Leading AI agent token AI16Z has emerged as the market’s top performer over the past 24 hours, experiencing an 8% price surge. Its trading volume during that period climbed 34%, totaling $452 million.

However, technical indicators suggest that this bullish momentum may be short-lived, as the AI16Z token rally seems fueled by speculative trading.

AI16Z’s Rally Lacks Support

An assessment of the AI16Z/USD one-day chart shows that the altcoin broke below its 20-day exponential moving average (EMA) during Thursday’s intraday trading session.

An asset’s 20-day EMA measures its average price over the past 20 days, giving more weight to recent prices to reflect current market trends. When the price falls below the 20-day EMA, it signals weakening bullish momentum and a potential shift to a bearish trend.

Traders often view this as a sign of reduced buying interest and interpret it as a sign to exit long positions and take short ones. For AI16Z, this dip below the 20-day EMA indicates that its recent rally is losing steam, putting it at risk of shedding its gains.

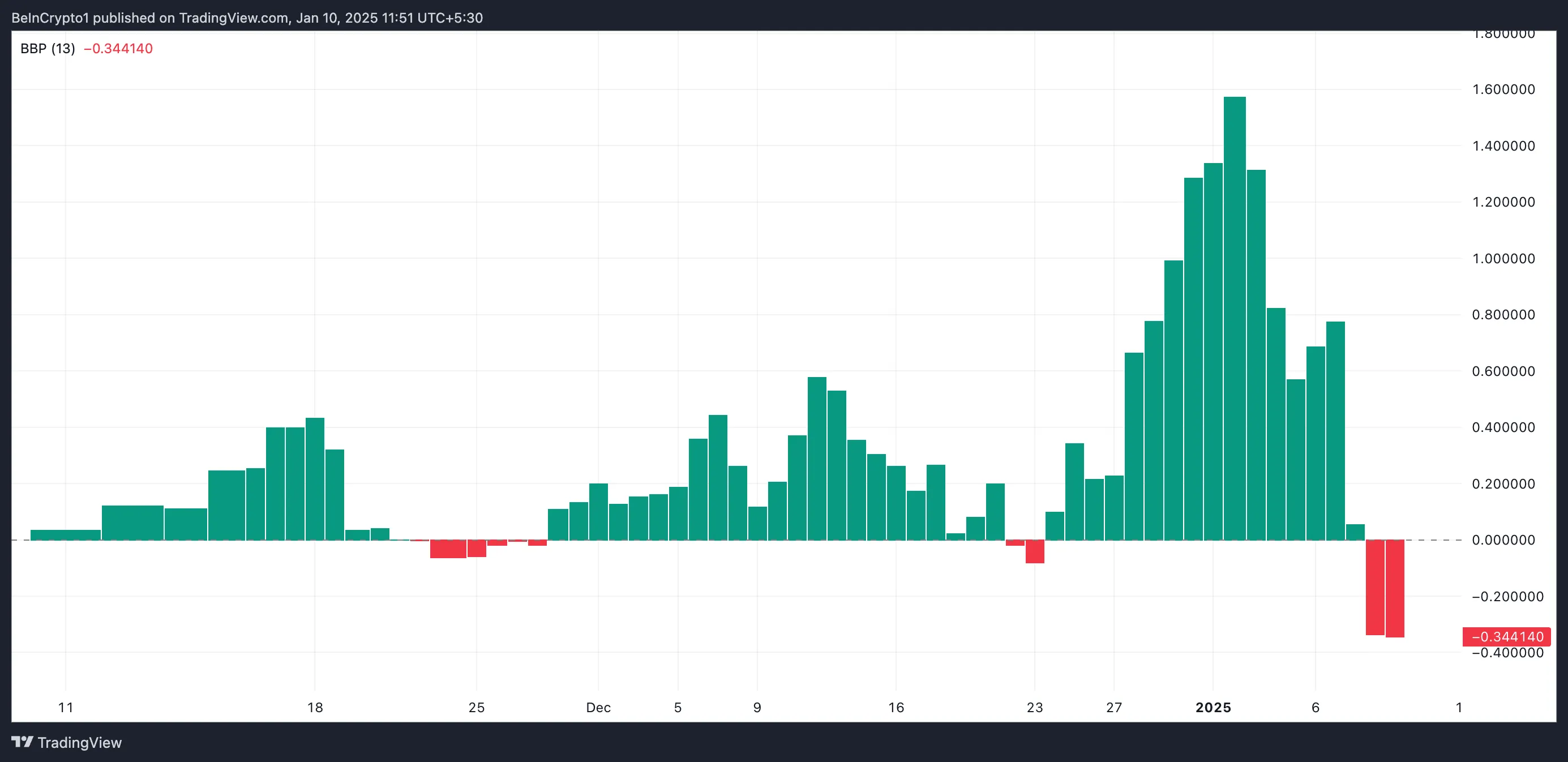

Notably, the altcoin’s negative Elder-Ray Index supports this bearish outlook. As of this writing, this stands at -0.34, indicating the strengthening bearish pressure.

This momentum indicator measures buying (bull power) and selling (bear power) pressure in the market by comparing an asset’s high and low prices to its exponential moving average.

When the index is negative, especially during a rally, it indicates that bearish pressure is overpowering bullish momentum. This suggests that AI16Z’s price rally lacks strong buyer support and may be driven more by speculation than sustainable demand.

AI16Z Price Prediction: Demand Could Trigger Rally to All-Time High

At press time, AI16Z trades at $1.56. According to its Fibonacci Retracement tool, mounting bearish pressure could cause the token’s price to plummet below the $1 range, potentially dropping to $0.68.

On the other hand, a spike in actual demand for AI16Z could invalidate this bearish outlook. In that scenario, the AI16Z token price could rally toward its all-time high of $2.50, last reached on January 2.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ai16z-leads-market-gains/

2025-01-10 09:30:00