The Artificial Superintelligence Alliance (FET) price is currently awaiting a bullish trigger to jump back on the recovery horse.

This could come at the hands of investors who are suffering from losses and would have to take the matter into their control.

Investors Hold Off on Selling

The FET price could benefit from the bullish investors’ optimism, as they remain optimistic even in the current dire conditions. Upon observing the active addresses by profitability, it can be seen that most of the investors are facing losses.

Of those conducting transactions on the network, less than 4% are observing gains. These investors tend to sell when they participate in the network, which negatively impacts the price. Thus, their domination exceeding 25% is a bearish signal, which is not the case with FET right now.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

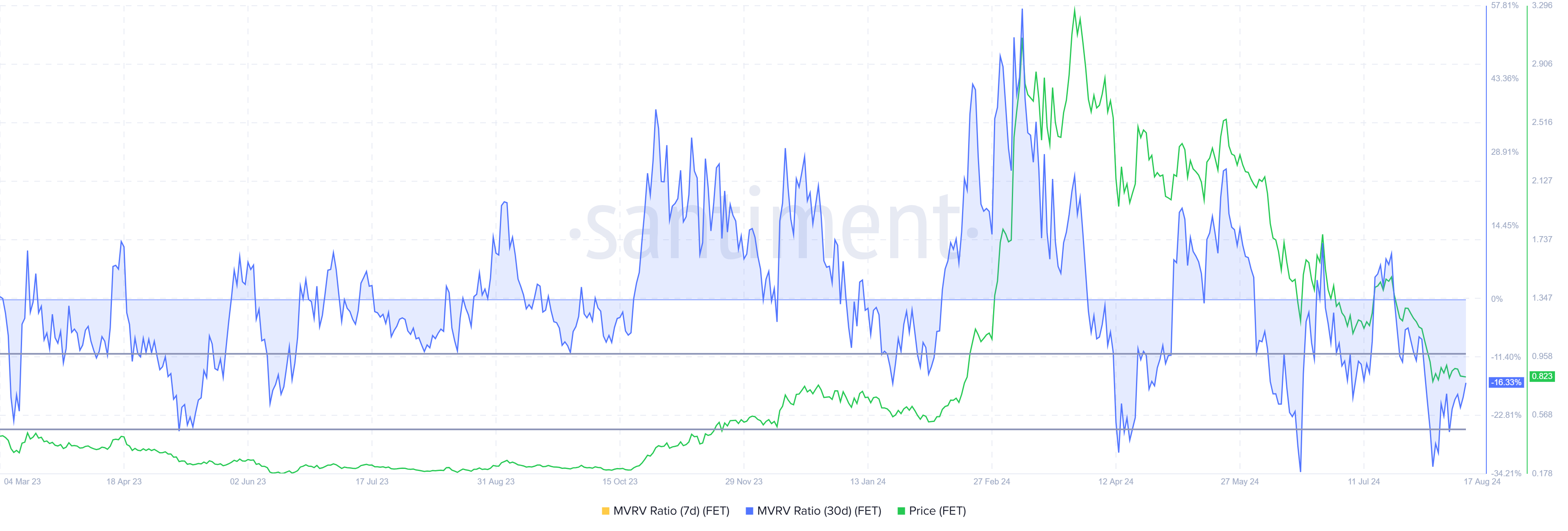

This could be a sign that the investors are looking in a different direction, potentially bullish. The Market Value to Realized Value (MVRV) ratio also supports this outlook.

The MVRV ratio assesses investor profit and loss. Currently, FET’s 30-day MVRV stands at -16%, indicating losses and possible buying pressure. Historically, FET’s MVRV between -10% and -25% usually signals the start of rallies, marking it as an accumulation opportunity zone.

The altcoin could benefit from this accumulation as the rising demand might lead to a surge in price.

FET Price Prediction: After Consolidation

FET price has been consolidated under the resistance of $0.90 for over a week, currently trading at $0.84. Bouncing from the support of $0.76, the altcoin has prevented multiple potential drawdowns.

However, as the aforementioned cues suggest, it could now be preparing for a breakout above the resistance. This could trigger a rise to $1.00 and above, sending FET towards reclaiming $1.40 as a support floor.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

However, if the breach fails, it could remain under $1.00, potentially continuing the ongoing sideways momentum. This would invalidate the bullish thesis and keep investors waiting for their profits.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/fet-price-low-selling-could-trigger-accumulation/

2024-08-17 21:00:00