AAVE, the governance token of the prominent lending protocol Aave, is experiencing downward pressure as large holders, or whales, initiated significant sell-offs early Tuesday.

This analysis explores potential price targets as AAVE’s value reacts to the intensified selling pressure from whales.

Aave Whales Sell Holdings

In a Tuesday post on X, on-chain sleuth Lookonchain noted that AAVE whales are actively selling off their holdings, with significant withdrawals noted in recent transactions.

One whale, identified as address 0x7634, withdrew 25,790 AAVE (around $3.39 million) from the Aave protocol and transferred it to the MEXC exchange. Just three hours earlier, another whale, address 0x790c, had removed 7,822 AAVE (approximately $1.04 million) from Aave and sent it to Binance. Additionally, crypto trading firm Cumberland deposited 10,000 AAVE to OKX.

The action of these AAVE whales has resulted in a sharp rise in its exchange flow balance. Santiment’s data shows that at press time, this balance is 53,000 AAVE, representing its single-day highest flow since September 10.

Read more: How To Use Aave?

The Exchange Flow Balance measures the net flow of a cryptocurrency into or out of exchanges, calculated by subtracting the total amount withdrawn from the total amount deposited. An uptick in this metric indicates that large quantities of the asset are being sent to exchanges. Such substantial inflows often signal potential price drops, as the added sell pressure can overwhelm the market’s capacity to absorb it.

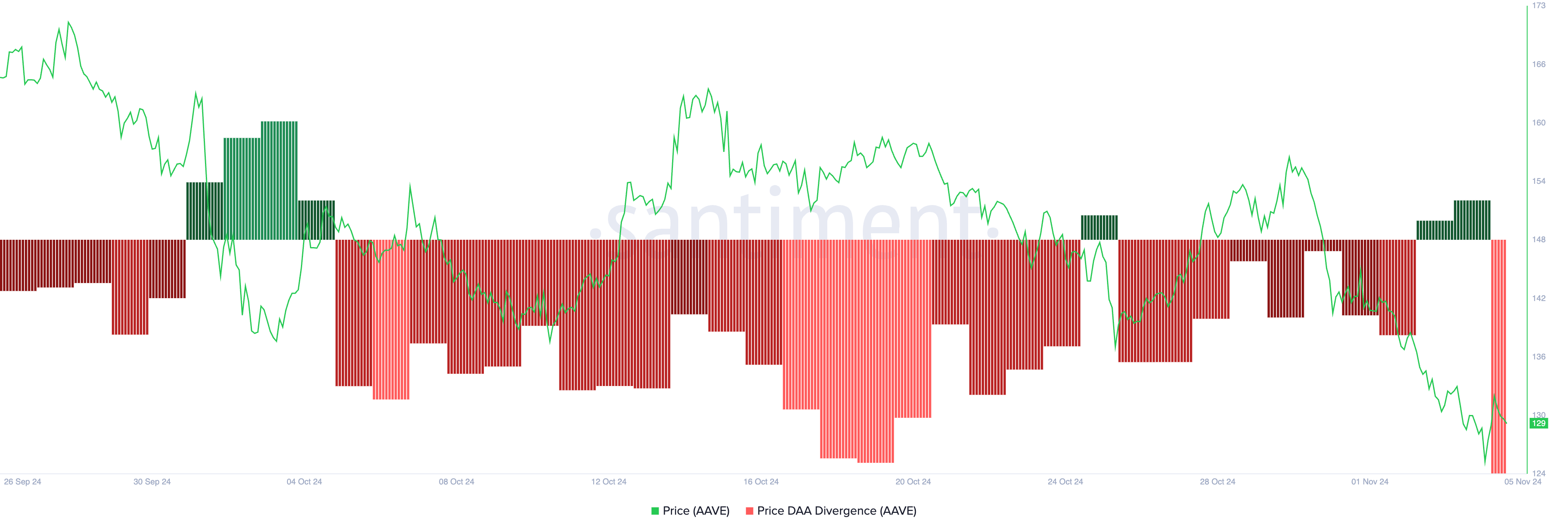

AAVE’s negative price daily active address (DAA) divergence confirms this rise in selling pressure in the market. At press time, the metric’s value stands at -39.24%.

This metric compares an asset’s price movements with the changes in its number of daily active addresses. Investors use it to track whether the price movements are supported by corresponding network activity. A negative value suggests weakening demand and potential selling pressure.

AAVE Price Prediction: Where Risks and Opportunities Lie

AAVE is currently trading at $130.29, hovering slightly above its key support level at $128.45. The diminishing buying momentum signals a potential risk of a drop below this threshold. Should AAVE’s price break through this support, it could fall further to $116.10.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Conversely, if market sentiment turns bullish, AAVE might see a reversal, with its price likely rallying toward the next resistance level of $140.79.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/aave-whales-trigger-selloffs/

2024-11-05 20:00:00