Real Vision analyst Jamie Coutts believes that the crypto market could finish out the year with strong rallies.

Coutts says that the TOTAL3 chart on the weekly timeframe appears to be breaking out of a descending trend line and printing a bull reversal pattern.

The TOTAL3 chart tracks the market capitalization of all crypto assets excluding Bitcoin (BTC), Ethereum (ETH) and stablecoins.

“Zoom out on the weekly log chart:

- Total market cap excluding BTC and ETH, aka ‘Alts,’ are breaking out.

- Total market cap excluding BTC and ETH/Total market cap is basing.

Crypto Q4 could get wild.”

Looking at his chart, the analyst suggests that TOTAL3 is breaking out from a rounding bottom pattern. The technical formation is often viewed as a bullish reversal pattern as it indicates that investors have accumulated the asset without allowing the price to move lower.

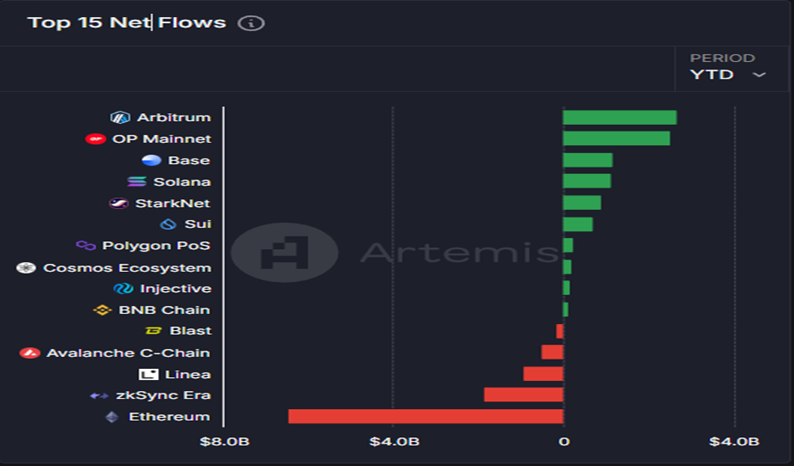

Next up, Coutts says there are reasons to be long-term bullish on Solana (SOL) competitor Sui (SUI), including the fact that the layer-1 (L1) project received a massive inflow of capital in 2024.

“Crypto capital flows are favoring Sui. Sui’s net flows this year hit $737.6 million, second highest among Alt-L1s after Solana’s $1.1 billion. On a relative basis Sui’s inflows are 18% of its market cap, while Solana’s are 2% – a 9x difference! Ethereum leads outflows across the crypto ecosystem, mainly to L2s (layer-2s), but some capital is spilling over to other L1s. Sui is the top recipient, with 92.9% of its inflows bridged from Ethereum and 5.3% from Solana. Net flows are akin to a blockchain network’s capital account – increasing net flows signals competitiveness and confidence, much like a nation’s capital markets.

A tenuous analogy: Ethereum is the US (property rights, the rule of law, deepest capital market), Solana is China (rapid growth, more centralized, degen traders), and Sui is the up-and-coming player, like South Korea or Singapore in the 2000s. It’s got the tech but is still building its capital markets and diversifying its economy.”

Sui is trading for $1.68 at time of writing, down 2.1% in the last 24 hours. With a market cap of $4.5 billion, Sui is the 28th largest crypto project.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Ongky Ady Widyanto/Vladimir Sazonov

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/09/27/analyst-jamie-coutts-says-fourth-quarter-could-get-wild-for-crypto-updates-outlook-on-solana-rival-sui/

2024-09-27 18:05:45