Crypto analyst CryptoCon recently alluded to a Bitcoin ‘Golden Multiplier Ratio,’ which he suggested paints a very bullish picture of the Bitcoin price. Based on this, the analyst remarked that the party was just getting started, indicating that the flagship crypto is likely going much higher.

Bitcoin Golden Ratio Multiplier Indicates Price Is Going Higher

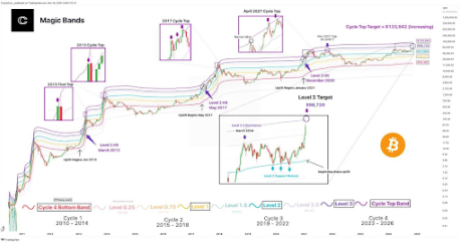

In an X post, CryptoCon highlighted how the Bitcoin Golden Multiplier Ratio indicates that the price is going much higher. He cited level 5 of the Golden Ration Multiplier, which he claimed is dual-purpose for the mid-top and cycle top. The analyst mentioned that Bitcoin formed the mid-top at level 5 in March earlier this year when it reached its previous all-time high (ATH) of $73,000.

Related Reading

CryptoCon further mentioned that it seems likely that Bitcoin will hit this level again before this market cycle is over. The analyst added that the level 5 band has increased to $122,000, and it is still climbing. In line with this, he remarked that the party is just getting started, indicating that the Bitcoin rally could still rally way higher and even reach this $122,000 target.

In an earlier X post, CryptoCon also used the Magic Bands indicator to provide insights into Bitcoin’s price action and how high it could reach in this bull run. He said Bitcoin is racing to meet level 3 of the Magic Bands at $98,720. He added that the bands are set to rapidly expand to the upside as they adjust for the volume beyond the ATHs.

Based on this, the analyst said that the cycle top target is now $134,000 and that the Bitcoin price could gain $1,000 weekly. CryptoCon remarked that he anticipates the cycle top sometime in late 2025. That means there is a lot of time for the bands to expand to higher prices, indicating that the Bitcoin price could rise higher.

BTC Primed To Reclaim Local Highs

Crypto analyst CrediBULL Crypto stated that the Bitcoin price looks primed to move to the local highs as long as the $87,700 level isn’t breached. The analyst also mentioned that a clear and impulsive move above the local highs at $93,800 would send Bitcoin above $100,000, making the possibility of dropping to $72,000 unlikely until the next bear market.

Related Reading

However, if that clear and impulsive move doesn’t happen, CrediBull Crypto stated that it would imply that the move is corrective and makes the odds of retesting the range between $70,000 and $72,000 exponentially higher. He suggested that BTC could even drop below $70,000.

At the time of writing, the Bitcoin price is trading at around $91,200, up almost 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-golden-multiplier-ratio/

2024-11-17 04:30:31