Contrary to the anticipated “Uptober” rally, the cryptocurrency market has experienced a significant downturn, largely driven by geopolitical tensions in the Middle East. Major assets have seen their values decline, with some retesting multi-week lows.

Despite the market volatility, crypto whales have continued to accumulate certain tokens. Toncoin (TON), Ethereum (ETH), and Axie Infinity (AXS) have emerged as top choices for these large holders.

Toncoin (TON)

Telegram-linked Toncoin (TON) currently trades at $5.35, noting a 9% price decline over the past seven days. In fact, it plunged to a weekly low of $5.16 during the intraday trading session on Thursday.

However, this has not deterred the whales from buying the altcoin, demonstrating their long-term confidence in its price growth. In the past seven days, TON’s large holders’ netflow — the difference between the coins whale addresses buy and sell over a specific period — has skyrocketed by 1698%.

Read more: What Are Telegram Bot Coins?

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. When their netflow surges, it indicates an uptick in whale accumulation.

Ethereum (ETH)

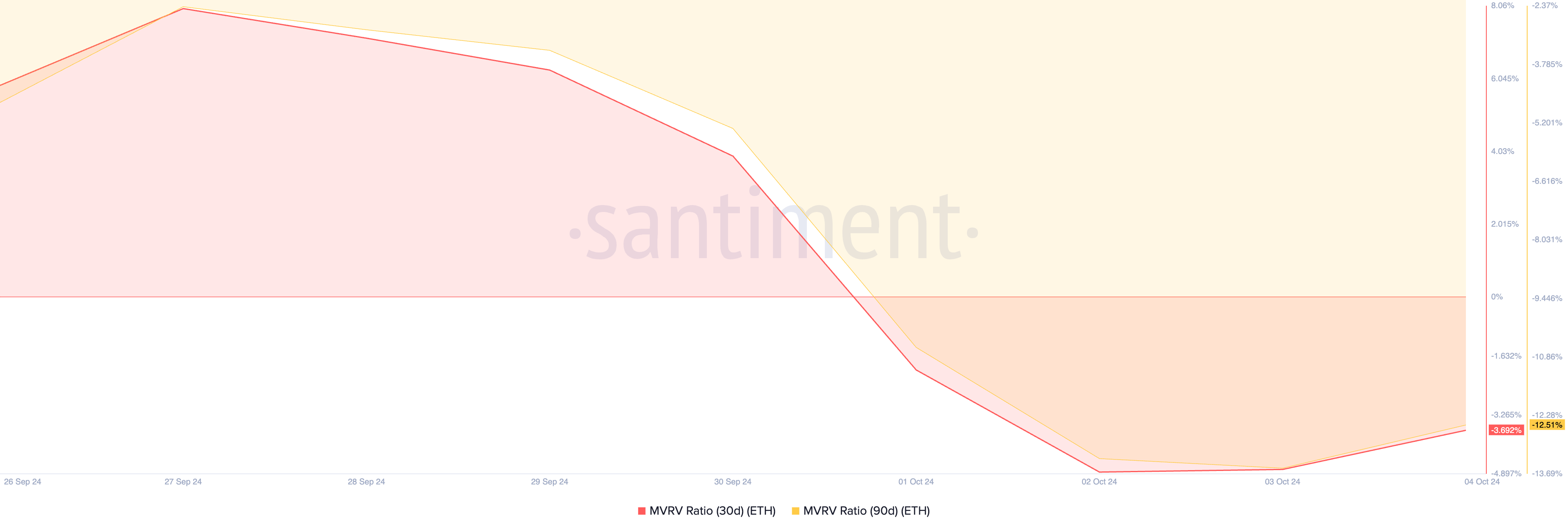

Leading altcoin, Ethereum (ETH), has seen its value dip by 10% in the past seven days. However, this decline has presented a buying opportunity as evidenced by its negative market value to realized value (MVRV) ratio, which measures the overall profitability of all its holders.

Read more: How to Invest in Ethereum ETFs?

As of this writing, the coin’s 30-day and 90-day MVRV ratios are -3.69% and -12.51%, respectively. Historically, negative MVRV ratios are a buy signal. They indicate that the asset trades below its historical acquisition cost, giving a chance for traders looking to buy the dip.

