Bitcoin has seen a retracement from the $66,000 level, but that does not mean that the bullishness of the pioneer cryptocurrency is completely gone. It is currently sitting around 4% below $66,000, which still makes its $63,000 level very attractive for bulls. Although, given the current movement of Bitcoin, the market could see a deeper correction from here that could send its price spiraling below $60,000 once again.

Bitcoin Symmetrical Triangle Could Trigger A Retest

Crypto analyst Xanrox has presented a possible scenario where the Bitcoin price could decline further from here. The analyst points to the previous symmetrical triangle that had been formed on the Bitcoin chart with the last decline. This end of this symmetrical triangle sits somewhere around $56,000, which could present a roadblock for the BTC price.

Related Reading

However, as the analyst explains, a retest of the symmetrical triangle that takes the price back down is not entirely a bad thing. This is because a first breakout of a pattern such as the symmetrical triangle, and then a retest of it is often a positive. This is because it give traders another chance to get in on a good price.

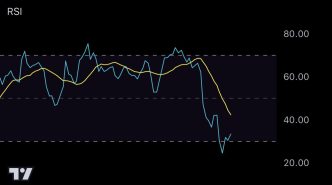

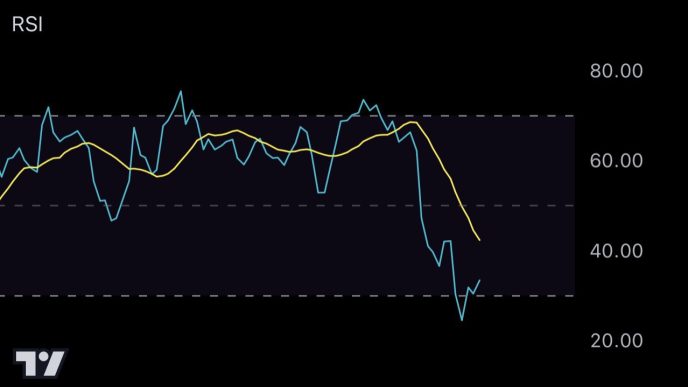

Furthermore, the crypto analyst points out that there is an ascending channel that is being broken down on the Bitcoin chart. This also lends credence to the fact that the BTC price could still correct from here. Taking the ascending channel and the symmetrical triangle into account, then it is possible that Bitcoin does fall below $60,000 again.

As the crypto analyst explains, the first wave 1 impulse has already been completed, so a correction is in the works. Taking a look at the Fibonacci retracement, the crypto analyst tells traders to look toward the 0.382 level, as well as the 0.5 and 0.618 levels. However, the first two are much more important.

When Is The Right Time To Buy BTC?

When it comes to buying Bitcoin, the crypto analyst points out that the 0.382 and 0.5 Fibonacci levels are the best time to buy. Additionally, Xanrox points to “an unfilled FVG (Fair Value Gap)” and tells traders that it is within this region that they want to get in on the digital asset.

Related Reading

Currently, this unfilled FVG is sitting between $60,277 and $61,590. Given this, setting the buy orders between these levels would be advisable. The crypto analyst explains that this Bitcoin gap may not be filled completely, but that even a partial fill would be a good thing.

“I am currently very bullish on Bitcoin, and if you buy now and sell above 120K, I would consider it a good trade!” the crypto analyst said in closing.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-final-test-btc-price/

2024-10-02 19:00:11