The crypto market has seen the largest leverage flush out since April 2021 yesterday, December 9, as reported earlier today. Amidst the market shakeout, Dogecoin (DOGE) is one of the altcoins which is displaying significant signs of strength. In a post on X, crypto analyst CRG (@MacroCRG) argues that the DOGE price is showing “incredible” signs of resilience compared to the broader altcoin market.

Here’s Why Dogecoin Looks ‘Incredible’

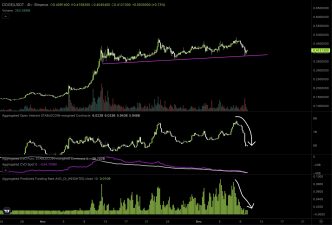

Despite the market downturn, Dogecoin managed to maintain the most crucial support level. CRG shared the below chart and commented, “DOGE looks incredible. Whole market shat itself but it barely flinched + didn’t break structure. Now funding has completely reset and a ton of OI has been washed out. Won’t be long until this is trending hard again IMO.”

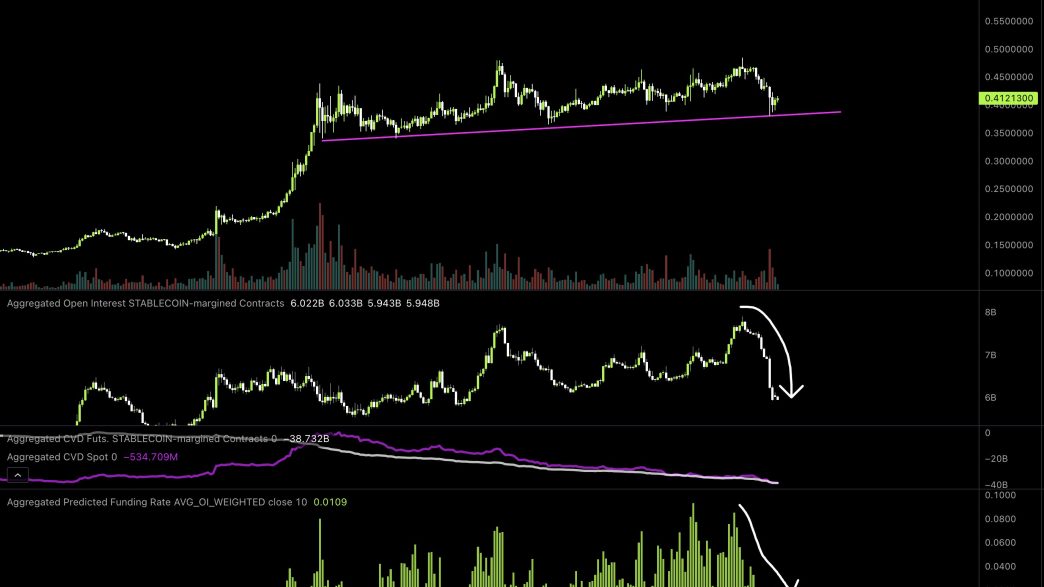

The chart reveals several critical insights that support his optimistic outlook for DOGE. Firstly, Dogecoin maintained a crucial uptrend line in the 4-hour chart (DOGE/USDT). This trend line has acted as a dynamic support level which the Dogecoin price has touched but not fallen below on three separate occasions since mid-November.

Related Reading

Each touch of this trend line triggered a rebound for the Dogecoin price, suggesting strong buyer interest at these levels. This alignment with the uptrend line is crucial because it indicates not only support but also growing confidence among investors each time the price dips to this line and subsequently recovers.

Resistance, on the other hand, formed near the $0.47 mark. This level has been tested multiple times, and each attempt to break through has been met with resistance. The repeated tests of this resistance level without a breakthrough could typically suggest a consolidation phase, potentially building up for a stronger move upward if the market sentiment shifts positively.

Furthermore, the chart shows a notable reduction in open interest in stablecoin-margined contracts. According to Coinglass data, $86.29 million in DOGE long positions were liquidated on December 9, the highest since the bull run of 2021.

Related Reading

This reduction in open interest presents a major ‘washout’ of speculative positions, typically viewed as a market reset where weaker hands exit, and the excess leverage is reduced. Notably, this cleansing of market participants could be another hint that a more sustainable upwards move is brewing.

Another vital aspect shown in the chart is the reset of funding rates to lower levels, which is significant as it reduces the cost of holding long positions. Lower funding rates can encourage new buying activity, especially from participants who were previously sidelined due to high costs associated with maintaining leveraged positions.

CRG’s analysis also includes an observation on the Cumulative Volume Delta (CVD) for both futures and spot markets. The CVD for futures has moved below that of the spot market, indicating that futures traders might be taking more bearish positions or closing existing positions more aggressively compared to spot traders. This divergence suggests that the spot market, which is generally less speculative, retains bullishness, while acting as a buffer against the bearish futures markets.

At press time, DOGE traded at $0.40.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/dogecoin/dogecoin-crypto-crash-looks-incredible/

2024-12-10 20:00:37