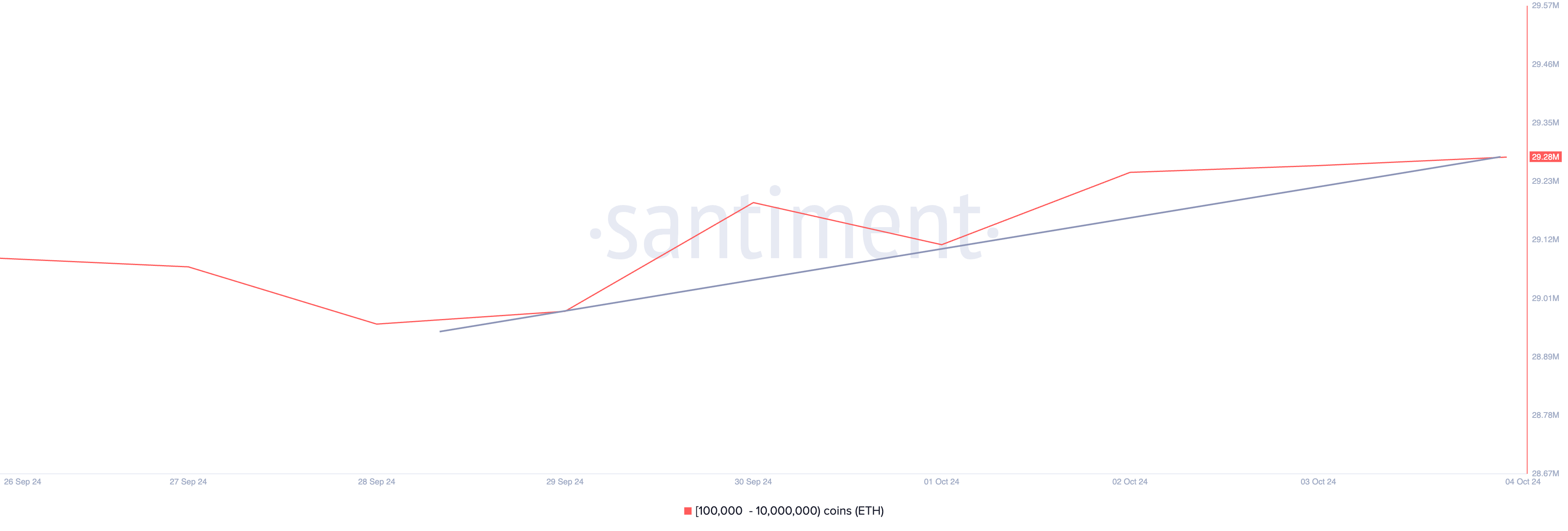

Ethereum whales holding between 10,000 and 10,000,000 ETH coins have done just this. Over the past week, this cohort of large investors have added 200,000 ETH valued at $476 million to their portfolio.

Axie Infinity (AXS)

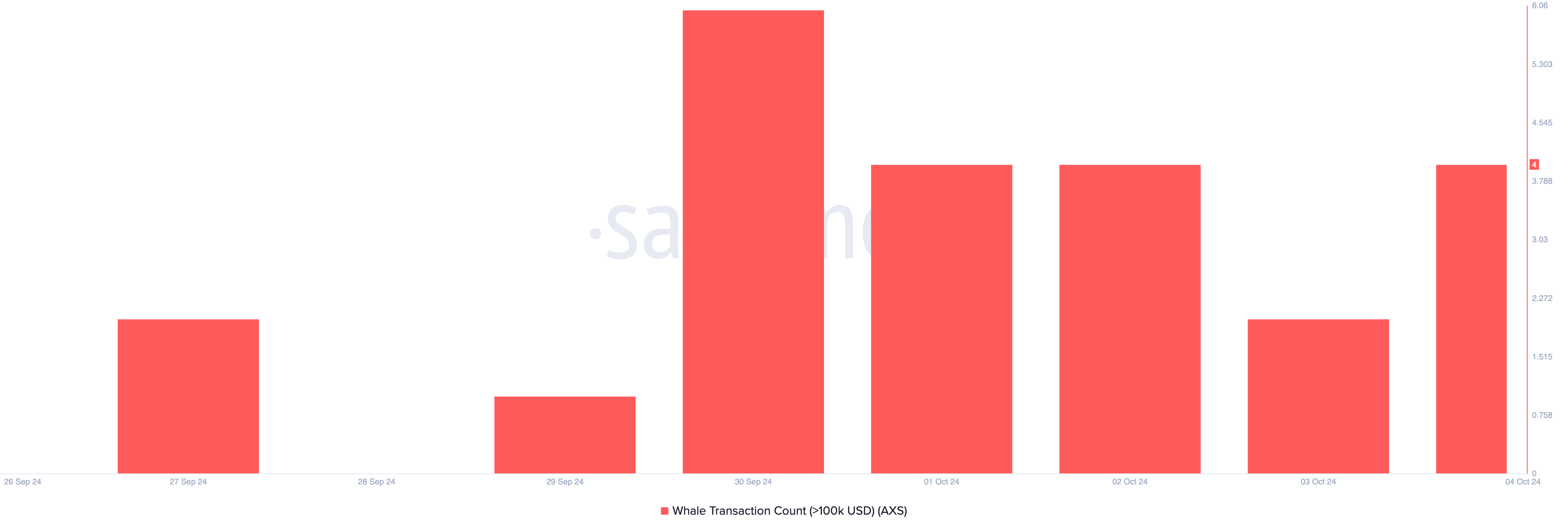

AXS, the native token of the leading play-to-earn platform Axie Infinity, has also attracted crypto whale attention this week. Despite a 14% drop in its price over the period, the number of whale transactions involving AXS has steadily increased.

Read More: Axie Infinity (AXS) Explained for Beginners

On-chain data reveals a consistent rise in the daily count of AXS transactions exceeding $100,000 since September 30. A spike in large transactions may signal a shift in market sentiment. If large players are buying, it could suggest they expect future price appreciation.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/whales-bought-these-altcoins-first-week-october/

2024-10-04 23:55:00