With an impressive increase in coin acquisition, Ethereum aficionados are causing waves in the crypto space. From January’s 11.5 million, the most recent statistics reveal a solid 19 million ETH now stashed in long-term holding addresses, almost doubled, data from CryptoQuant shows.

With investors apparently increasing their bets, this huge surge points to a growing faith in Ethereum’s future. The crypto world is rife with conjecture since many estimate this count will reach 20 million by year’s end.

Related Reading

Clearly, there is a significant optimism in Ethereum’s long-term potential despite market swings, which leaves many wondering what is behind this increase in confidence and what this could mean for the scene of cryptocurrencies going forward.

A number of factors are encouraging institutional and individual investors to increase their holdings. Notably, the US Securities and Exchange Commission’s (SEC) approval of spot Ethereum exchange-traded funds (ETFs) has allowed new players to enter the market.

Spot ETFs Push Demand

More interest from mainstream investors has come from Ethereum spot ETF approval in great part. This indicates that both individual investors and institutions are getting ready for Ethereum’s long-term future. One researcher of cryptocurrencies even thinks that by the end of 2024, the ETH in accumulating addresses will equal the market value of the biggest companies worldwide.

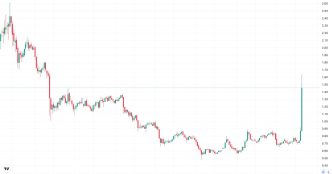

Furthermore, assuming Ethereum prices remain around $4,000, the analyst projects that if these patterns continue, the total value of ETH held in these addresses may reach $80 billion. At $2,737 right now, ETH has increased in value by over 3% over the last 24 hours and over 10% over the last week.

Staking Secures More Ethereum

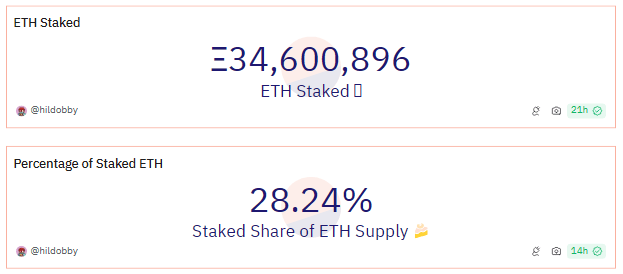

The other main reason why less ETH is found in the market to trade is through the increase in Ethereum staking. According to Dune Analytics, staking contracts have locked up over 34.6 million ETH that equates to nearly 30% of the entire Ethereum supply, hence showing the statistics. This led to a lack of tokens for sale and therefore played a part in taming prices.

More price growth for ETH may be possible if the amount staked keeps increasing. The Ethereum market may experience less volatility and more long-term growth potential if there are less sell-side pressures.

Related Reading

The Price Outlook Is Good

The current price swings of Ethereum are primarily upward. ETH is currently trading above $2,700—a crucial support level—thanks to the support of its 50-day moving average. The 200-day moving average, which is $3,022, remains a barrier, though. If Ethereum is to experience consistent price growth, it will be imperative to break over that obstacle.

Ethereum’s long-term supporters are undoubtedly upbeat about the platform’s future, and the accumulating tendency along with staking and spot ETFs suggest that this confidence might not be unfounded. It will be interesting to see if Ethereum can overcome significant pricing obstacles, but one thing is certain: for the time being, the long-term picture looks promising.

Featured image from Pexels, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/ethereum-holders-on-the-rise-accumulation-addresses-double-since-january-2024-report/

2024-10-21 07:30:03