On August 15, the International Monetary Fund (IMF) released a report titled “Carbon Emissions from AI and Crypto Are Surging and Tax Policy Can Help.” The report calls for a significant increase in electricity taxes for crypto miners and AI data centers.

The IMF argues that the proposed tax would incentivize more sustainable practices and align these industries with global carbon reduction goals.

Rising Carbon Costs: IMF Targets Crypto and AI with New Levy Recommendations

In its report, the IMF recommends a tax of $0.047 per kilowatt hour to incentivize the crypto mining industry to reduce emissions in line with global targets. The report further mentions that if the impact of air pollution on local health is also considered, the recommended tax rate would increase to $0.089. This adjustment represents an 85% hike in the average electricity cost for miners.

“Such a levy would raise annual government revenue of $5.2 billion globally and reduce annual emissions by 100 million tons (around Belgium’s current emissions),” the IMF remarked.

Read more: How Much Electricity Does Bitcoin Mining Use?

Meanwhile, it suggests a slightly reduced tax of $0.032 per kilowatt-hour for AI data centers. This lower rate is attributed to the fact that such centers typically opt for locations with greener electricity sources.

The report highlighted the growing carbon footprint of these industries, which together accounted for 2% of global electricity demand in 2022. Projections suggest this could rise to 3.5% by 2025. According to the IMF, this figure is “equivalent to the current consumption of Japan,” which is “the world’s fifth largest electricity user.”

“A recent IMF working paper found that crypto mining could generate 0.7% of global carbon dioxide emissions by 2027. Extending the analysis to data centers (based on IEA estimates) means their carbon emissions could reach 450 million tons by 2027, or 1.2% of the world total,” the report added.

Bitcoin Mining’s Green Evolution: Experts Challenge IMF’s Findings

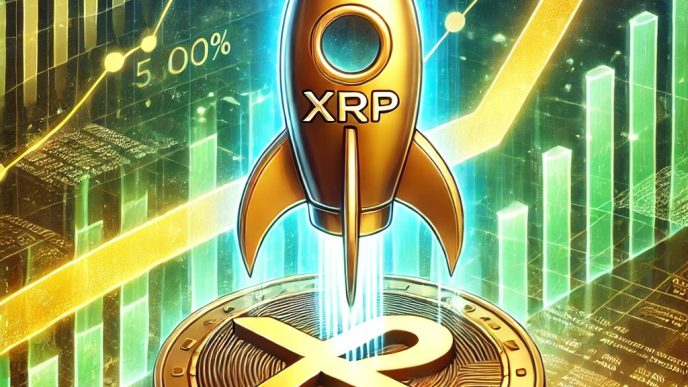

Industry leaders, however, have responded with sharp criticism. Daniel Batten, a Bitcoin environmental analyst and Marathon Digital advisory board member, described the IMF’s report as misleading and poorly researched. He accused the IMF of unfairly associating the carbon impact of AI data centers with Bitcoin mining, ignoring the crypto industry’s significant advancements in sustainability.

Furthermore, Batten emphasized that the IMF’s approach oversimplifies the issue by failing to distinguish between AI data centers and crypto mining operations. While both sectors are energy-intensive, they differ in how they consume energy and their environmental impacts.

“There is no contemporary evidence in the report that Bitcoin mining produces a rising amount of carbon emissions, but plenty of evidence that AI data centers’ carbon emissions are rising. […] So, the article says, ‘AI datacenter emissions are rising, and Bitcoin is just like AI.’ The technique is effective and will fool some people. But it’s also factually incorrect,” Batten remarked.

Batten noted that the IMF’s report also overlooks the potential environmental benefits of crypto mining when managed responsibly. He cited a report by the Digital Assets Research Institute that indicates that “as price and hashrate grow, Bitcoin mining emissions have not grown.”

“Until we get intellectual honesty from the IMF, apples-for-apples comparisons, eschewing of already-discredited research, use of contemporary datasets, and an acknowledgment that the scientific consensus shows predominantly positive environmental externalities from Bitcoin mining, any reports from this institute should be disregarded as being of a low research-standard; unusable to policymakers and regulators,” Batten stated.

The past few years have seen some jurisdictions, such as Venezuela and Iran, banned crypto mining in their countries, citing power issues. However, it is important to note that miners nowadays actively seek efficient and sustainable Bitcoin mining, with some utilizing excess or wasted energy.

A January report by Coinshares also supports this approach. It noted that Bitcoin mining consistently seeks the most affordable energy sources. This sector often utilizes stranded energy that cannot be easily integrated into the existing power grid, usually by tapping into renewable energy projects in remote areas.

Read more: Bitcoin Mining From Home: Is It Possible in 2024?

Consequently, there is an increasing trend of Bitcoin mining operations using electricity from sustainable sources. In his previous report, Batten estimated that approximately 52.6% of the energy consumed by Bitcoin mining operations is now renewable. This figure is higher than the finance industry’s use of sustainable energy, estimated at 40%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lynn Wang

https://beincrypto.com/experts-challenge-imf-crypto-miner-tax-proposal/

2024-08-17 05:43:43