Cardano’s price has traded sideways this week: it has remained range-bound, facing resistance at $1.02 while finding support at $0.96.

Despite the subdued market movement, on-chain data shows that a buy signal has emerged, sparking renewed interest from large investors.

Cardano Whales Ape In as Coin Flashes Buy Signal

Cardano’s Market Value to Realized Value (MVRV) ratio — a key indicator of whether an asset is overvalued or undervalued—signals that the coin may be undervalued at its current market price. As of this writing, the coin’s seven-day and 30-day MVRV ratios are -2.88% and -0.98%, respectively.

When an asset’s MVRV ratio is positive, its market value is higher than the realized value, suggesting it is overvalued.

On the other hand, as is the case with ADA, when it is negative, the asset’s market value is lower than its realized value, indicating that it is undervalued. This means the coin is being traded below its historical acquisition cost and may be due for a rebound. Hence, market participants looking to “buy low and sell high” may begin to accumulate the altcoin.

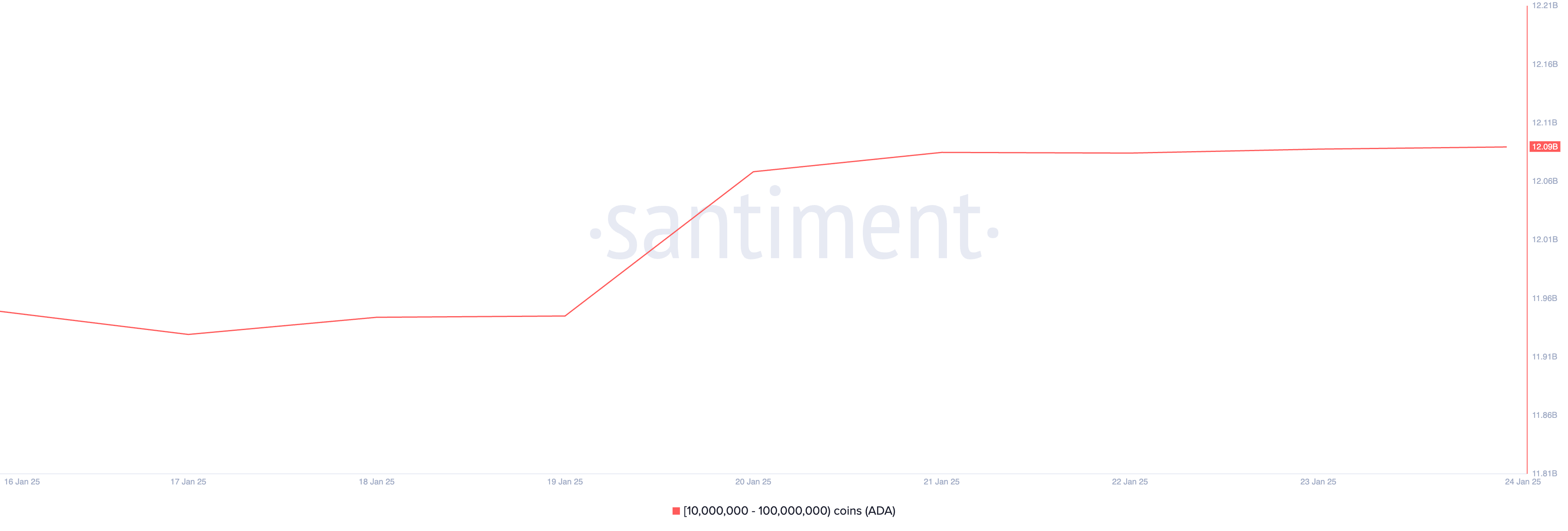

This has caught the attention of ADA whales, who have recently started accumulating significant amounts of the coin. According to Santiment, whale addresses that hold between 10 million and 100 million ADA have purchased a staggering $140 million worth of the coin in the past seven days.

Typically, such moves from whales indicate increased confidence in the asset’s near to short-term prospects. If retail traders follow the trend, Cardano’s price could experience significant upward momentum in the coming weeks.

ADA Price Prediction: Will Whale Accumulation Sustain the Momentum?

As of this writing, ADA trades at $0.99. If this accumulation trend is maintained, it could propel ADA’s price above the resistance formed at $1.02. A succesful breach of this level could pave the way for the altcoin to rally to $1.08.

On the other hand, if the whales reduce their accumulation and selloffs increase, ADA could break below the support formed at $0.96 to trade at $0.94.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ada-whales-accumulate-buy-signal/

2025-01-24 10:30:00