This week is crucial for the crypto market as several significant events are on the horizon. These developments encompass the release of the FOMC minutes, updates on EigenLayer, and the introduction of Arbitrum’s new staking initiative.

Investors and observers pay close attention to these occurrences to assess their potential impact on asset valuation and overall financial movements. Let’s explore what lies ahead in depth.

FOMC Minutes Loom: What’s Next for Bitcoin and the Crypto Market?

The Federal Open Market Committee (FOMC) will release its minutes on August 21 at 14:00 ET. In its previous July meeting, the FOMC decided to keep the Fed Funds interest rate steady at 5.25% to 5.50%. This decision aligned with market expectations and underscored the Federal Reserve’s cautious approach toward inflation.

Fed Chair Jerome Powell hinted at a possible rate cut if inflation continues its downward trend. The market has priced in a potential rate reduction in September, with further cuts anticipated by year-end.

Historical data from 10x Research shows a strong correlation between Bitcoin’s performance and inflation trends. Typically, Bitcoin rallies when inflation decreases, and vice versa. At the time of writing, Bitcoin is trading at $58,575, reflecting a 1.45% decrease in the last 24 hours.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Arbitrum’s New Staking Proposal with stARB Token

On August 16, the Arbitrum Decentralized Autonomous Organization (DAO) approved a proposal to introduce ARB staking for the Ethereum layer-2. The proposal garnered overwhelming support, with 91% of participating voters backing the initiative.

By implementing ARB staking, the governance will actively use only about 10% of the current circulating supply of ARB tokens — roughly 100 million ARB out of the 1 billion in circulation. This new initiative aims to increase voter participation and ensure that the DAO’s decision-making process is more secure and representative of the broader community.

The staking mechanism will introduce a liquid staking token, stARB, which will offer auto-compounding features and compatibility with various DeFi protocols. The initial staking rewards will be streamed from multiple DAO-generated sources, such as sequencer fees, MEV fees, validator fees, token inflation, and treasury diversification. The launch of this staking system is expected to commence in late August, with further updates and specific timelines to be provided in the coming weeks.

EigenLayer Expands ERC-20 Token Support

EigenLayer, a prominent restaking protocol, announced the upcoming release of permissionless token support on its mainnet. This update, expected later this week, will allow users to restake any ERC-20 token, broadening the assets that contribute to the security of decentralized networks.

“Currently, this feature is on the testnet for a short permissioned testing phase. EigenDA will be the first AVS to test and use permissionless token support. Mainnet deployment, a protocol-level update, is scheduled for [this] week. User Interface support for restakers will be added later in Q3,” the EigenLayer team stated.

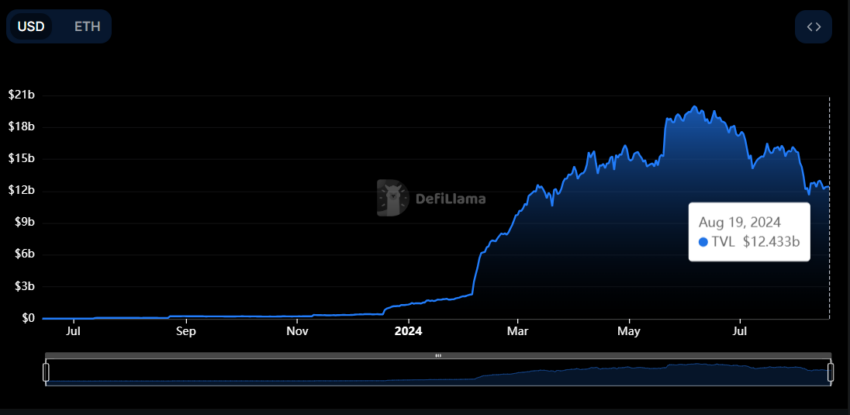

This expansion marks another milestone for EigenLayer, which continues to dominate the DeFi market. At the time of writing, DefiLlama data shows EigenLayer is the second-largest DeFi protocol, with a total value locked of approximately $12.4 billion.

Babylon to Begin Phase 1 of Its Bitcoin Staking Mainnet Launch

This week, Babylon, a Bitcoin staking protocol, will begin phase 1 of its Bitcoin Staking Mainnet Launch. This phase allows Bitcoin holders to start locking their BTC for staking within a secure, self-custodial environment. Stakers can delegate their voting power to a finality provider, with the option to unbond their stake before its expiration.

The initial staking cap is set at 1,000 BTC, with strict limits on transaction sizes to encourage broad participation. While no direct staking rewards will be distributed during this phase, a point system will track stakers’ activities. This system is designed to lay the groundwork for future staking phases.

AVAX and Other Major Token Unlocks This Week

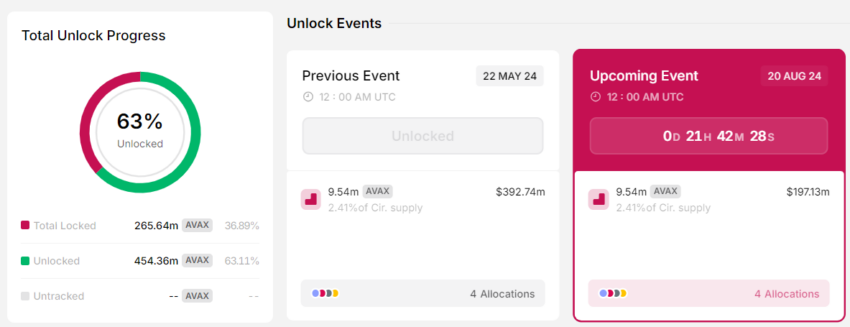

This week will also see significant token unlocks, totaling over $230 million. Among the largest is Avalanche’s release of 9.54 million AVAX tokens, valued at over $197 million. This unlock might influence the asset’s price, especially as no additional tokens will be allocated to the team or strategic partners following this event.

Read more: What Is Avalanche (AVAX)?

Other major token unlocks include Space ID (ID), PIXEL, and Ethena (ENA). Read this article for further detailed information on major crypto token unlocks this week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lynn Wang

https://beincrypto.com/top-crypto-market-news-august-19-25/

2024-08-19 02:32:31