According to RootData statistics, 1,530 publicly disclosed crypto venture capitalist (VC) investment rounds occurred in 2024, a whopping 25.1% increase from the previous year.

Total fundraising this year reached $10.04 billion, a 7.59% increase from 2023.

A Healthy Surge in Crypto Investment

Venture capital investment activity is an important metric regarding the crypto industry’s health, and current levels paint an optimistic picture. Initially, the strongest fundraising activity took place in the first half of the year, with a steady decline in the following months. However, since Trump’s re-election to the US Presidency, this trend is reversing thanks to new inflows.

Investment rounds over $20 million fell compared to the previous year, but all other crypto fundraising sizes between $1 and $20 million increased. Additionally, seed funding rounds represented a smaller portion of total fundraising rounds, with strategic funding rising in 2024.

Although the amount of investment capital in the crypto space increased, its sector allocation underwent a few dramatic changes. To be fair, blockchain infrastructure was far and away the largest VC recipient during both years.

However, DeFi funding nearly doubled, sweeping into a comfortable second place. CeFi, on the other hand, cratered to fifth.

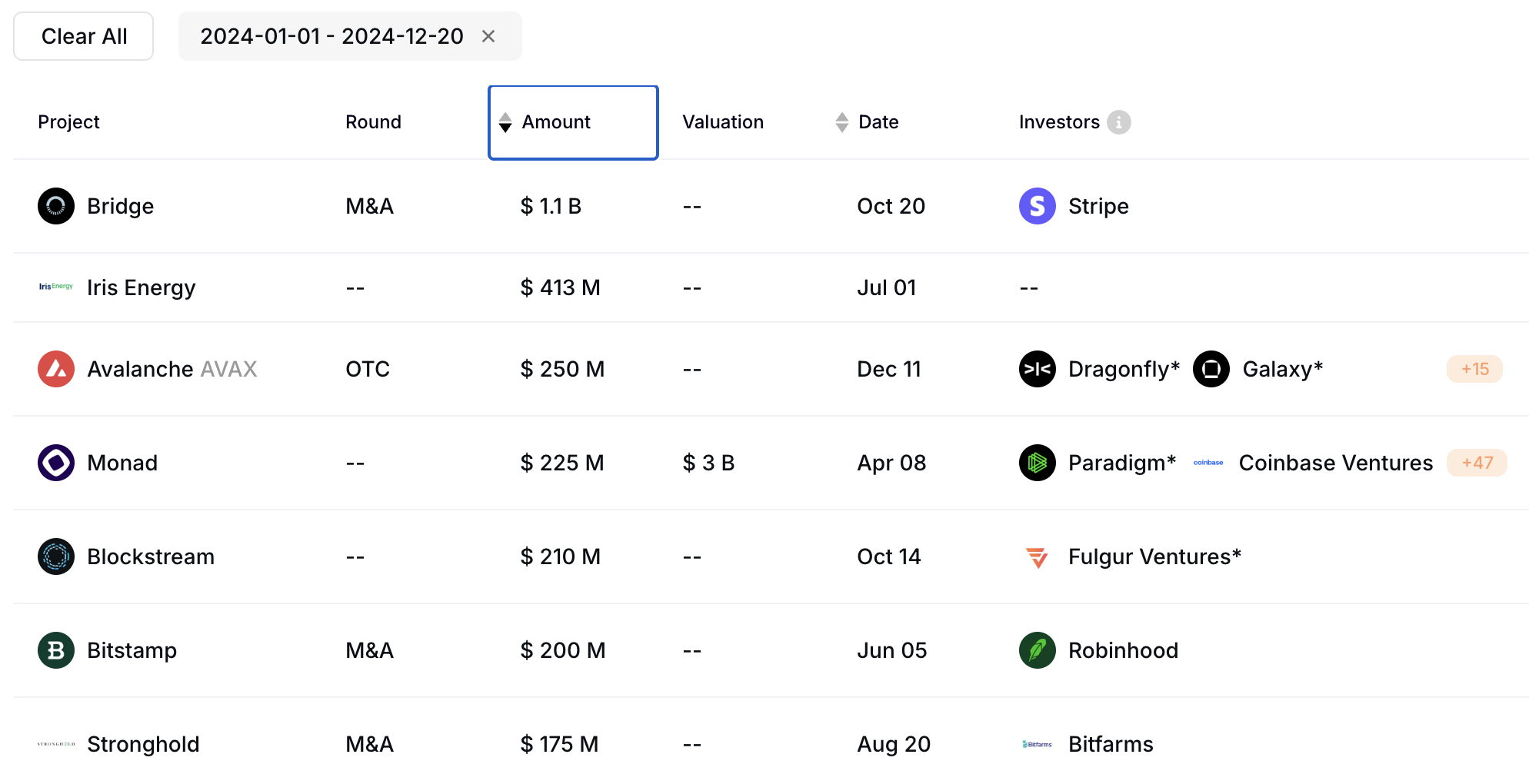

Stripe’s Bridge Deal Leads the Way

The largest single investment took place in October, thanks to Stripe, the massive payments platform. In a “landmark” deal meant to facilitate the company’s activities in the crypto space, Stripe purchased Bridge for $1.1 billion. This huge sum easily topped the chart of largest fundraisers, more than double over the runner-up.

“The $1 billion acquisition of Bridge by Stripe signals to VCs that stablecoin startups which were previously underfunded due to lack of early token liquidity now have a clearer path towards big exits. Expect more funding and more entrepreneurs building around stablecoins,” wrote Qiao Wang, founder of Alliance DAO.

Another high-level crypto investment was for Australian miner Iris Energy, which received $413 million in July. The company planned to use these VC funds to boost its operational capacity, adding 30 EH/s and 510 megawatts (MW) of data centers in 2024. Iris also worked on a 1400 MW mining venture in West Texas.

Avalanche, a notable blockchain project, also brought in substantial VC funds near the end of the year. This contributed to the trend of blockchain infrastructure receiving more fundraising capital than any other crypto/Web3 area. On December 11, it conducted a private locked-token sale, with institutions like Galaxy Digital contributing the most.

Altogether, 2024 has been a bullish year for crypto investment. Since the Bitcoin ETF approval began the year, institutional adoption has risen dramatically throughout the entire space. Recent surveys of the crypto community suggest a high level of individual optimism, and such bullish sentiments are reflected in these intense investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/crypto-investment-in-2024-bullish/

2024-12-24 16:00:00