Crypto analyst Tony Severino has revealed that the Bitcoin price bull run could end as soon as January 2025. The analyst further projected that BTC will top below $150,000 as its bull run ends by next month.

Bitcoin Price Could Top By January 2025 Below $150,000

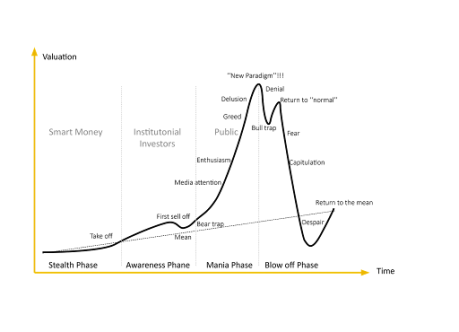

In an X post, Tony Severino reaffirmed his theory that the Bitcoin price could top as soon as January 20, 2025. He shared an accompanying chart showing that BTC follows a textbook example of a “complete” market cycle. The chart showed that Bitcoin could top below $150,000 as it reaches the market top next month.

Related Reading

The chart shows that the Bitcoin price is on the last leg of this market cycle’s motive wave. Once this motive wave is done, possibly as soon as January 2025, the corrective wave of this market cycle will begin. This wave, which ushers in the bear market, could last until mid-2027 and cause BTC to retrace to as low as $50,000.

Donald Trump’s Pro-Crypto Moves May Already Be Priced In

In a detailed blog post, Tony Severino provided more insights on why the Bitcoin price bull run could top this early. He noted that Donald Trump’s victory in the US presidential elections is the narrative that has caused a market-wide takeoff. Thanks to his pro-crypto stance, BTC broke out of a resistance level the night he was declared the winner and has since rallied to $100,000.

Related Reading

However, Severino remarked that Trump’s pro-crypto world is the new paradigm this time around. He acknowledged that market participants cannot envisage a world where the Bitcoin price doesn’t rise much higher, considering that the president-elect has promised to create a Strategic Bitcoin Reserve, which could create a lot of FOMO among other nation-states.

However, the crypto analyst asked market participants to consider the fact that the Efficient Market Hypothesis says that the market is forward-looking and prices in all information the moment it is available. Severino believes that BTC could have already priced into Trump’s pro-crypto moves.

If so, he predicts this “new paradigm” could create the perfect atmosphere of euphoria and a cyclical peak when Trump finally takes office. In other words, Donald Trump’s inauguration could mark the top for the Bitcoin price bull run, and the corrective wave could begin as soon as he takes office.

The Last Two ‘New Paradigm’ Became Cycle Peaks

Tony Severino alluded to what happened the last two times the term “new paradigm” was regularly used. According to him, those events became the cyclical peaks for the Bitcoin price. First, he noted that when CME Futures were about to launch, many expected that the fact that institutions could have exposure to BTC would bring a lot of capital.

However, that wasn’t the case, as it kicked off a bear market instead. The same thing happened with Coinbase going public, sparking optimism that the Bitcoin price could easily cruise to $100,000. However, that wasn’t the case, as that event marked the cyclical peak for the Bitcoin price bull run.

At the time of writing, the Bitcoin price is trading at around $99,200, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-bull-run-150000/

2024-12-09 08:30:10