A widely followed crypto analyst is updating his outlook on Ethereum (ETH) competitor Solana (SOL) as the market chops around.

In a new video update, crypto strategist Benjamin Cowen tells his 808,000 YouTube subscribers that Solana could plummet in value if a similar 2019 market pattern plays out again.

Looking at the TOTAL3 chart, which tracks the total market cap of crypto excluding Bitcoin (BTC), Ethereum and stablecoins, Cowen shows that alts rallied in 2019 but then plummeted that same year when the Federal Reserve enacted a looser monetary policy. The Fed is now expected to cut interest rates next month after years of hikes.

“[Altcoins] had a nice little rally, but they’re giving a lot of it back, which is exactly what happened in the last cycle. Altcoins rallied. They rallied a lot, and then they gave it all back in the halving year. They gave it all back in the pre-halving year and then going into the halving year. They gave it back right around the time as that looser monetary policy arrived. A lot of that, a lot of those gains are given back. And so you have to wonder is it just kind of doing the same thing. Alts are still struggling to break through here.”

Cowen notes that SOL hasn’t reached its all-time high (ATH) and warns it could suffer a sell-off similar to what happened to other alts in 2019.

“I tip my hat to Solana’s outperformance against Bitcoin since 2023 began. I will remind people that there are actually other alts that went on to new all-time highs…[SOL] is still technically not a higher high… If it follows some of the altcoins last cycle that did very well in the QT (quantitative tightening) rally, then if it were to follow through the entire way then essentially what would happen is that there would be a selloff and then there would be another rally after QE (quantitative easing) returns.”

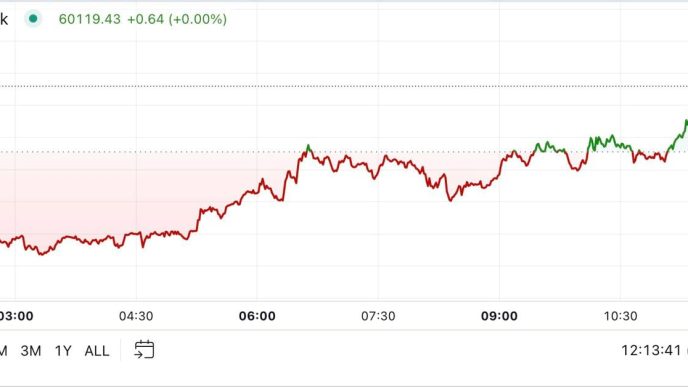

Solana is trading for $143 at time of writing, down more than 3% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/08/29/analyst-benjamin-cowen-updates-solana-sol-outlook-says-ethereum-rival-may-be-repeating-2019-fakeout/

2024-08-29 11:45:29