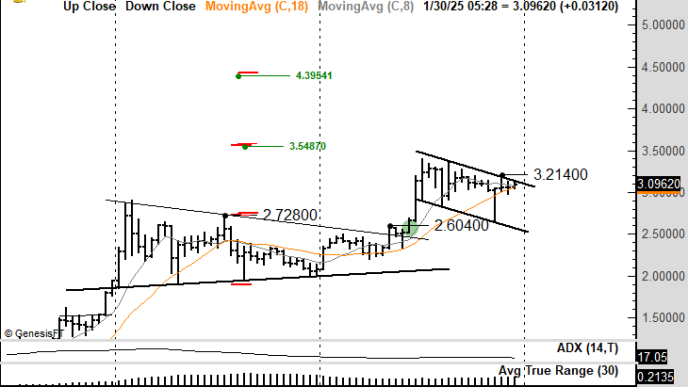

A closely followed crypto analyst says long-term holders are nearly done selling off Bitcoin, setting BTC up for a series of rallies.

In a new video update, the host of InvestAnswers tells his 560,000 YouTube subscribers that Bitcoin could potentially increase more than 66% from its current value as those who have held their BTC for 155 days or longer are about 70% done selling.

Amid the decline in selling pressure, he says that if Michael Saylor’s MicroStrategy and the spot Bitcoin exchange-traded funds (ETF) purchased an additional $82 million worth of BTC combined the flagship digital asset could hit $175,000 per coin.

“The question I had is, What would it take, how much money would it take to get to $175,000? Well, if Saylor spends another $40 billion, and the ETFs spend another $40 billion, call it $82 billion, the increase in Bitcoin’s market cap will be, based on the multiplier, $1.34 trillion, which would take the total Bitcoin market cap to $3.44 trillion, which, divided by 19.7 million Bitcoin will be $175,000…

I still do believe the American ETFs will do at least $40 billion, and I think Saylor will do at least $40 billion. So that’s coming…

Just these two players alone, if they continue to do what they did last year, and the selling is the same level of selling we have now, which I don’t think they’ll repeat, it’ll be less because they’re 70% done, I think it’s theoretically possible get to $175,000.”

Bitcoin is trading for $105,054 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Elena Paletskaya/Sensvector

Source link

Daily Hodl Staff

https://dailyhodl.com/2025/01/31/analyst-says-bitcoin-long-term-holders-are-70-done-offloading-the-crypto-asset-outlines-btc-path-to-175000/

2025-01-31 19:05:55