Cardano (ADA) price is down 15% over the past seven days, following a surge that pushed it to its highest levels since 2022. Momentum indicators like ADX show growing bearish strength, signaling intensifying selling pressure in the current downtrend.

Whale activity has also declined recently, reversing earlier accumulation and adding to short-term bearish concerns. With key supports and resistances in play, the next moves will determine whether ADA continues its correction or finds a path to recovery.

Cardano Downtrend Is Getting Stronger

Cardano ADX is currently at 19.96, a sharp increase from 11 just a day ago, signaling a strengthening trend. However, since ADA is in a downtrend, the rising ADX indicates that the bearish momentum is gaining traction.

This suggests that selling pressure is intensifying, and ADA may face further downside in the short term if buyers fail to counteract the growing strength of the bearish trend.

The ADX (Average Directional Index) measures the strength of a trend without indicating its direction. Values above 25 denote a strong trend, while readings below 20 suggest a weak or non-trending market.

With ADA ADX approaching 20 and climbing, the downtrend could soon transition into a more pronounced bearish phase, potentially leading to increased price volatility. Unless Cardano price finds support or sees a surge in buying activity, the current trajectory points toward continued short-term weakness.

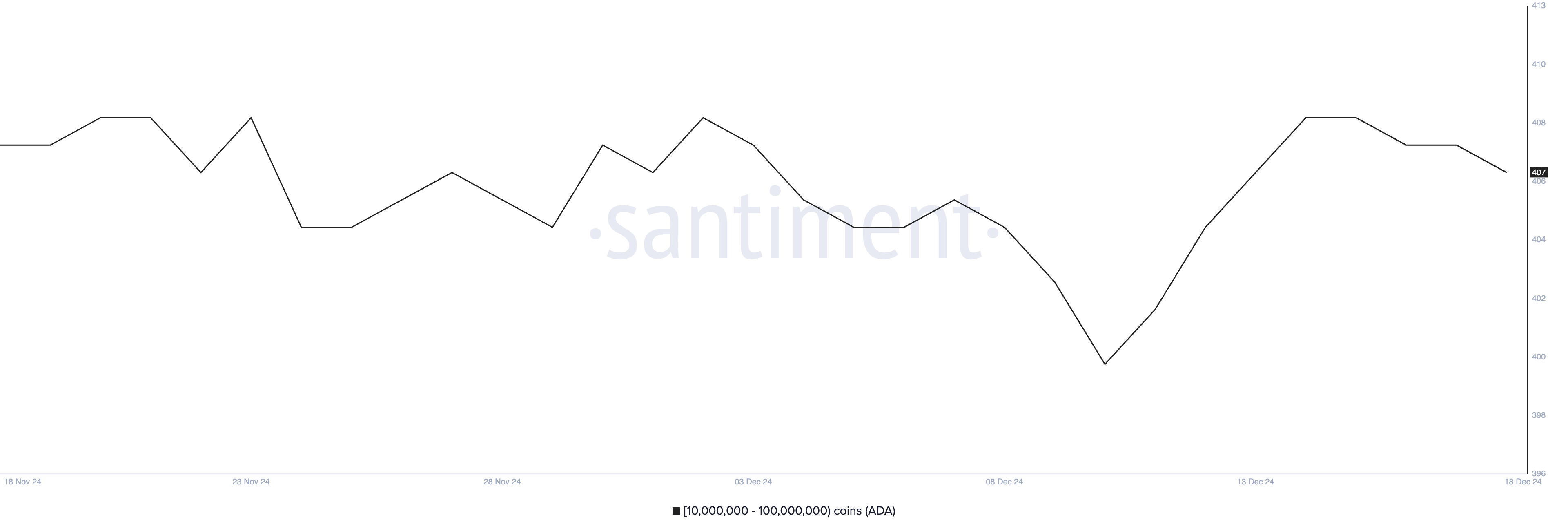

ADA Whales Are Exiting the Market

The number of addresses holding between 10 million and 100 million ADA has declined to 407, down from 409 five days ago. This decrease signals a steady reduction in the number of large holders, or whales, following a sharp increase earlier in December.

The decline suggests that some whales may be offloading their positions, which could indicate reduced confidence or profit-taking.

Tracking whale activity is crucial because these large holders significantly influence market trends. Between December 10 and December 14, the number of ADA whales increased from 400 to 409, reflecting strong accumulation during that period.

However, the subsequent decline indicates that this accumulation phase may be reversing, potentially leading to increased selling pressure and short-term downside for ADA unless new buying interest emerges.

Cardano Price Prediction: Can ADA Correct By 46%?

Cardano EMA lines indicate the potential for a stronger correction as short-term EMAs are trending downward. The shortest EMA is nearing a crossover below the longest EMA, which would form a death cross, a bearish signal that typically points to sustained downward momentum.

If that happens, ADA price could test the immediate support at $0.95, and if that level fails, it may decline further to $0.65 or even $0.519.

On the other hand, if the trend reverses and buying momentum strengthens, Cardano price could challenge the resistance at $1.03. A successful breakout above this level could pave the way for further gains, with targets at $1.18 and potentially $1.24.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/ada-price-falls-bearish-momentum-suggests-losses/

2024-12-19 15:30:00