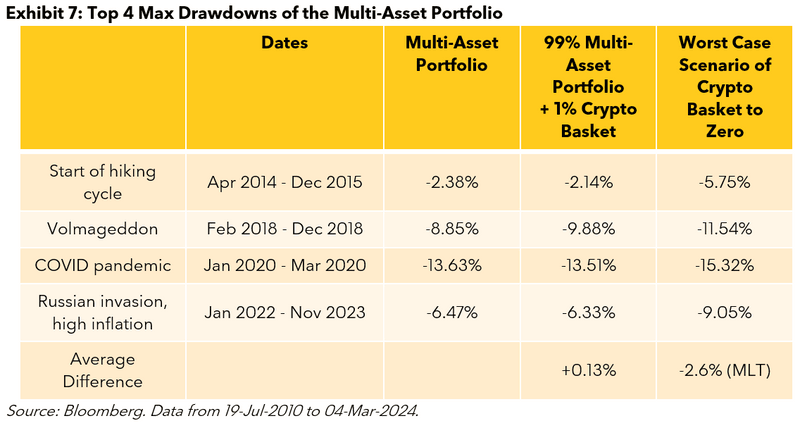

We introduce the concept of the Max Loss Tolerance (MLT) to solve for the appropriate allocation to Crypto. We define the MLT term as the expected additional loss that would have been experienced in the top Max DDs of the Multi-Asset Portfolio if the Crypto Basket had linearly devalued to 0 over the drawdown window. That is to ask yourself, “How much additional loss (%) am I willing to tolerate if the value my Crypto investment falls to zero while my Multi-Asset Portfolio is suffering from a drawdown?”

This Loss Tolerance model can be applied to stress crypto performance to various scenarios such as down by half / third…etc., however for a “worst case” scenario we devalue crypto down to 0.

In the table above we highlight the Top 4 Max DD events for the Multi-Asset Portfolio and compare against the performances of the Multi-Asset Portfolio including 1% allocation to the Crypto Basket and the hypothetical performance of the Max Loss Tolerance. The results show that for 1% allocation to Crypto Basket a Multi-Asset Portfolio investor should have Max Loss Tolerance level of -2.6%.

We extend our analysis to each of the portfolios by adding an incremental 1% allocation to the Crypto Basket and calculate the Max Loss Tolerance measures.

We present a risk framework to consider when sizing an allocation to crypto in a traditional Multi-Asset Portfolio in this article. In Exhibit 9, we observe that a greater allocation to the Crypto Basket does boost the Multi-Asset Portfolio’s Sharpe Ratio upwards from 0.73 however this comes at the cost of greater potential losses in a worst-case scenario as defined by our Max Loss Tolerance model.

Market participants have gained exposure to Crypto for a multitude of reasons. While the asset class is regarded as being volatile, its volatility has been decreasing. When we apply a risk framework for sizing – an institutional perspective, we find that a little goes far when it comes to allocating to crypto in a Multi-Asset Portfolio. A small Crypto allocation can provide an additional source of returns to traditional assets, however when deciding how much to invest understand your loss tolerance.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.

https://www.bloomberg.com/professional/insights/trading/the-power-of-a-crypto-allocation-with-an-institutional-perspective/

2024-05-17 07:00:00