dogwifhat (WIF) price noted a decline over the last few days, which has nearly erased the recent gains noted by the meme coin.

Mixed sentiments among investors and the broader market could drive the WIF price lower.

Dogwifhat Holders Seem Skeptical

The WIF price is painting red on the daily chart, which shows that the holders’ losses continue to mount. This is likely affecting their judgment regarding the meme coin, which is visible in their changing behavior.

The uncertainty among WIF holders is further dampening the possibility of an uptrend. This is evident in the Funding Rate, which has been fluctuating between positive and negative for the past two weeks. It indicates a lack of clear direction in the market.

This oscillation in the Funding Rate reflects investor hesitation as they struggle to commit to either a bullish or bearish stance. Such uncertainty can often lead to increased volatility as the market searches for a new equilibrium.

Read more: How To Buy Dogwifhat (WIF) and Everything Else To Know

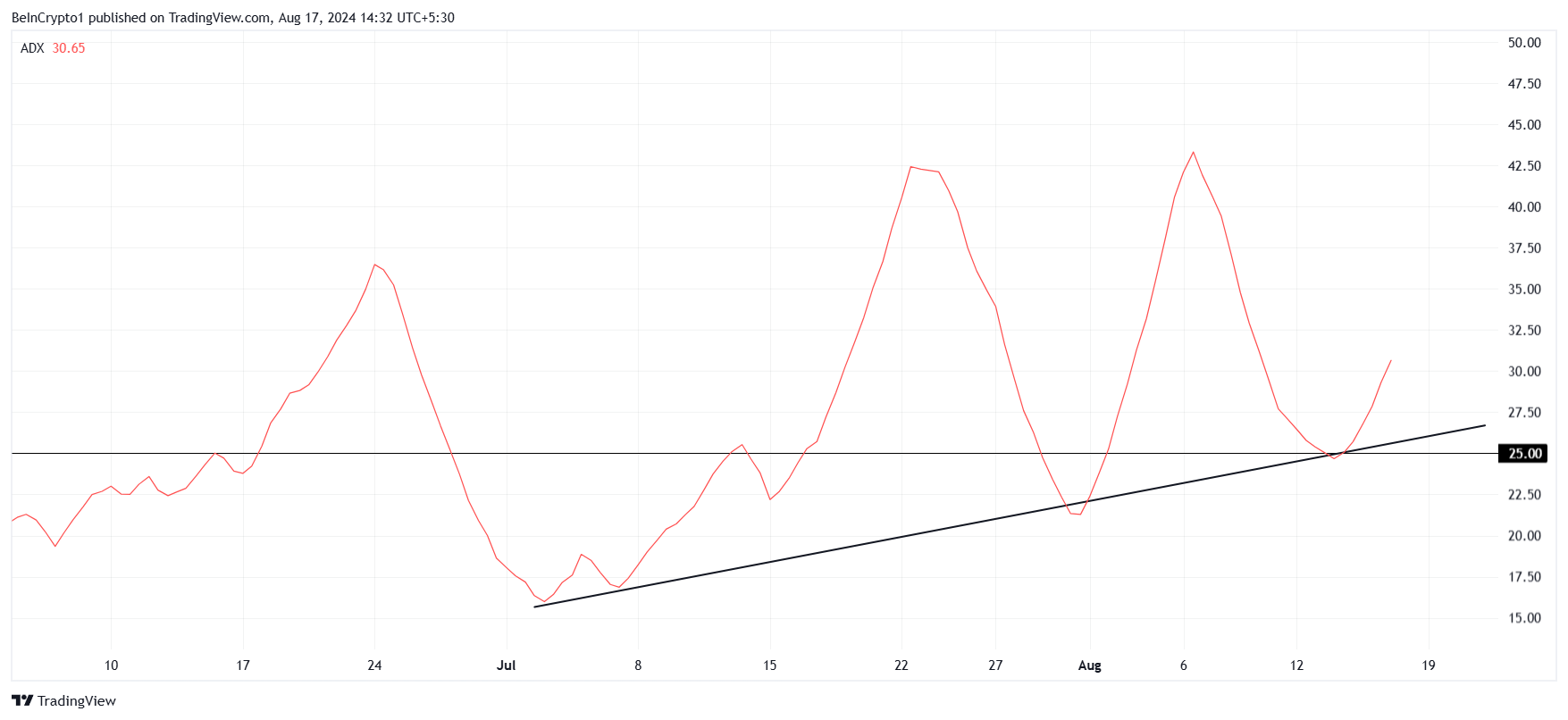

Meanwhile, the ADX (Average Directional Index) is highlighting a strengthening macro trend, which happens to be bearish. The indicator is currently above the critical threshold of 25.0, signaling that the downtrend is gaining momentum.

With the ADX pointing to a further decline in WIF price, the investors may need to brace for continued downward pressure. The combination of investor uncertainty and a strengthening bearish trend could lead to higher losses in the short term.

WIF Price Prediction: New Lows Ahead

WIF price is presently trading at $1.39, marking a 27% drawdown in the last seven days. This drawdown has nearly erased the 51% rally observed in three days in early August. As a result of this decline, the meme coin lost the potential to note an uptrend.

WIF is now at risk with a drop to $1.24, the critical support level for the meme coin. If the aforementioned factors prove to be true and the altcoin falls further, it could lose this support. The meme coin would thus mark a five-month low, falling to $1.04.

Read more: Dogwifhat (WIF) Price Prediction 2024/2025/2030

On the other hand, if the WIF price bounces off this support as it has in the past, the decline could be prevented. The altcoin would be on its way to reclaiming $2.01 as support, and a breach would completely invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/dogwifhat-wif-plagued-with-macro-bearishness/

2024-08-17 11:30:00