XRP has faced a significant challenge, experiencing a sharp 25% drop in price within just one week. Although it has made attempts at recovery, the altcoin has yet to fully regain investor confidence.

The market sentiment remains cautious, and the responsibility for recovery now lies with a specific group of investors.

XRP Has A Shot At Bouncing Back

The weighted sentiment surrounding XRP remains predominantly pessimistic. Recent price action, including the failed attempt to form a new all-time high (ATH), has left investors feeling disheartened. The altcoin’s sharp decline in the past week has only deepened the skepticism, with many choosing to adopt a wait-and-see approach.

However, if market conditions improve, there’s potential for a shift in sentiment. Should the weighted sentiment indicator move above the neutral line, it would mark a return of bullish sentiment for the first time in a month. Such a shift could encourage renewed interest from investors and trigger a positive price movement.

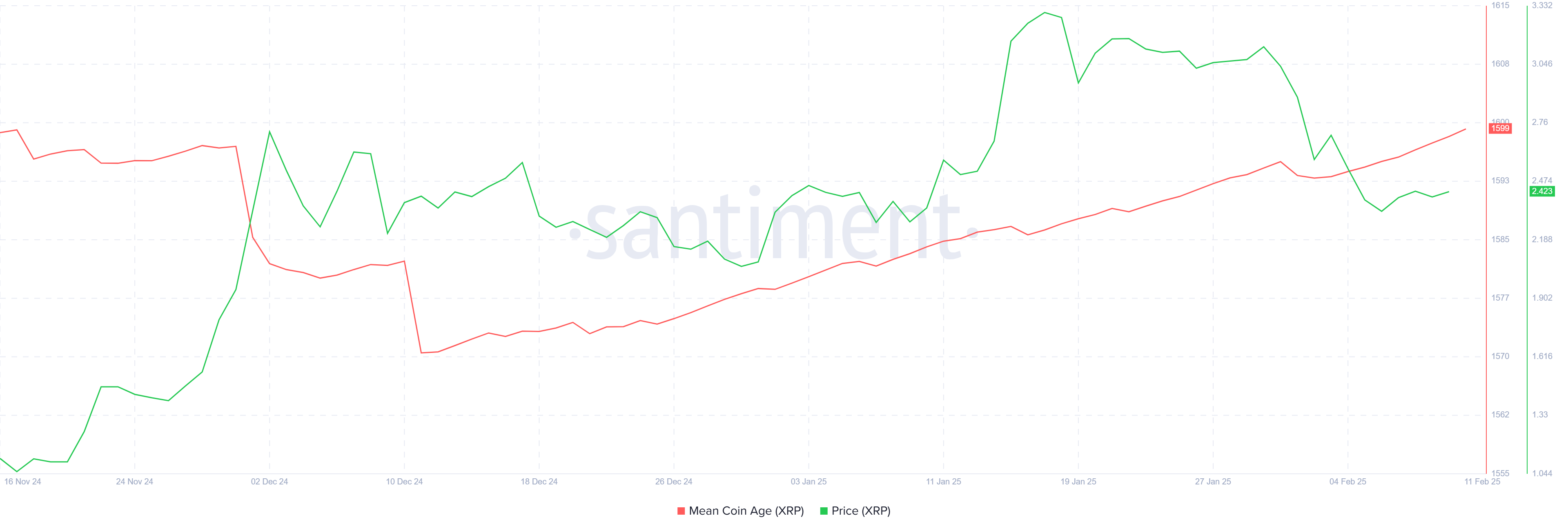

The macro momentum of XRP is showing signs of stability, with the Mean Coin Age (MCA) indicator continuing to rise. This uptick signals that long-term holders (LTHs) are opting for HODL instead of selling during the downturn. LTHs are often considered the backbone of any asset, and their decision to hold plays a crucial role in stabilizing prices.

Their actions indicate that, despite recent price challenges, they are confident in XRP’s long-term prospects. This behavior helps prevent further downside and offers the potential for a price recovery. As LTHs continue to hold their positions, they may help create a strong base for future upward momentum.

XRP Price Prediction: Rising To The Next Barrier

XRP is currently trading at $2.47, making efforts to recover from the recent 25% crash. Holding above the support level of $2.33, XRP is forming an ascending wedge, which suggests potential upward movement. The altcoin needs to maintain this support to continue its recovery trajectory.

While the ascending wedge is a macro bearish pattern, the short-term outlook for XRP remains positive. A rise to $2.70 appears likely, and if the altcoin manages to break this resistance, it could rally toward $2.95. This price level represents a crucial test for XRP, determining whether the bullish trend can be sustained.

However, if bearish market conditions persist, XRP could fall back to the $2.33 support level. A loss of this support would invalidate the bullish outlook, pushing the price further down. This scenario would likely dampen investor sentiment and delay any potential recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/odds-of-xrp-price-recovery/

2025-02-11 08:00:00