The altcoin market is evolving, but not in the way many expected. While some believe the altseason has begun, others argue it’s merely delayed.

With shifting market structures, ETF-driven Bitcoin strength, and changing investor behavior, what’s really happening with altcoins?

“Selective” Altseason

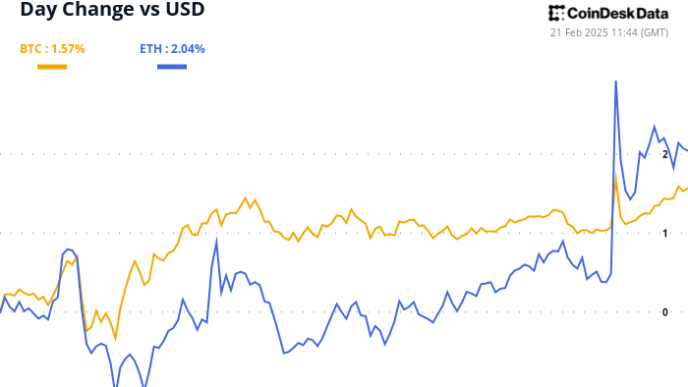

Ki Young Ju, CEO of CryptoQuant, has signaled the start of a selective altcoin season. In a recent tweet, Ju pointed out that while Bitcoin (BTC) is not experiencing a direct rotation into altcoins, stablecoin holders are increasingly favoring alternative assets.

Alt season has begun.

No direct BTC-to-alt rotation, but stablecoin holders are favoring alts. Alt volume is 2.7x BTC. BTC Dominance no longer defines alt season—trading volume does.

It’s a very selective alt season tho. DYOR. pic.twitter.com/7lSffDuuM8

— Ki Young Ju (@ki_young_ju) February 21, 2025

This trend is evident in trading volumes, as altcoins are currently seeing 2.7 times the volume of Bitcoin. He also noted that BTC’s dominance – historically a key indicator of altseason – no longer holds the same influence. This is because trading activity now serves as a more relevant metric, the exec said.

Additionally, Ju emphasized that Bitcoin is no longer acting as a primary quote currency for altcoin trades. This marks a significant structural change in market behavior, and the latest selective altseason suggests that while some altcoins may see strong inflows, the rally is not uniform across the board.

Altseason Delayed?

Crypto analyst “Xremlin,” however, offered a different perspective on the timing of the next altcoin season. The trader suggests that while an altcoin rally is likely in 2025, it may not follow the traditional February start seen in previous cycles. Instead, historical data points to two potential peaks: one in May-June 2025 and another in August-September 2025. Xremlin attributed the delayed altseason to key structural changes in the market.

Unlike previous cycles, where Bitcoin whales took profits and funneled them into altcoins, much of BTC’s current strength is ETF-driven, meaning those funds are effectively locked and unable to rotate into alts. Additionally, the massive number of tokens has exploded – multiple times more than in 2021 – spreading out demand and preventing a concentrated alt rally.

Another major shift has been the rise and decline of meme coin speculation, which altered retail investor behavior. While the 2021 altseason was driven by long-term bets on technology and innovation, Xremlin believes that today’s market is more short-term and casino-like and favors quick flips over sustained holding.

However, the analyst remains optimistic and cited a highly favorable macro environment, such as easing crypto regulations, pro-crypto policies, rising global liquidity, and potential ETF approvals for major altcoins like Solana and XRP.

He went on to predict that while not all altcoins will benefit equally, sectors like Real World Assets (RWA) and AI-related projects could see significant gains.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Chayanika Deka

https://cryptopotato.com/altseason-or-just-a-mirage-analysts-debate-the-future-of-altcoins/

2025-02-21 11:52:51